No Data

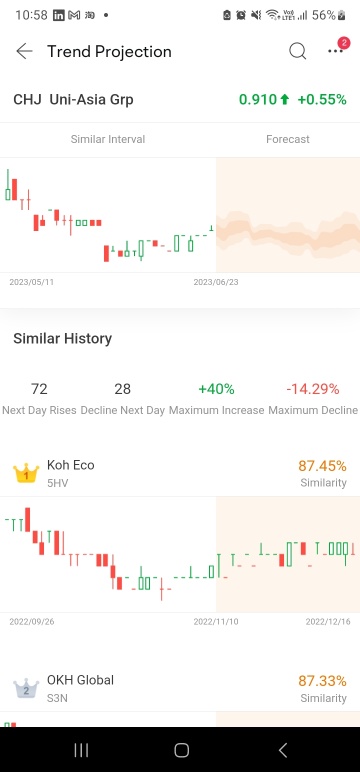

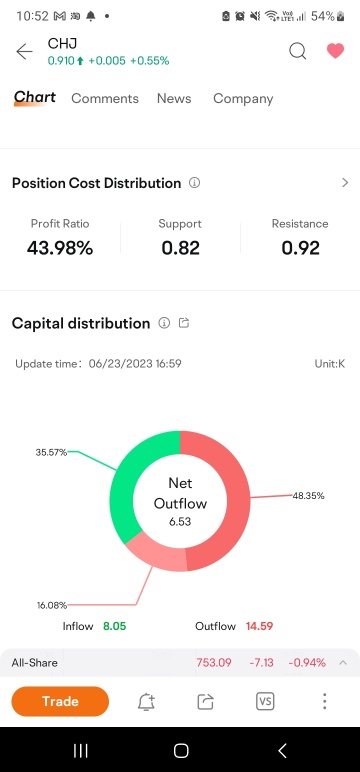

CHJ Uni-Asia Grp

- 0.770

- -0.015-1.91%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Uni-Asia Group Subsidiary Lands Private Finance Initiative Project in Japan

Singapore Industrial Output Opens Door to Growth Forecast Upgrades

The Red Sea crisis has caused freight rates to skyrocket. Who are the winners and losers among Asia Enterprises?

The Red Sea crisis has caused a sharp rise in logistics costs in Asia, boosting the performance of shipping companies, while companies dependent on exports have faced higher logistics costs.

Uni-Asia Group announces interim results, with a shareholder net profit of HKD 62.532 million, a year-on-year decrease of 15.7%.

Uni-Asia Group (00458) announced its mid-year performance for 2024, with revenue of HKD 1.926 billion, a decrease of 6.3% year-on-year; the equity shareholders of the company accounted for a net profit of HKD 62.532 million, a decrease of 15.7% year-on-year; basic earnings per share of HKD 0.23, proposed interim dividend of HKD 0.06 per share. The garment business continued to generate stable revenue and net profit in the first half of 2024. The brand business experienced an increase in net losses, mainly due to a decrease in the contribution of revenue and net profit from its own brand C.P. Company.

Uni-Asia Group's (SGX:CHJ) Dividend Is Being Reduced To $0.01

Non-oil Domestic Exports Grow 15.7% in July After June Decline

Comments

●Singapore shares opened higher on Monday; STI up 0.25%

●S-Reits rebound 7.4 per cent in November, best month in 3 years

●Stocks to watch: OCBC, Uni-Asia

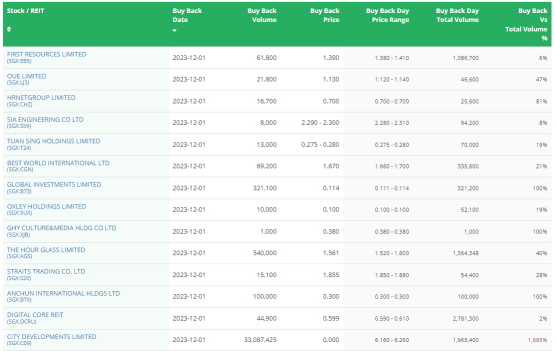

●Latest share buy back transactions

-moomoo News SG

Market Trend

Singapore shares opened higher on Monday. The $FTSE Singapore Straits Time Index (.STI.SG)$ rose 0.25 per cent to 3,098.13 a...

Resistance at 0.92 thin clouds once resistance cleared. Watch out.

Analysis

Price Target

No Data

No Data

jennifer j : do u know what kind of news?