ESG stands for Environment, Social Responsibility, and Corporate Governance. The ESG concept includes the top 100 US-listed companies in terms of ESG rankings.

- 1369.800

- +0.111+0.01%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Sales have plummeted by 47% year-on-year! Foreign phones have faced a "Waterloo" in China, is Apple no longer appealing?

According to media calculations, in November 2024, the shipment of foreign smartphone brands in the Chinese market will be only 3.04 million units, a significant year-on-year decline of 47.4%, with a quarter-on-quarter drop as high as 51%. Among them, Apple phones occupy the vast majority of the market share, while other international brands like Samsung occupy only a small portion.

Santa Clause Came and Went Without Bringing Gifts | Weekly Buzz

Friday? More Like Grinch Day | Wall Street Today

Evercore ISI Predicts Tech Will Lead the S&P 500 to Another 20% Upside Year in 2025

PLTR, NVDA, Among Top Technology Gainers in 2024; INTC and ENPH Among Losers

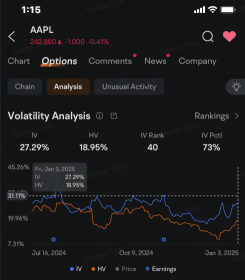

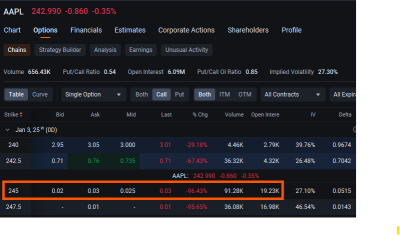

Apple Options Open Interest Rises as Volatility Gains Amid Concerns Over iPhone Sales

Comments

$Walmart (WMT.US)$

$Target (TGT.US)$

$Best Buy (BBY.US)$

$NVIDIA (NVDA.US)$

Hopefully these N53 bands kick off this year. 👍.

The implied volatility rose to 27.3% Friday, the highest since early November, as Apple shares headed for their fifth straight loss. A decline today would mark the longest losing streak for the stock since April.

Shares slipped after news reports that shipments of foreig...

Ultratech : why are you pumping gsat when it's high. ppl not holding previously are at risk dude

junclj1223 : What is the connection between a trash company and Apple? Why would stocks of other companies appear in the Apple discussion area here?

Ryand83 OP junclj1223 : Apple is working with GSAT on N53