The Buffett's Holdings selection refers to the latest holdings released by Berkshire Hathaway. Warren Buffett's portfolio of holdings is closely watched by many investors and analysts due to its long history of above average market performance under Buffett's leadership. Warren Buffett is known as one of the most successful investors of all time and has built up a reputation for making savvy investment decisions that have earned him and Berkshire Hathaway, a substantial following among investors. When Buffett buys or sells a stock, it can move the market and signal to other investors of value in a particular company or industry.

- 1620.597

- -16.218-0.99%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Notable Analyst Calls This Week: FREYR Battery, Apple and ServiceNow Among Top Picks

Apple Halts iPhone 14, iPhone SE Sales In EU: Here's Why

Weekly Buzz: So far, Santa is Letting us Down

Nvidia, Tesla, Apple, Palantir, AMD Top Options Volume as Holders Exit 0DTE

10 Information Technology Stocks Whale Activity In Today's Session

Friday Market Pulls Back, Led by Mag Seven Decline | Live Stock

Comments

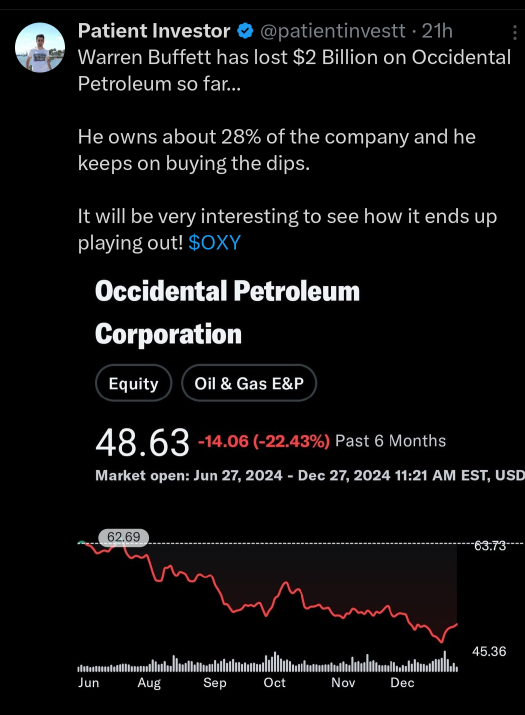

when Trump's president and oil production goes up 100 plus percent more than what it is and the US becomes a net exporter, oil prices will fall precipitously. down 50% within 12 months of January 20th is inauguration. profits for every oil company will drop significantly and their stock prices will also drop. it's not rocket science people it's history repeating itself.

and as was mentioned before even the goat can be wrong

Make Your Choice

Weekly Buzz

The week was slow in terms of news and trade volume, but that did not stop investors from pushing $Apple (AAPL.US)$ to new records, a rally that fizzled out by the end of the week. After multiple down sessions, it looks like...