Investment ThemesDetailed Quotes

Asset Management

Watchlist

- 1546.783

- -9.059-0.58%

Trading Dec 30 14:39 ET

1549.132High1528.452Low

1542.211Open1555.841Pre Close48.82MVolume1Rise18.14P/E (Static)3.96BTurnover--Flatline0.16%Turnover Ratio2.95TMarket Cap31Fall2.85TFloat Cap

Constituent Stocks: 32Top Rising: AIV+0.18%

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Constituent Stocks

SymbolStock Name

PriceChg% ChgVolumeTurnoverOpenPre CloseHighLowMarket CapFloat CapSharesShs Float5D % Chg10D % Chg20D % Chg60D % Chg120D % Chg250D % Chg% Year-to-dateDiv YieldTTMTurnover RatioP/E (TTM)P/E (Static)AmplitudeIndustry

WatchlistPaper Trade

AIVApartment Investment & Management

8.3350.015+0.18%389.14K3.22M8.2908.3208.3458.1601.18B1.08B141.27M129.11M+0.79%-3.31%-5.71%-5.18%+0.30%+6.45%+6.45%--0.30%LossLoss2.22%REIT - Residential

USBU.S. Bancorp

48.460-0.030-0.06%2.16M104.04M48.11548.49048.48547.65575.60B75.38B1.56B1.56B+1.13%-5.04%-9.06%+10.19%+20.10%+14.27%+15.94%4.07%0.14%14.9114.821.71%Banks - Regional

MTBM&T Bank

189.095-0.135-0.07%307.90K57.95M187.575189.230189.530186.75031.37B31.21B165.92M165.03M-0.20%-5.12%-13.51%+10.40%+25.85%+40.48%+42.48%2.80%0.19%13.9911.981.47%Banks - Regional

HBANHuntington Bancshares

16.365-0.015-0.09%6.00M97.68M16.26016.38016.41016.11023.78B23.58B1.45B1.44B+0.28%-3.81%-8.29%+16.56%+27.72%+33.03%+34.50%3.79%0.42%15.8913.201.83%Banks - Regional

ZIONZions Bancorp

54.600-0.080-0.15%368.44K19.96M54.30054.68054.63053.4908.07B7.90B147.71M144.63M+1.73%-5.32%-9.78%+19.32%+22.64%+28.61%+29.40%3.00%0.26%12.4412.552.09%Banks - Regional

FITBFifth Third Bancorp

42.820-0.080-0.19%1.22M52.00M42.69042.90042.90042.19528.71B28.55B670.54M666.63M-0.26%-5.99%-10.90%+2.59%+17.21%+26.64%+27.71%3.32%0.18%14.2713.301.64%Banks - Regional

RFRegions Financial

23.695-0.045-0.19%2.36M55.68M23.48023.74023.75023.34521.54B21.49B908.86M907.02M-0.32%-5.64%-12.27%+6.62%+19.73%+27.17%+27.95%4.09%0.26%13.3111.231.71%Banks - Regional

AIGAmerican International Group

72.850-0.150-0.21%986.42K71.66M72.11073.00073.00071.96545.44B45.27B623.77M621.47M+0.22%+0.52%-4.72%+1.26%-3.03%+8.09%+9.83%2.09%0.16%Loss14.631.42%Insurance - Diversified

GSGoldman Sachs

574.770-1.410-0.24%727.95K415.06M568.475576.180576.020565.100180.43B180.40B313.91M313.87M+1.53%-1.83%-5.09%+18.83%+21.33%+51.61%+52.61%1.96%0.23%16.8525.131.90%Capital Markets

STTState Street

98.330-0.250-0.25%367.18K35.91M97.55098.58098.50096.88028.83B27.24B293.15M277.02M+0.13%-2.12%-0.18%+14.39%+31.39%+29.93%+30.42%2.88%0.13%15.4117.621.64%Asset Management

KEYKeyCorp

17.150-0.050-0.29%3.57M60.87M17.13017.20017.17016.89017.00B16.92B991.28M986.51M+0.35%-5.41%-11.01%+5.90%+19.62%+23.62%+25.42%4.78%0.36%0.0019.491.63%Banks - Regional

PFGPrincipal Financial

77.475-0.235-0.30%215.13K16.58M76.76077.71077.60076.33017.72B17.63B228.73M227.50M+0.23%-1.82%-10.29%-7.65%-3.33%+1.39%+1.96%3.60%0.10%Loss30.381.63%Asset Management

PNCPNC Financial Services

192.680-0.600-0.31%377.26K72.38M191.050193.280193.010190.11176.45B75.86B396.78M393.73M-0.04%-4.38%-10.26%+8.92%+19.39%+27.92%+29.28%3.24%0.10%16.2915.061.50%Banks - Regional

JPMJPMorgan

240.395-0.775-0.32%2.48M592.81M238.610241.170240.840237.110676.79B673.06B2.82B2.80B+1.18%+0.19%-3.73%+17.85%+16.40%+43.04%+44.70%1.91%0.09%13.3614.811.55%Banks - Diversified

