No Data

C250110C60000

- 12.45

- 0.000.00%

- 5D

- Daily

News

CNBC Daily Open: South Korea's Markets Power Through Troubles

Earnings Preview: Citigroup to Report Financial Results Pre-market on January 15

BlackRock Reportedly Leaving Net-Zero Trade Group

Headline from the foreign market: Several Federal Reserve officials have spoken, suggesting that interest rates may remain unchanged for some time. Citigroup has raised its expectations for Brent Crude Oil Product prices in the first quarter.

The main headlines that Global financial media focused on last night and this morning include: Several Federal Reserve officials have indicated that interest rates may remain unchanged for a period of time. Multiple Federal Reserve officials confirmed that interest rates may be maintained at the current level for a long time and will only be cut again if inflation significantly cools. Boston Fed President Susan Collins stated that, given the "substantial uncertainty" in the economic outlook faced by Federal Reserve officials, there is reason to slow the pace of rate adjustments. This view was echoed by other Fed presidents and Federal Reserve Governor Michelle Bowman.

Citi has given YONGDA AUTO a "Buy" rating, with the Target Price adjusted to 2.82 Hong Kong dollars.

Citibank released a research report stating that the Target Price for YONGDA AUTO (03669) has been lowered from 2.98 HKD to 2.82 HKD, with a rating of "Buy." Given that the gross margin of new car sales for YONGDA AUTO in the second half of last year was below expectations, coupled with weak used car sales, the bank has revised its Net income forecasts for 2024 to 2026 down to 0.205 billion, 0.645 billion, and 0.818 billion yuan, respectively, with the gross margin forecast also revised down from 8.7%, 9.2%, and 9.6% to 8.5%, 9.1%, and 9.5%. The bank expects that YONGDA AUTO's new car sales in the fourth quarter of last year grew by 30% quarter-on-quarter.

Citigroup Options Spot-On: On January 8th, 147.28K Contracts Were Traded, With 2.28 Million Open Interest

Comments

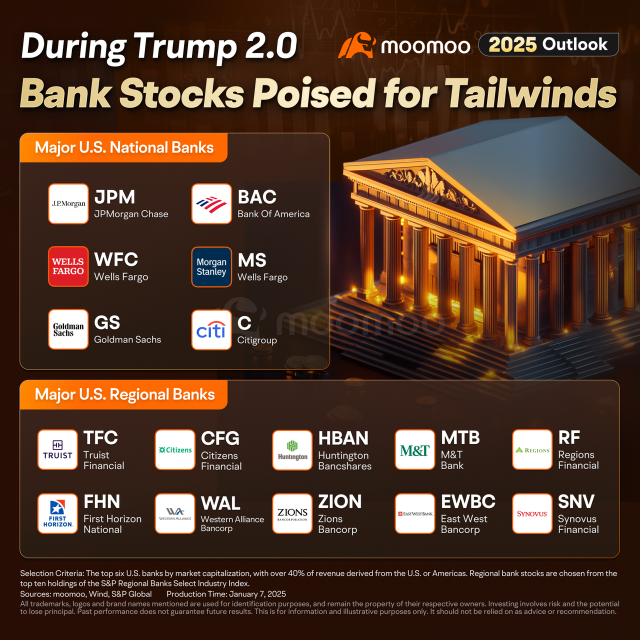

Following the announcement, bank stocks broadly gained, with $Citigroup (C.US)$ and $Morgan Stanley (MS.US)$ rising more than 2%, and regional banks $Synovus Financial (SNV.US)$ and $East West Bancorp (EWBC.US)$ climbing ...

Tax-Loss Harvesting: Investors often sell off underperf...

