Investment ThemesDetailed Quotes

ESG Investing

Watchlist

ESG stands for Environment, Social Responsibility, and Corporate Governance. The ESG concept includes the top 100 US-listed companies in terms of ESG rankings.

- 1407.707

- +21.011+1.52%

Close Dec 20 16:00 ET

1409.575High1372.044Low

1379.479Open1386.696Pre Close304.99MVolume11Rise32.63P/E (Static)62.24BTurnover--Flatline1.24%Turnover Ratio5.37TMarket Cap4Fall5.34TFloat Cap

Constituent Stocks: 15Top Rising: FSLR+3.70%

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Constituent Stocks

SymbolStock Name

PriceChg% ChgVolumeTurnoverOpenPre CloseHighLowMarket CapFloat CapSharesShs Float5D % Chg10D % Chg20D % Chg60D % Chg120D % Chg250D % Chg% Year-to-dateDiv YieldTTMTurnover RatioP/E (TTM)P/E (Static)AmplitudeIndustry

WatchlistPaper Trade

FSLRFirst Solar

182.3906.510+3.70%3.46M626.82M174.460175.880183.010173.36019.53B18.46B107.06M101.20M-8.65%-6.08%+0.24%-28.66%-15.84%+7.04%+5.87%--3.42%15.7123.565.49%Solar

HSTHost Hotels & Resorts

18.2000.570+3.23%19.80M359.16M17.43017.63018.35517.38012.72B11.69B699.03M642.45M-2.05%-3.19%+1.73%+0.89%+4.27%-2.76%-3.46%4.40%3.08%17.6717.505.53%REIT - Hotel & Motel

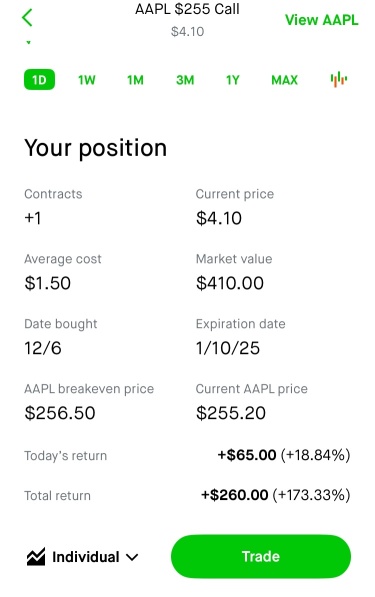

AAPLApple

254.4904.700+1.88%147.50M37.34B248.040249.790255.000245.6903.85T3.84T15.12B15.09B+2.56%+4.80%+11.36%+11.98%+15.80%+32.10%+32.83%0.39%0.98%41.8641.863.73%Consumer Electronics

LNGCheniere Energy

208.8902.950+1.43%2.60M542.80M205.660205.940210.230204.77046.87B46.54B224.37M222.80M-1.96%-5.88%-7.16%+17.47%+20.33%+22.30%+23.64%0.83%1.17%13.285.132.65%Oil & Gas Midstream

MPCMarathon Petroleum

133.3801.730+1.31%11.49M1.53B132.000131.650133.420130.54042.87B42.74B321.39M320.44M-8.37%-11.63%-16.27%-17.92%-22.59%-9.79%-8.26%2.47%3.59%10.355.642.19%Oil & Gas Refining & Marketing

TXNTexas Instruments

186.8702.400+1.30%11.46M2.14B184.470184.470188.470183.350170.47B170.06B912.22M910.03M-2.46%-3.23%-5.72%-10.11%-4.58%+14.24%+12.75%2.78%1.26%34.7326.432.78%Semiconductors

JBHTJB Hunt Transport Services

170.2302.130+1.27%2.14M363.55M168.510168.100171.375165.50017.16B13.65B100.83M80.17M-5.32%-5.95%-6.25%-0.52%+7.30%-14.80%-13.97%1.00%2.67%30.9524.423.50%Integrated Freight & Logistics

CVXChevron

142.8501.700+1.20%32.21M4.59B140.825141.150142.850140.550256.71B243.94B1.80B1.71B-7.16%-7.98%-11.62%+1.63%-6.91%-1.35%-0.10%4.48%1.89%15.7012.571.63%Oil & Gas Integrated

SRESempra Energy

86.8100.910+1.06%4.75M410.79M85.34085.90087.22585.34054.99B54.91B633.40M632.48M-2.64%-3.11%-7.70%+6.67%+17.15%+21.53%+19.85%2.83%0.75%19.1218.122.19%Utilities - Diversified

