Dividend Aristocrats includes high-dividend stocks that offer a regular stream of income to investors in the form of dividend payments. High-dividend stocks are often issued by stable, established companies with strong cash flows and earnings. They are defensive investments because they tend to be less volatile than other types of stocks. During periods of market volatility or economic uncertainty, these stocks may hold up better than growth stocks, which can help protect investors during market downturns. Refer to the S&P 500 Dividend Aristocrats Index for more details.

- 1480.191

- -2.603-0.18%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Amcor Plc (AMCR) Q1 2025 Earnings Call Transcript Summary

Hope for the Holidays, Underrated AI Potential? Key Takeaways From Amazon's Earnings Report

Thursday, Halloween Market Falls in Scary Reaction to Earnings | Wall Street Today

Amcor Shares Are Trading Lower After the Company Reported Worse-than-expected Q1 Financial Results.

Walmart Analyst Ratings

Amcor Reaffirms 2025 Outlook Of Adj. EPS $0.72-$0.76

Comments

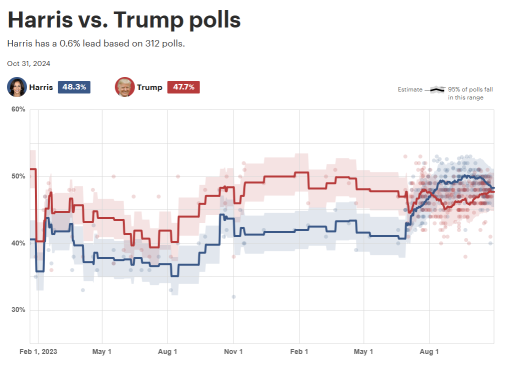

The U.S. stock market is witnessing a revival of the "Trump Trade." Shares in Trump's social media venture, $Trump Media & Technology (DJT.US)$, have soared more than 220% since Octobe...

$Kamala Harris (LIST22990.US)$

Harris Trade Investment Opportunities:

1. Core Concept Stocks:

- Clean Energy Leaders: $First Solar (FSLR.US)$ , $NextEra Energy (NEE.US)$, $Bloom Energy (BE.US)$

- Electric Vehicle Supply Chain: $Tesla (TSLA.US)$ , $Rivian Automotive (RIVN.US)$ , $Lucid Group (LCID.US)$

- ESG-themed ETFs: $iShares Global Clean Energy ETF (ICLN.US)$ , �������...