CCitigroup

70.690-0.310-0.44%3.84M270.17M70.38071.00070.82069.795133.69B129.41B1.89B1.83B+2.17%-0.45%-0.25%+16.32%+7.50%+38.24%+42.54%3.04%0.21%20.1417.501.44%Banks - Diversified

BENFranklin Resources

20.240-0.100-0.49%1.49M30.20M20.22020.34020.32019.98010.61B6.28B523.98M310.47M+0.33%-6.42%-9.67%+5.05%-7.04%-26.91%-27.39%6.13%0.48%23.8123.811.67%Asset Management

AMGAffiliated Managers

186.610-1.030-0.55%78.11K14.55M186.690187.640187.635184.2005.64B5.38B30.23M28.85M+2.24%+0.01%-0.50%+4.57%+16.98%+24.57%+23.27%0.02%0.27%12.1310.711.83%Asset Management

WFCWells Fargo & Co

70.705-0.405-0.57%4.28M301.54M70.46071.11070.79569.770235.41B234.93B3.33B3.32B+0.52%+0.38%-7.17%+29.34%+19.99%+47.12%+47.45%2.05%0.13%14.7014.641.44%Banks - Diversified

AMPAmeriprise Financial

532.570-3.380-0.63%113.51K60.10M532.190535.950533.035524.88051.67B51.46B97.01M96.63M+0.08%-3.13%-7.21%+11.38%+21.68%+42.44%+42.14%1.06%0.12%20.3622.461.52%Asset Management

MSMorgan Stanley

125.940-0.820-0.65%1.23M153.80M124.570126.760126.160124.020202.89B154.89B1.61B1.23B+2.03%-1.15%-4.31%+21.39%+23.80%+39.01%+39.98%2.76%0.10%19.1424.311.69%Capital Markets

SPGSimon Property

170.870-1.140-0.66%369.13K62.71M170.270172.010171.010168.51055.75B52.28B326.28M305.98M-0.43%-4.86%-5.86%+2.67%+17.91%+25.59%+25.94%4.62%0.12%22.7224.481.45%REIT - Retail

BACBank of America

44.040-0.300-0.68%9.11M400.02M43.97044.34044.14043.555337.91B337.43B7.67B7.66B-0.29%-3.57%-6.79%+12.83%+6.79%+33.22%+34.13%2.23%0.12%15.9614.301.32%Banks - Diversified

BKBank of New York Mellon

76.960-0.610-0.79%792.71K60.91M76.88077.57077.12076.22055.96B55.83B727.08M725.41M-0.85%-2.37%-6.00%+9.34%+28.54%+51.20%+52.16%2.25%0.11%16.7319.241.16%Banks - Diversified

IVZInvesco

17.540-0.140-0.79%865.36K15.11M17.41017.68017.61017.2657.88B5.91B449.44M337.02M+1.21%-2.77%-3.04%+1.59%+14.10%+3.94%+3.41%4.62%0.26%LossLoss1.95%Asset Management

COFCapital One Financial

178.760-1.460-0.81%652.95K116.00M177.990180.220179.300175.83068.20B65.68B381.51M367.45M+0.06%-3.13%-6.90%+23.62%+32.02%+37.74%+38.78%1.34%0.18%16.8814.961.93%Credit Services

VNOVornado Realty Trust

41.450-0.340-0.81%306.88K12.62M41.36041.79041.57040.3107.90B6.68B190.65M161.20M-0.14%-5.62%-2.09%+6.92%+57.86%+46.86%+49.20%0.72%0.19%Loss180.223.02%REIT - Office

VTRVentas Inc

58.395-0.495-0.84%680.41K39.66M58.67058.89058.82057.97024.50B24.39B419.51M417.69M-0.62%-2.53%-8.86%-6.67%+12.85%+18.54%+20.28%3.08%0.16%LossLoss1.44%REIT - Healthcare Facilities

NTRSNorthern Trust

102.900-0.930-0.90%333.06K34.19M102.360103.830103.200101.69020.40B20.10B198.22M195.34M+0.41%-1.98%-6.79%+16.98%+22.35%+25.39%+26.12%2.92%0.17%12.8120.261.45%Asset Management

INTUIntuit

631.800-6.770-1.06%364.91K229.69M632.850638.570634.126623.410176.85B172.40B279.92M272.88M-1.80%-3.76%-1.55%+4.81%+0.00%+5.27%+1.69%0.59%0.13%61.4660.581.68%Software - Application

SCHWCharles Schwab

73.930-0.810-1.08%1.96M145.07M74.20074.74074.27573.320135.33B113.78B1.83B1.54B-0.51%-7.05%-10.67%+17.01%-0.20%+8.58%+9.05%1.35%0.13%28.8829.111.28%Capital Markets

1

2

News

Dow Jones 2024 Scoreboard: Top 5 Winners, Losers — And How Amazon, Nvidia Could Reshape 2025