MAMasterCard

528.0304.750+0.91%7.32M3.86B522.870523.280532.080519.420484.64B483.39B917.83M915.46M-0.18%-0.10%+2.51%+7.63%+19.09%+25.23%+24.52%0.48%0.80%39.9144.632.42%Credit Services

VRSKVerisk Analytics

276.8601.280+0.46%1.71M474.03M274.350275.580279.610273.23539.10B39.01B141.21M140.89M-2.29%-3.42%-3.59%+4.62%+1.94%+17.92%+16.60%0.55%1.22%43.1966.392.31%Consulting Services

COPConocoPhillips

95.120-0.060-0.06%29.54M2.81B94.75595.18096.38094.230123.04B122.84B1.29B1.29B-5.84%-7.85%-15.00%-6.38%-15.46%-16.89%-15.75%3.07%2.29%11.2810.502.26%Oil & Gas E&P

WORWorthington Enterprises

40.780-0.440-1.07%1.46M59.50M40.48041.22041.74040.4202.05B1.27B50.26M31.26M+3.92%+0.31%+3.51%+2.21%-9.00%-29.24%-28.16%1.20%4.67%48.5518.543.20%Metal Fabrication

SCLStepan

67.120-0.770-1.13%273.52K18.40M67.17067.89068.79066.9951.51B1.42B22.49M21.20M-8.75%-10.40%-11.24%-13.27%-18.54%-28.57%-27.68%2.23%1.29%33.5638.352.64%Specialty Chemicals

MRKMerck & Co

98.050-1.470-1.48%29.29M2.88B98.83099.52099.68097.900248.03B247.73B2.53B2.53B-3.10%-4.13%-1.03%-12.60%-22.10%-6.47%-7.60%3.14%1.16%20.51700.361.79%Drug Manufacturers - General

News

Options Market Statistics: Tesla's Rollercoaster Week Ends with Friday Sell-Off; Options Pop

Which Magnificent 7 Stock Will Do Best In Santa Claus Rally? Tesla Edged Out As 28% Select...

Looking Into Texas Instruments's Recent Short Interest

UBS Says 'Underweight the Names With High China Exposure'

J.P. Morgan's Top Technology Stocks for 2025

9 Financials Stocks Whale Activity In Today's Session

Comments

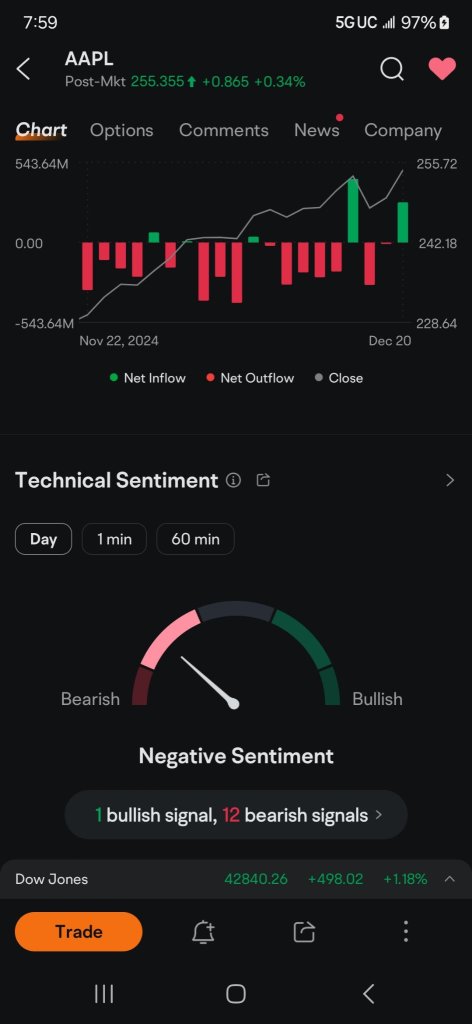

$Apple (AAPL.US)$ it’s so sneaky. the last mega cap to turn green, yet has the largest gain.

$Apple (AAPL.US)$ $Invesco QQQ Trust (QQQ.US)$

I dare somebody to find 5 weeks on this chart. For the past many years that have the most perfect candles as these in the gold box..... And they all coincide with major outflow and perfect weekly resistance..... I hate to be conspiracy theory here, but this is a bit ridiculous....

I dare somebody to find 5 weeks on this chart. For the past many years that have the most perfect candles as these in the gold box..... And they all coincide with major outflow and perfect weekly resistance..... I hate to be conspiracy theory here, but this is a bit ridiculous....

1

5

$Apple (AAPL.US)$ How likely is for this to gap up without filling the gap afterwards on Monday?

Read more