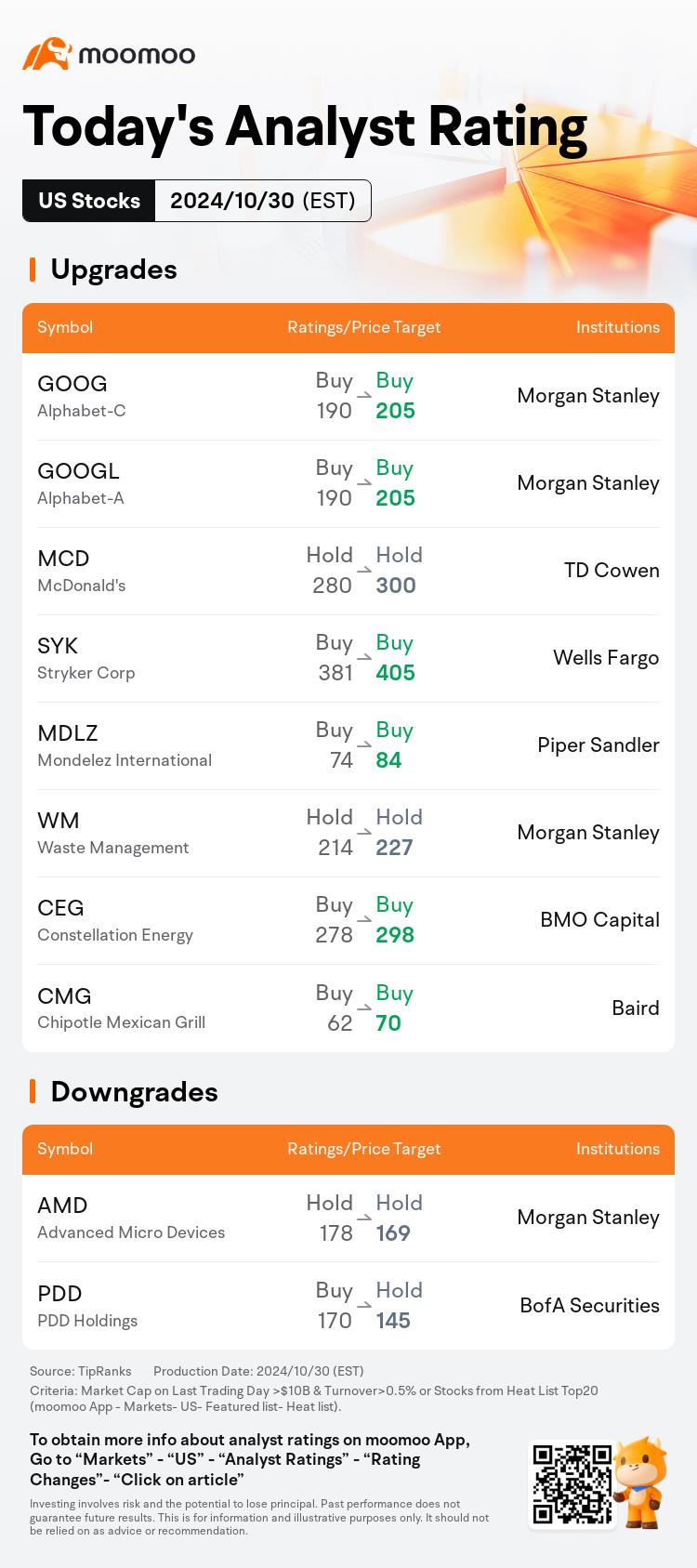

Gapping up

$Alphabet-A (GOOGL.US)$ stock rose 6.3% following third-quarter results that exceeded expectations, with a notable increase in advertising revenue, which alleviated concerns over competition from AI-driven search products.

$Biogen (BIIB.US)$ stock increased 1.2% after the biotech company raised its annual earnings forecast and reported third-quarter earnings that surpassed both top and bottom line expe...

Caterpillar reported its third-quarter earnings for '24.

revenue of $16.1 billion (-4.2% YoY). That beat the consensus by $140 million.

non-GAAP EPS of $5.17 (-6.3% YoY). It missed the consensus by $0.18.

The company's shares are trading 4.00% lower in the premarket. Sales were lower,

led by lower sales, as sales of machinery and equipment to end-users fell.

Sales of machinery related to construction and raw materials fell 9% and 10%,

respectively, and/ conversel...

Coach Donnie OP : We have been here before. Remember, the stock market only exists because it makes money and multiplies wealth. In order to transfer wealth to you and your family you’ll need to be patient.

Last earnings season we saw the same thing with Megacaps and the broader stock market. But it rebounded very well in Sept and Oct. I believe Nov and Dec will be higher for the stock market. Don’t allow market manipulation to cause you to panic sell. Of course, when you buy or sell is your decision.. For me, I’m staying strong and staying long. All will be well’

