Investment ThemesDetailed Quotes

Digital Payment

Watchlist

Digital Payments are transactions that take place via digital or online modes, with no physical exchange of money involved. The Digital Payments concept includes major US-listed companies that offer electronic and cashless means of payments.

- 1070.766

- -11.856-1.10%

Close Oct 31 16:00 ET

1098.812High1070.438Low

1084.837Open1082.622Pre Close63.35MVolume6Rise32.42P/E (Static)8.26BTurnover--Flatline0.62%Turnover Ratio1.49TMarket Cap16Fall1.39TFloat Cap

Constituent Stocks: 22Top Rising: EVTC+1.61%

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Constituent Stocks

SymbolStock Name

Latest PriceChg% ChgVolumeTurnoverOpenPre CloseHighLowMarket CapFloat CapSharesShs Float5D % Chg10D % Chg20D % Chg60D % Chg120D % Chg250D % Chg% Year-to-dateDiv YieldTTMTurnover RatioP/E (TTM)P/E (Static)AmplitudeIndustry

WatchlistPaper Trade

EVTCEvertec

32.7600.520+1.61%534.89K17.51M32.39032.24032.95032.1502.10B2.08B63.98M63.42M+1.27%-1.91%-2.26%+1.83%-11.86%+0.77%-19.54%0.61%0.84%31.2027.072.48%Software - Infrastructure

PYPLPayPal

79.3001.080+1.38%13.92M1.10B78.49078.22079.82078.30079.50B79.28B1.00B999.69M-2.57%-0.65%+2.57%+26.39%+26.01%+44.02%+29.13%--1.39%18.9720.651.94%Credit Services

ADYEYAdyen N.V. Unsponsored ADR

15.3000.080+0.53%452.21K6.88M15.32015.22015.34015.11047.54B47.54B3.11B3.11B-0.46%+1.86%+2.68%+36.12%+14.01%+115.95%+18.79%--0.02%53.1362.701.51%--

GPNGlobal Payments

103.7100.380+0.37%2.91M303.26M103.000103.330105.840102.66026.38B26.18B254.40M252.42M+4.20%+2.06%+5.62%+4.51%-4.58%-6.58%-17.78%0.96%1.15%19.5727.513.08%Specialty Business Services

IMXIInternational Money Express

17.5900.060+0.34%177.35K3.12M17.65017.53017.75017.480573.57M508.94M32.61M28.93M+0.06%-4.25%+2.51%+0.51%-15.02%+6.28%-20.37%--0.61%10.4710.791.54%Software - Infrastructure

EEFTEuronet Worldwide

98.4700.250+0.25%340.29K33.50M98.24098.22099.36097.0904.42B4.14B44.91M42.08M-3.71%-0.61%+2.21%+2.69%-13.68%+24.00%-2.98%--0.81%13.4017.902.31%Software - Infrastructure

VVisa

289.850-0.310-0.11%7.95M2.32B292.090290.160296.340289.621571.13B538.04B1.97B1.86B+2.34%-0.19%+4.69%+13.22%+3.65%+20.10%+11.97%0.72%0.43%29.7929.792.32%Credit Services

MQMarqeta

5.660-0.010-0.18%5.20M29.46M5.6705.6705.7505.5852.88B2.31B508.37M408.77M+7.40%+9.90%+16.94%+14.81%+2.72%+3.66%-18.91%--1.27%LossLoss2.91%Software - Infrastructure

WUThe Western Union

10.760-0.040-0.37%3.11M33.49M10.81010.80010.94010.7503.63B3.61B337.80M335.82M-3.58%-9.81%-7.88%-4.29%-15.87%-0.51%-4.48%8.74%0.93%5.496.401.76%Credit Services

JKHYJack Henry & Associates

181.930-0.850-0.47%570.22K104.03M182.430182.780183.995181.52013.27B13.17B72.92M72.38M-1.44%-2.18%-0.90%+9.94%+8.20%+29.86%+12.41%1.18%0.79%34.7934.791.35%Information Technology Services

WEXWEX Inc

172.600-1.160-0.67%440.43K76.31M174.430173.760175.500171.5706.87B6.81B39.78M39.47M-4.71%-19.18%-16.29%+2.02%-16.49%+0.29%-11.28%--1.12%21.9328.022.26%Software - Infrastructure

FOURShift4 Payments

90.440-0.690-0.76%776.90K70.51M91.00091.13092.00090.1806.05B5.35B66.86M59.10M-3.52%-4.52%+1.38%+42.36%+38.97%+88.89%+21.66%--1.31%54.8163.242.00%Software - Infrastructure

DLODLocal

8.750-0.110-1.24%420.70K3.69M8.8108.8608.8808.6952.49B597.94M284.82M68.34M0.00%-2.78%+1.16%+18.89%-34.01%-52.05%-50.54%--0.62%19.8917.862.09%Software - Infrastructure

SQBlock

72.320-0.970-1.32%4.37M316.71M72.50073.29073.73071.60044.52B39.12B615.65M540.97M-0.32%-1.85%+10.18%+24.58%+1.42%+64.44%-6.50%--0.81%66.963616.002.91%Software - Infrastructure

AXPAmerican Express

270.080-4.000-1.46%2.32M626.51M273.700274.080274.080268.640190.26B148.89B704.44M551.27M+0.04%-5.49%+0.82%+18.35%+12.09%+81.19%+45.89%1.00%0.42%19.8724.091.99%Credit Services

STNEStoneCo

11.100-0.170-1.51%1.78M19.94M11.27011.27011.43011.0903.40B3.09B306.34M278.63M-1.77%+1.19%+1.09%-8.87%-33.13%+6.73%-38.44%--0.64%10.9513.553.02%Software - Infrastructure