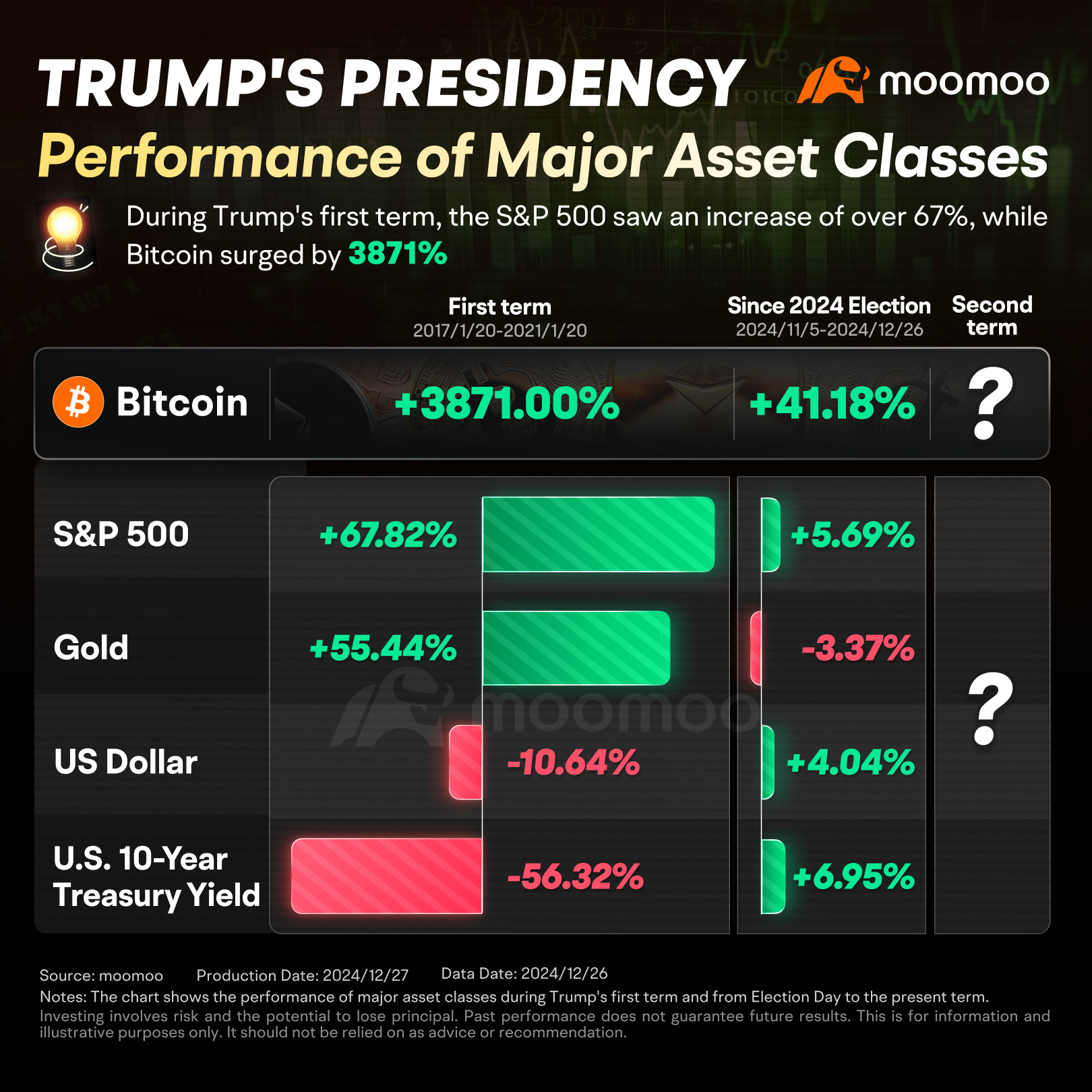

Since Election Day on November 5, 2024, up to December 26, 2024, the S&P 5...

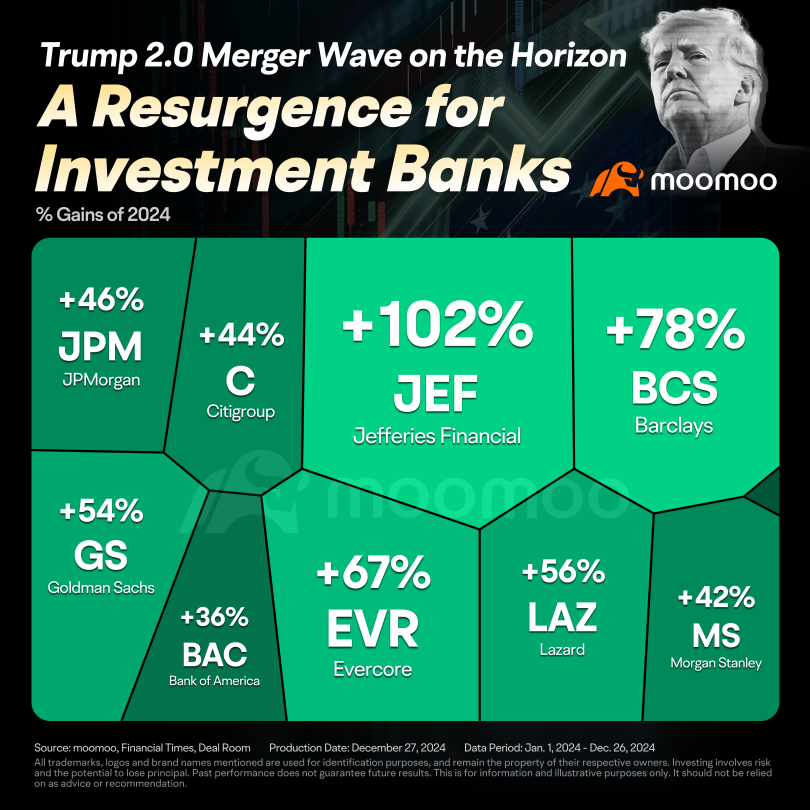

M&A activity is already showing signs of recovery. According to Dealogic, announced M&A deals in 2024 surpassed $1.4 trillion, up from $1.32 trillion in 2023, though slightly bel...