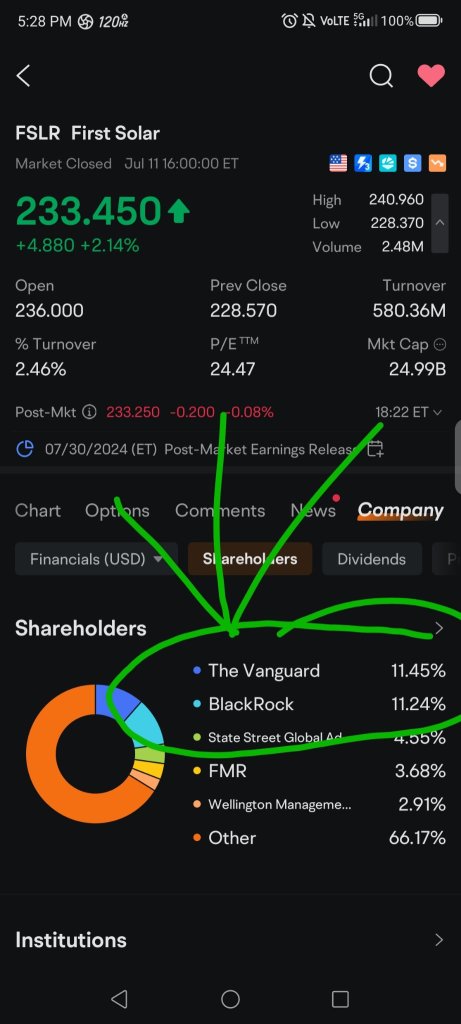

ESG stands for Environment, Social Responsibility, and Corporate Governance. The ESG concept includes the top 100 US-listed companies in terms of ESG rankings.

- 1308.276

- -19.378-1.46%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Yardeni Raises S&P 500 Year-End Target To 5,800, Hints At Faster-Than-Expected Discounting Of 'Roaring 2020s Scenario'

Veteran Wall Street investor Ed Yardeni has adjusted his outlook for the S&P 500, raising the year-end target to 5,800 from 5,400, and maintaining a target of 8,000 by the end of the decade. "The

Solar, Clean Energy Stocks Rally as Tame Inflation Data Lifts Rate Cut Hopes

Apple Stock Got Bit By Sellers Thursday: What Happened?

Despite some positive developments for Apple Inc (NASDAQ:AAPL) on Thursday, the stock closed the day down nearly 2.5% as investors rotated out of tech stocks. Here's what you need to know.What To

If You Invested $1000 In This Stock 15 Years Ago, You Would Have $24,000 Today

Mastercard (NYSE:MA) has outperformed the market over the past 15 years by 11.11% on an annualized basis producing an average annual return of 23.69%. Currently, Mastercard has a market

Nvidia Leads Slide as Investors Rotate Out of Mega Tech

Apple-EU Settlement Could Be a Boon for PayPal, Analyst Says

Spread Love N Joy : Good start!