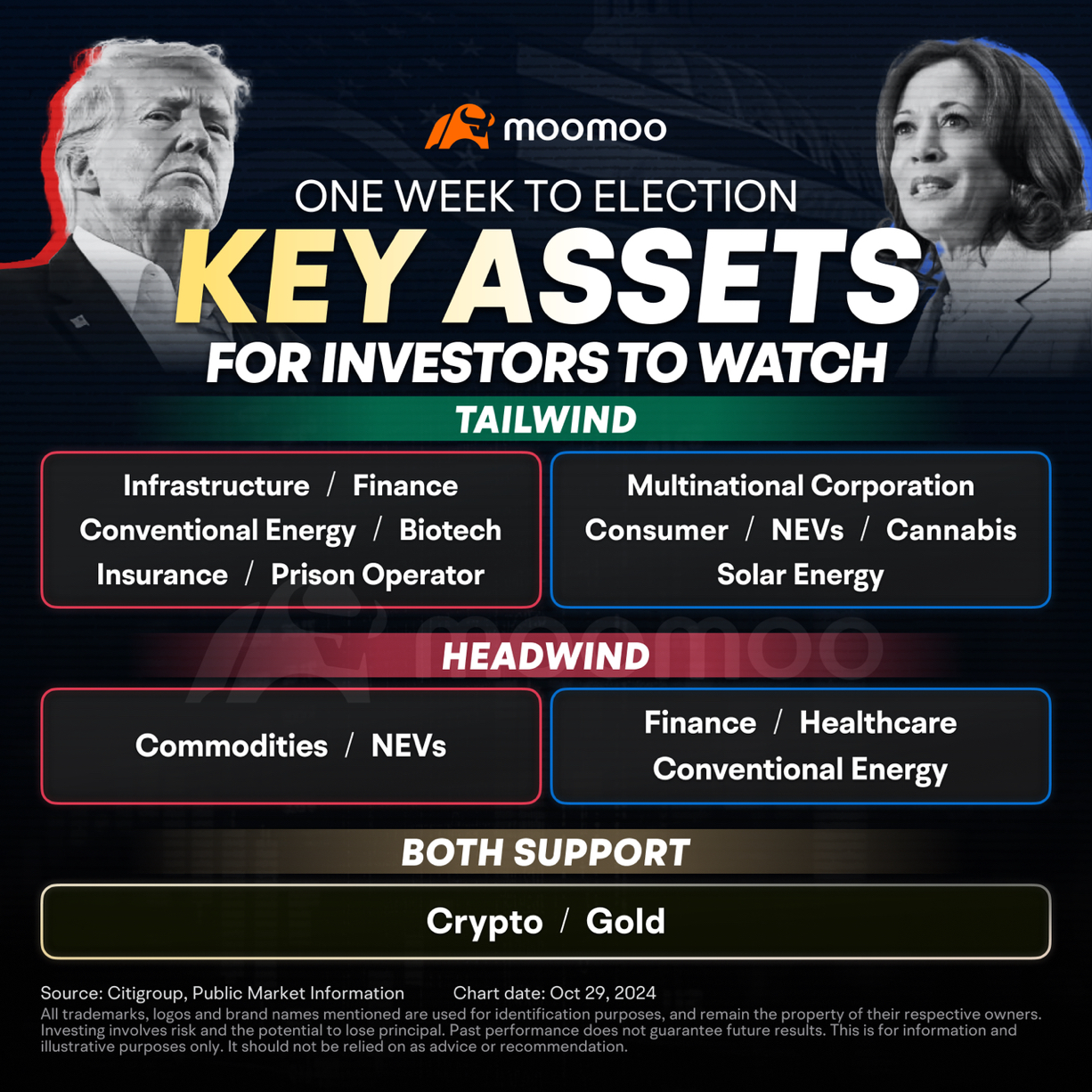

Coach Donnie OP : ELECTION COUNTDOWN: HOW THE MARKET

COUNTDOWN: HOW THE MARKET  MAY MOVE

MAY MOVE  HOW WILL YOU STRATEGIZE

HOW WILL YOU STRATEGIZE

Coach Donnie OP : I know this is taboo but I refuse not to Help when I can

with our Dollar, Our Habits, Our Beliefs, How we Treat Each Other etc WAYYYY more than at the Ballots

with our Dollar, Our Habits, Our Beliefs, How we Treat Each Other etc WAYYYY more than at the Ballots

need to Get Together and Fight

need to Get Together and Fight  for what we Believe in.

for what we Believe in.

Not a fan of politics

Definitely an advocate of Helping People and Truth

We have to Pay Attention.

Both sides have very sinister stuff going on.

We vote

We need to UNIFY or we di

It ain’t about who’s in office but we have to stay informed

Poly means Many

Ticks is Blood Suckin Leeches

Congress is the opposite of Progress

We The People

Instead of expecting some Lady or Dude we never met to improve our lives