Market Falling Monday, With Few Santa Clause 'Rally' Days Left | Live Stock

Top 10 Dividend Stocks With a 2% Yield and Buy or Strong Buy Rating

Credit Card Charge-offs Hit Highest Level Since 2010 - Report

Mark Cuban Once Said Credit Card Users 'Don't Want To Be Rich.' Now, US Credit Card Defaults Have Skyrocketed To Highest Levels Since 2008 Financial Crisis

This Analyst With 82% Accuracy Rate Sees Around 28% Upside In Apple - Here Are 5 Stock Picks For Last Week From Wall Street's Most Accurate Analysts

Comments

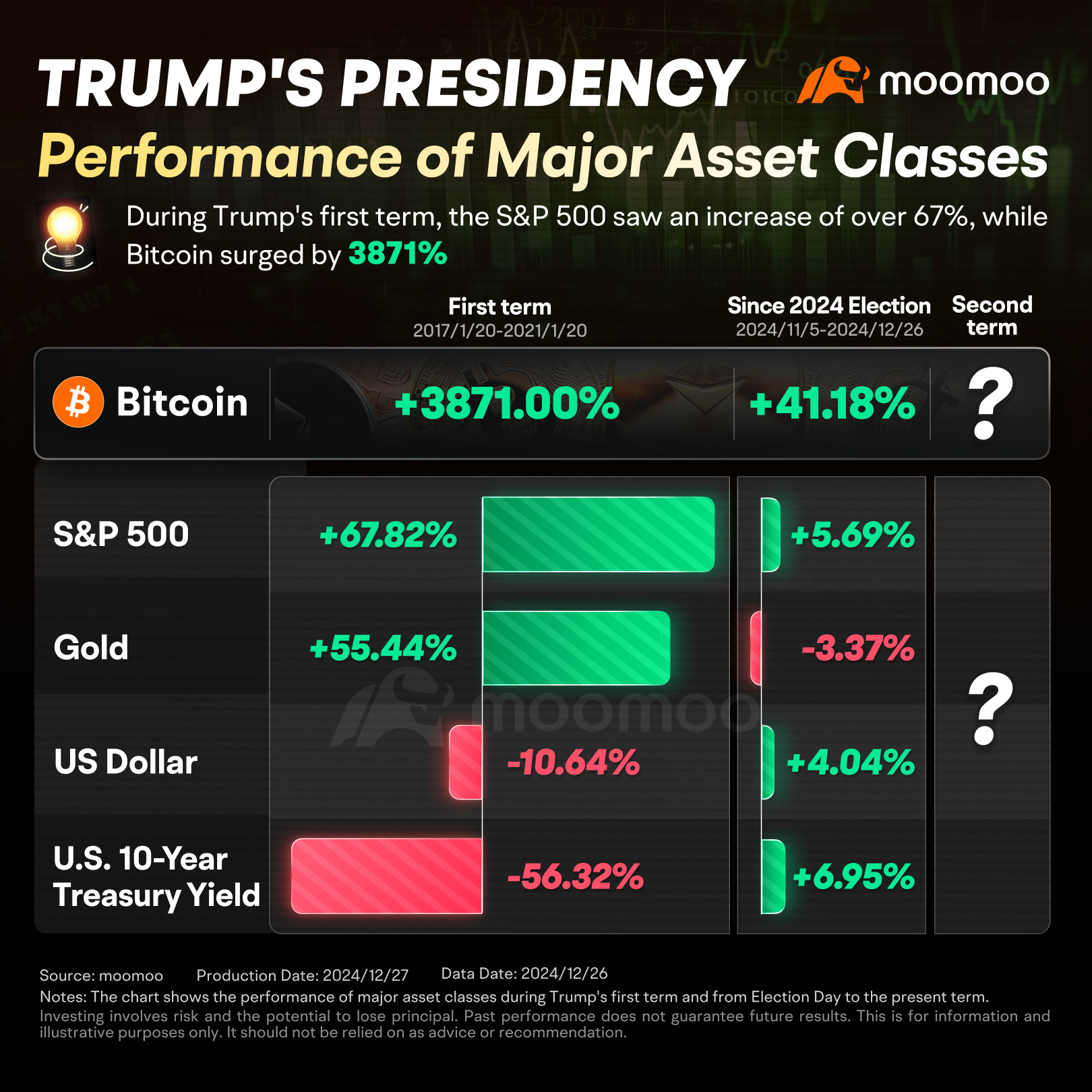

Trump's first term spanned from January 20, 2017, to January 20, 2021, during which time major asset classes like $Bitcoin (BTC.CC)$, $S&P 500 Index (.SPX.US)$, and $XAU/USD (XAUUSD.CFD)$ saw remarkable gains, increasing by 3,871%, 67.82%, and 55.44% respectively. Conversely, $USD (USDindex.FX)$ and $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ experienced declines of 10.64% and 56.32% respectively.

Since Election Day on November 5, 2024, up to December 26, 2024, the S&P 5...

Since Election Day on November 5, 2024, up to December 26, 2024, the S&P 5...

+1

79

10

111

Read more