The Buffett's Holdings selection refers to the latest holdings released by Berkshire Hathaway. Warren Buffett's portfolio of holdings is closely watched by many investors and analysts due to its long history of above average market performance under Buffett's leadership. Warren Buffett is known as one of the most successful investors of all time and has built up a reputation for making savvy investment decisions that have earned him and Berkshire Hathaway, a substantial following among investors. When Buffett buys or sells a stock, it can move the market and signal to other investors of value in a particular company or industry.

- 1475.017

- -21.536-1.44%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Before the USA election, the world's largest bitcoin ETF saw record inflows of funds.

Both presidential candidates' prospects are bullish for encrypted assets, with strong demand driving the influx of $0.872 billion into Blackrock's iShares Bitcoin Trust ETF, the world's largest bitcoin ETF, on Wednesday.

Will Iran launch attacks against usa before the US election? The international oil market responds by rising again.

①According to sources, Israeli intelligence indicates that Iran will launch attacks on Israel through its proxies in Iraq, expected to occur before the US presidential election; ②The international oil market rose again under this news impact. After Thursday settlement, WTI futures prices rose more than 3%, Brent crude oil futures prices rose more than 2%.

Apple, Amazon, Intel, Peloton, And Tesla: Why These 5 Stocks Are On Investors' Radars Today

Apple's quarterly revenue exceeded expectations, but sales in greater china remained stagnant.

①Apple's revenue in this quarter reached $94.93 billion, an increase of 6% year-on-year, with adjusted earnings per share of $1.64, both stronger than market expectations; ②Apple incurred a one-time tax expense of $10.2 billion earlier this year due to a ruling by the European Union, resulting in a nearly 36% year-on-year decline in net income for the quarter.

Here's the Major Earnings Before the Open Tomorrow

Earnings Movers: Intel, Amazon Fly up in Late Trade After Rough Day Session for Big Tech

Comments

For a deeper understanding of each profitability indicator, please refer to our course>>> Evaluating Profitability with Five Important Indicators

