No Data

CNHHKD CNH/HKD

- 1.0634

- -0.0001-0.01%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Who will implement the reserve requirement ratio cut and interest rate cut first as expectations rise to the maximum? Industry predictions suggest that the likelihood of a reserve requirement ratio cut by the end of the year is relatively high, while an i

① Currently, it has entered the observation period for policy effects, and the signals for reserve requirement ratio and interest rate cuts are unclear. The probability of an interest rate cut this week is low, but the likelihood of a reserve requirement cut before the end of the year is higher, and the interest rate cut may have to wait until 2025 for a suitable opportunity; ② A domestic interest rate cut may further increase short-term Exchange Rates pressure, and the probability of a short-term reserve requirement cut is greater than that of an interest rate cut. Recently, the Renminbi's exchange rate against the US dollar has declined, reflecting more of a passive depreciation nature.

The central bank today net withdrew 643.5 billion yuan from the open market, and the year-end funding situation will remain relatively loose.

1. It is believed in the industry that the central bank is currently inclined to "protect but not excessively loosen" the monetary policy, focusing on whether to initiate a Reserve Requirement Ratio (RRR) cut before and after the MLF renewal. 2. The central bank will strive to maintain reasonable and ample market liquidity, and the volatility of the funding situation at the end of the year will be significantly lower than in previous years.

Hong Kong Central Bank Cuts Interest Rate Tracking Fed Move, Banks Follow

Hong Kong's Unemployment Rate Unchanged in September-October

Timely lowering of reserve requirements and interest rates, preventing and resolving risks in key areas, maintaining stable Exchange Rates. The central bank, financial regulatory authority, and Forex bureau collectively responded on how to proceed next ye

① The central bank also pointed out the need to explore and expand the macro-prudential and financial stability functions of the central bank, and effectively implement two monetary policy tools to support the stable development of the Capital Markets. Experts indicate that this statement significantly improves market expectations and enhances market anticipation for a slow bull market trend in the medium to long term; ② The Financial Regulatory Bureau pointed out the necessity to effectively prevent and resolve risks in key areas, continuously improving the quality and effectiveness of financial regulation, and promoting high-quality development in the Banking and Insurance industries.

Hong Kong: Preliminary Statistics indicate that the GDP grew by 1.8% year-on-year in the third quarter.

According to the analysis of the service Industry by composition and comparison with the same period last year, the total value added by all service activities effectively increased by 1.9% in the third quarter of 2024, which is similar to the 2.0% increase in the second quarter.

Comments

July 25, Tue, 15 bln yuan

July 26, Wed, 25 bln yuan

July 27, Thu, 26 bln yuan

July 28, Fri, 13 bln yuan

---

Total 112 bln yuan 7-day RRP.

$USD/CNH (USDCNH.FX)$ $CNH/USD (CNHUSD.FX)$ $USD/CNY (USDCNY.FX)$ $CNY/USD (CNYUSD.FX)$ $HKD/CNH (HKDCNH.FX)$ $CNH/HKD (CNHHKD.FX)$

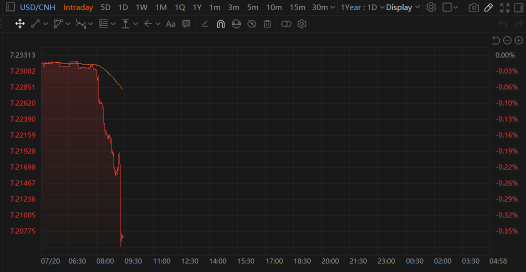

Offshore yuan $CNH strengthens per USD by 260 pips and back to the 7.21 mark.

$USD/CNH (USDCNH.FX)$ $CNH/HKD (CNHHKD.FX)$ $HKD/CNY (HKDCNY.FX)$ $CNY/HKD (CNYHKD.FX)$ $USD/HKD (USDHKD.FX)$ $iShares MSCI China ETF (MCHI.US)$ $CSOP Hang Seng TECH Index ETF (03033.HK)$ $Global X MSCI China Consumer Discretionary ETF (CHIQ.US)$ $BABA-W (09988.HK)$ $JD-SW (09618.HK)$

$CNH/HKD (CNHHKD.FX)$ $CNH/CNY (CNHCNY.FX)$ $CNY/USD (CNYUSD.FX)$ $USD/CNY (USDCNY.FX)$ $BANK OF CHINA (03988.HK)$ $HKEX (00388.HK)$

$USD/CNY (USDCNY.FX)$ $CNY/USD (CNYUSD.FX)$ $CNH/CNY (CNHCNY.FX)$ $CNH/HKD (CNHHKD.FX)$ $NASDAQ Golden Dragon China (.HXC.US)$