BFHBread Financial

49.850-1.120-2.20%524.08K26.29M51.52050.97051.88049.7302.48B2.46B49.72M49.39M-0.42%-5.60%+5.66%+10.85%+23.05%+76.90%+53.74%1.69%1.06%7.953.484.22%Credit Services

PAGSPagSeguro Digital

8.040-0.190-2.31%3.08M24.97M8.2108.2308.3008.0252.57B1.47B319.07M182.88M-3.02%-3.60%-1.95%-30.81%-36.19%+9.39%-35.53%--1.69%7.949.123.34%Software - Infrastructure

MAMasterCard

499.590-14.100-2.74%5.52M2.79B521.250513.690527.900499.030459.62B457.36B920.00M915.46M-2.16%-2.76%+1.07%+11.21%+9.63%+31.30%+17.81%0.51%0.60%37.7642.235.62%Credit Services

GDOTGreen Dot

11.360-0.340-2.91%376.07K4.30M11.67011.70011.75011.350610.22M475.40M53.72M41.85M-1.22%-4.94%+6.47%+30.88%+19.33%-3.24%+14.75%--0.90%Loss87.383.42%Credit Services

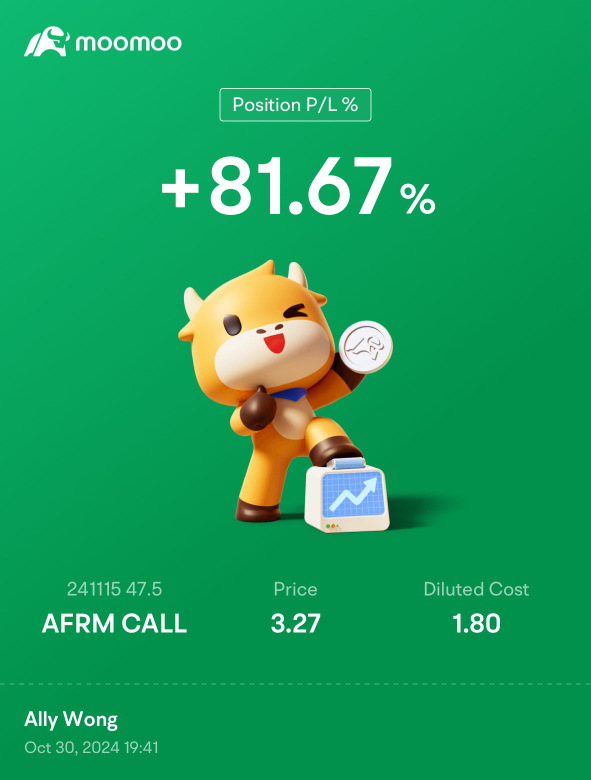

AFRMAffirm Holdings

43.850-1.390-3.07%7.56M331.54M44.39045.24045.29042.78013.77B10.31B314.00M235.14M+4.33%-0.18%+13.90%+81.80%+38.81%+108.41%-10.77%--3.22%LossLoss5.55%Software - Infrastructure

FLYWFlywire

17.420-0.580-3.22%1.02M17.92M17.95018.00018.13817.3802.18B1.94B125.26M111.43M-0.46%+2.17%+9.77%-4.65%-0.97%-35.96%-24.75%--0.92%LossLoss4.21%Software - Infrastructure

News

Thursday, Halloween Market Falls in Scary Reaction to Earnings | Wall Street Today

Global Payments Analyst Ratings

Cathie Wood's Ark Innovation, Genomic ETFs Celebrate 10 Years: How Annual Returns Stack Up Against S&P 500

Stocks Tumble, Nasdaq 100 Selloffs As Tech Giants Disappoint, Crypto Companies Plummet: What's Driving Markets Thursday?

Mastercard Incorporated (MA) Q3 2024 Earnings Call Transcript Summary

Halloween Market Falls, Scared of Meta and Microsoft CapEx | Live Stock

Comments

Afternoon traders. Happy Wednesday, October 30th. The market is pulling some mischief on the day before Halloween, known as mischief night in the United States. Indexes are climbing, but some earnings responses are severe. $Meta Platforms (META.US)$ and $Microsoft (MSFT.US)$ are due to report after the market closes.

My name is Kevin Travers; here is the news about animal spirits moving markets today.

$Super Micro Computer (SMCI.US)$ fell 30% ...

My name is Kevin Travers; here is the news about animal spirits moving markets today.

$Super Micro Computer (SMCI.US)$ fell 30% ...

27

10

$Visa (V.US)$ reported an adjusted EPS of $2.71, which beat the analyst consensus estimate of $2.58, and a revenue of $9.6 billion, which exceeded the forecast of $9.49 billion.

The results was driven by the year-over-year growth in payments volume, cross-border volume, and processed transactions.

Visa projects high single-digit net revenue growth for the first quarter of 2025 and high single to low double-digit growth for FY25.

Also, the company just announced a partnership with $Coinbase (COIN.US)$ to allow ...

The results was driven by the year-over-year growth in payments volume, cross-border volume, and processed transactions.

Visa projects high single-digit net revenue growth for the first quarter of 2025 and high single to low double-digit growth for FY25.

Also, the company just announced a partnership with $Coinbase (COIN.US)$ to allow ...

6

$PayPal (PYPL.US)$ this will go sideway for a while

1

3

4

1

Read more

are taking advantage of this dip in stock price SMCI.. Just my opinion. Be greedy when others are fearful. Be fearful when others are greedy.. Warren Buffett

are taking advantage of this dip in stock price SMCI.. Just my opinion. Be greedy when others are fearful. Be fearful when others are greedy.. Warren Buffett are recent things I read not necessarily my views.

are recent things I read not necessarily my views. DISCLAIMER

DISCLAIMER