$Apple (AAPL.US)$ $Tesla (TSLA.US)$ $NVIDIA (NVDA.US)$ $Amazon (AMZN.US)$

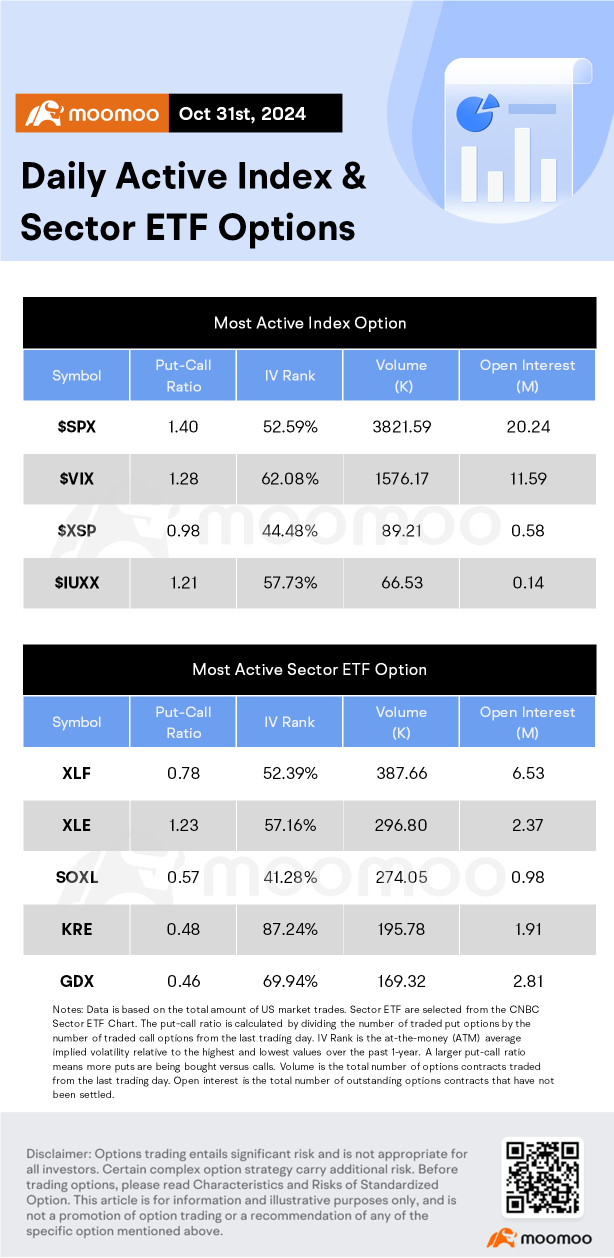

$E-mini S&P 500 Futures(DEC4) (ESmain.US)$ (4 Hour Chart) -[NEUTRAL]We turn neutral as price is currently between 5740 resistance level and 5710 support level. We lean towards a bearish scenario as we expect price to drift lower towards 5710 support level. Technical indicators are displaying a bearish scenario as well.

Alternatively: A 4 hour c...

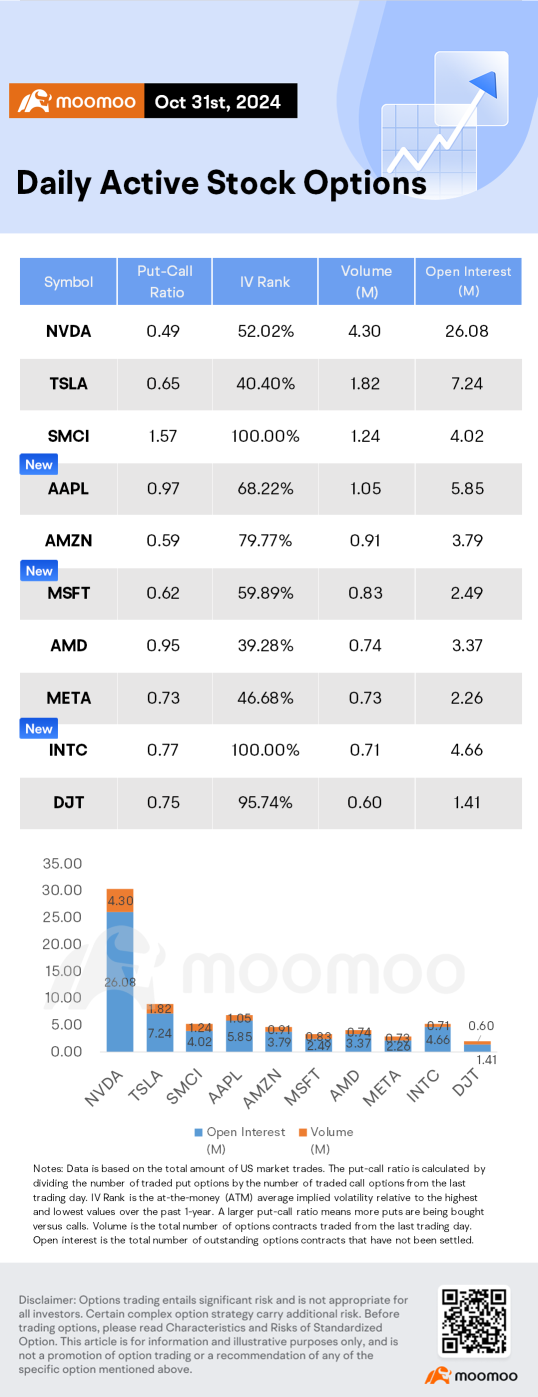

1. $Apple (AAPL.US)$ experienced a 1.82% drop in its stock price, closing at $225.91. The options market was notably active, with a volume of 1.05 million contracts, where calls constituted 50.7% of the activity. Among the options, the $235 calls set to expire on November 15 were the most actively traded.

Apple shares edged about 1.8% lower after the tech giant reported record revenue for the Septe...

the problem i have is that they are lacking innovation