No Data

EMB241122C105000

- 0.02

- 0.000.00%

- 5D

- Daily

News

US Blue-Chip Bond Issuance Reaches Second-Highest Level Ever

The dynamics have changed! Under the strong US dollar, emerging markets are at risk.

Analysis suggests that under deglobalization, the growth momentum will shift from emerging markets to the USA, which will be bullish for the US dollar. If the USA further implements even larger tariffs, many currencies in emerging markets pegged to the US dollar will become even more fragile and face the risk of explosive devaluation, especially countries like Argentina, Egypt, and Turkey. The prices of csi commodity equity index will also decline.

Trump's 2.0 policy supports the strength of the dollar, while emerging markets face a double blow in both stocks and currency.

The MSCI emerging markets stocks index fell by 0.8% at one point, marking its fourth consecutive day of decline, setting the longest losing streak in three weeks.

Global money market funds have attracted over $20 billion in inflows for three consecutive weeks, while demand for stock funds has cooled down.

Global currency market funds have attracted inflows for the third consecutive week.

HSBC: In 2024, the issuance of bonds in EMEA emerging markets is expected to reach a record high.

jpmorgan expects that although the November US presidential election and escalating tensions in the Middle East may cause market volatility, this year the bond issuance volume in the emerging markets of Europe, the Middle East, and Africa (EMEA) will reach a record high.

Daiwa: The next ten years will be the "decade of emerging markets".

Morgan Stanley stated that the 'macro overall fundamentals in emerging markets look good', the Fed rate cut and the weakening of the US dollar have opened the door for emerging market stocks to outperform US stocks.

Comments

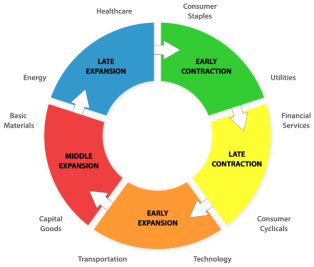

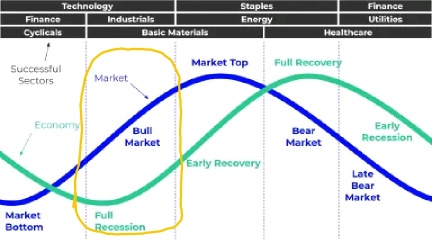

Tech has been killing it in the market this year, thanks to the artificial intelligence boom. The tech sector has lifted the entire market while other sectors have greatly underperformed.

Occasionally, an overheated sector will begin to cool off as investors rotate their capital into underperforming sectors in expectation of a broadening rally or a change in the economy.

Even the NASDAQ announced a special rebalancing later this month, ...

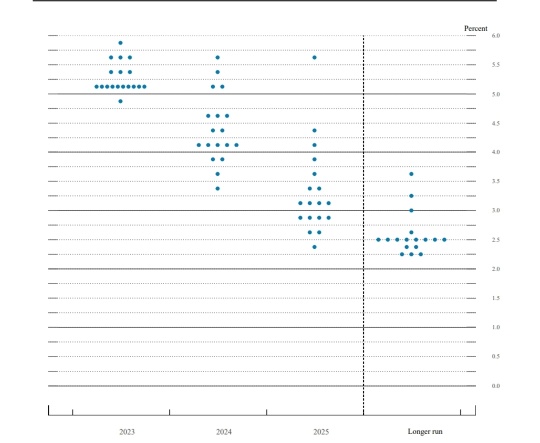

If you want guaranteed returns on a low risk investment, then look towards fixed income investing. US treasuries are some of the least risky investments in the fixed income space.

$Vanguard Total Bond Market ETF (BND.US)$ $iShares J.P. Morgan USD Emerging Markets Bond ETF (EMB.US)$ $Short-Treasury Bond Ishares (SHV.US)$ $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ $iShares 3-7 Year Treasury Bond ETF (IEI.US)$ $iShares 7-10 Year Treasury Bond ETF (IEF.US)$ $Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$

���������...

Silverbat : Inflation will be gone followed by transitional contraction of soft landing.

SpyderCall OP Silverbat : A soft landing is what I see playing out on the economic data. I think the market is already pricing in the soft landing possibly. But I'm not certain on that.

One thing that could be a worry is if inflation falls too fast and for too long. this would be very bad for any economy.

Silverbat SpyderCall OP : CPI will be up again after Oct-Nov based on its annual cycle,another 0.5% hike?

73582006 : Some time ago, inflation caused stocks to dive

SpyderCall OP Silverbat : Who knows. Europe, UK, and Australia paused and then hiked again. They haven't signaled a pause yet. However, the Fed has signaled a decrease in interest rates going further, so it will take a big increase in inflation to change that narrative. But anything can happen in these crazy markets

View more comments...