No Data

BLK Blackrock

- 1032.990

- +8.320+0.81%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Jim Cramer Recommends Buying BlackRock (BLK): 'Better Growth and More Consistent Management'

Bitcoin Hits $98k, Nvidia Falls on Forward Guidance, Google Chrome Break-Up | Live Stock

Bitcoin Hits New All-Time High Above $98,000 As Spot ETFs Crack $100 Billion Net Asset Value Milestone

The US bitcoin ETF assets have surpassed 100 billion dollars.

As the price of bitcoin continues to hit new highs, approaching the 0.1 million dollar mark, the total assets of the directly invested bitcoin exchange-traded funds (etf) in the usa have surpassed 100 billion dollars. Twelve bitcoin etfs, including products from blackrock and fidelity investments, reached this milestone just 10 months after their listing in January of this year, making it one of the most successful fund categories ever issued. Data shows that as bitcoin reached a record high, they recorded a net inflow of 0.773 billion dollars on Wednesday. On Thursday, bitcoin briefly rose by 3.6%, reaching a record 97,892 dollars since November 5.

Bitcoin broke through $97,500 and approaching $0.1 million?

On November 21, bitcoin continued to surge, breaking through $97,500, currently priced at $97,525.79 per coin. The sharp rise in bitcoin prices is primarily attributed to the large inflow of funds as financial giants like blackrock not only incorporated bitcoin into their balance sheets but also launched bitcoin exchange-traded funds (ETFs), attracting a record inflow of $2.6 billion shortly after the USA elections. J.D. Seraphine, CEO of the AI verification platform based on cryptos, Raiinmaker, stated in an interview, "Large financial institutions like blackrock have already taken bitcoin into account."

Certain BlackRock Funds Announce Final Results of Tender Offers

Comments

Caledonia Mining (NYSE AMERICAN: CMCL) announced receiving a notification from BlackRock, Inc. regarding a change in shareholding that crossed a threshold for notification on November 15, 2024. According to the detailed notification, BlackRock's total position decreased to 4.99% of voting rights, consisting of 4.74% in direct shares (911,442 voting rights) and 0.25% through financial instruments (49,190 voting rights through CFDs), down from a previous position of 5.0...

$Blackrock (BLK.US)$ ’s Bitcoin ETF options are a game-changer. $iShares Bitcoin Trust (IBIT.US)$ More tools for hedging, better liquidity, and finally, some legit respect for $Bitcoin (BTC.CC)$ . Let's gooooo!

$Grayscale Bitcoin Trust (GBTC.US)$ $ARK 21Shares Bitcoin ETF (ARKB.US)$ $Bitwise Bitcoin ETF (BITB.US)$

.

Documentation Beats Conversation 🗣

97k and counting 📈

Name something else besides $Bitcoin (BTC.CC)$ that started at 0 roughly and went to 100k in value per unit within 15 years and changed the world 🌍

.

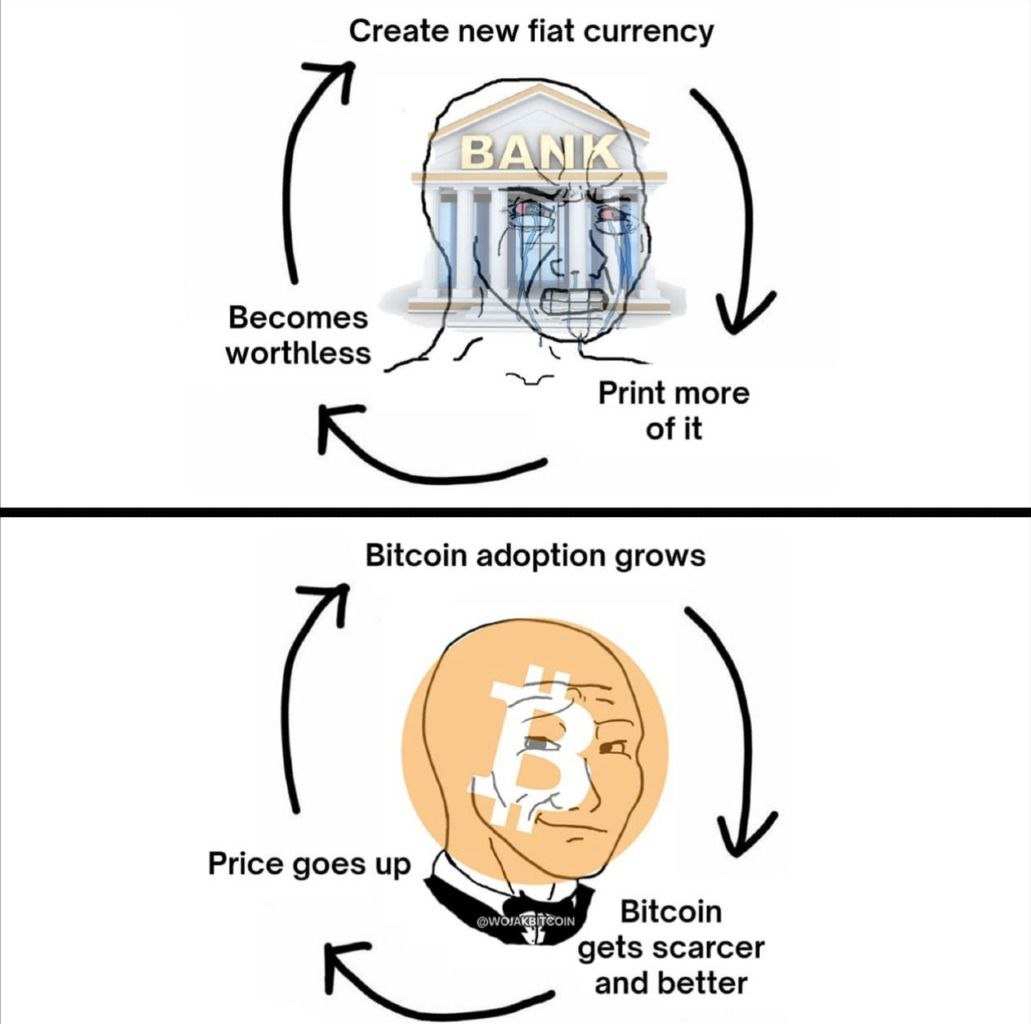

$Bitcoin (BTC.CC)$has no top because fiat has no bottom.

How high can BTC go?

As low as fiat goes, but in the opposite direction.

As more money gets printed (as it...

BlackRock, Inc., a major investment management corporation based in Delaware, has filed a Schedule 13G with the Securities and Exchange Commission (SEC) on November 12, 2024, indicating a significant ownership stake in Coinbase Global Inc Class A common stock. The filing reveals that BlackRock owns 11,470,846 shares, which represents 5.7% of the class, giving it sole voting and dispositive power over these shares

Analysis

Price Target

No Data

No Data