ESG stands for Environment, Social Responsibility, and Corporate Governance. The ESG concept includes the top 100 US-listed companies in terms of ESG rankings.

- 1298.735

- -19.809-1.50%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Will Iran launch attacks against usa before the US election? The international oil market responds by rising again.

①According to sources, Israeli intelligence indicates that Iran will launch attacks on Israel through its proxies in Iraq, expected to occur before the US presidential election; ②The international oil market rose again under this news impact. After Thursday settlement, WTI futures prices rose more than 3%, Brent crude oil futures prices rose more than 2%.

Apple, Amazon, Intel, Peloton, And Tesla: Why These 5 Stocks Are On Investors' Radars Today

Apple's quarterly revenue exceeded expectations, but sales in greater china remained stagnant.

①Apple's revenue in this quarter reached $94.93 billion, an increase of 6% year-on-year, with adjusted earnings per share of $1.64, both stronger than market expectations; ②Apple incurred a one-time tax expense of $10.2 billion earlier this year due to a ruling by the European Union, resulting in a nearly 36% year-on-year decline in net income for the quarter.

Here's the Major Earnings Before the Open Tomorrow

Earnings Movers: Intel, Amazon Fly up in Late Trade After Rough Day Session for Big Tech

Apple in Charts: Services Revenue Rises 12% Y/Y

Comments

For META, the current level is in the buying zone for both near & long-term. If VIX down, could up 2% or above.

For AAPL, it is quite difficult to say up or down because it is usually not voltile. But, due to recent earning reports, the stock might still be under massive s...

In this previous article, I mentioned that the stock:

attempted to reach its all-time high but closed with a doji formation. This doji suggests profit-taking at the highs...

For a deeper understanding of each profitability indicator, please refer to our course>>> Evaluating Profitability with Five Important Indicators

$Apple (AAPL.US)$ $Tesla (TSLA.US)$ $NVIDIA (NVDA.US)$ $Amazon (AMZN.US)$

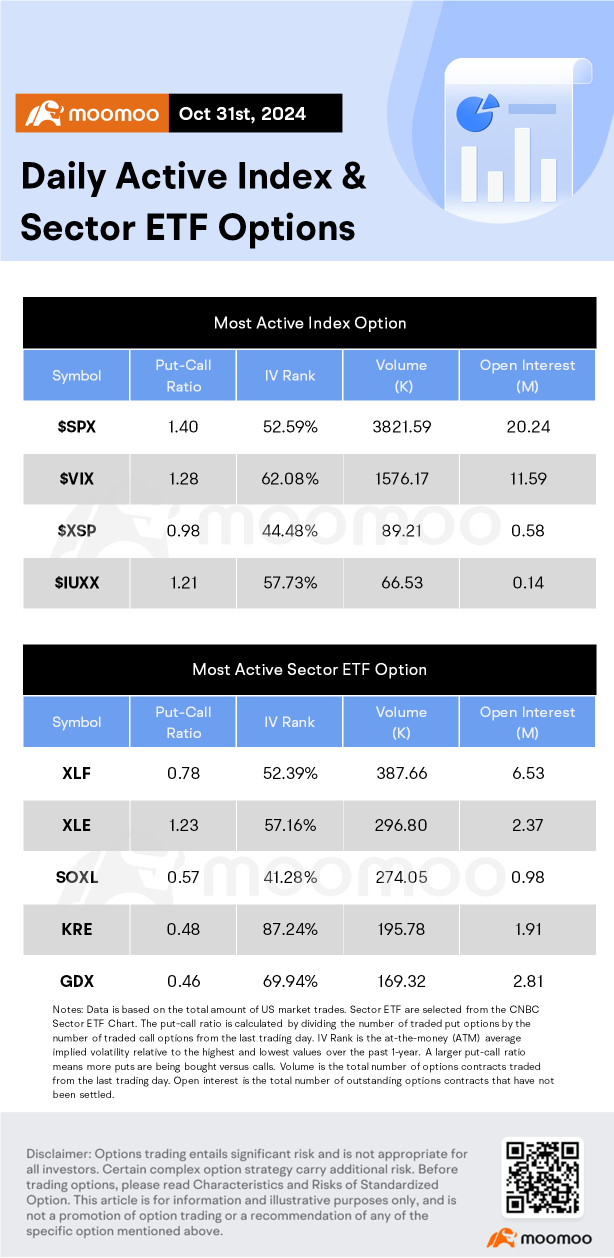

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[NEUTRAL]We turn neutral as price is currently between 5740 resistance level and 5710 support level. We lean towards a bearish scenario as we expect price to drift lower towards 5710 support level. Technical indicators are displaying a bearish scenario as well.

Alternatively: A 4 hour c...

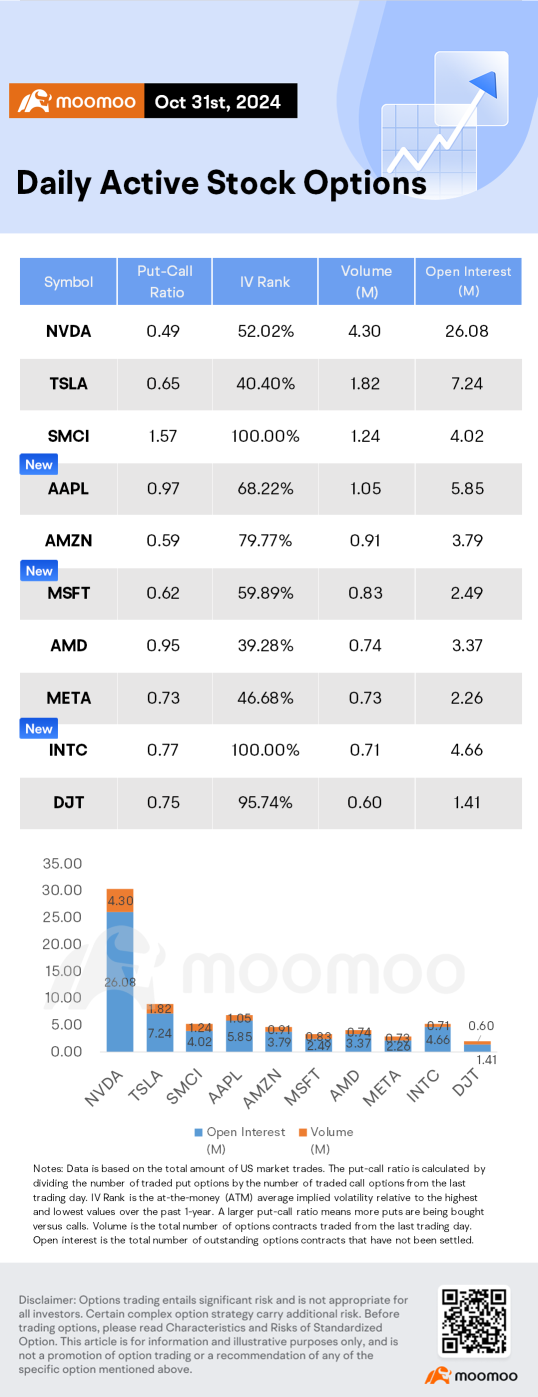

1. $Apple (AAPL.US)$ experienced a 1.82% drop in its stock price, closing at $225.91. The options market was notably active, with a volume of 1.05 million contracts, where calls constituted 50.7% of the activity. Among the options, the $235 calls set to expire on November 15 were the most actively traded.

Apple shares edged about 1.8% lower after the tech giant reported record revenue for the Septe...