No Data

HSBC241220P50000

- 2.90

- 0.000.00%

- 5D

- Daily

News

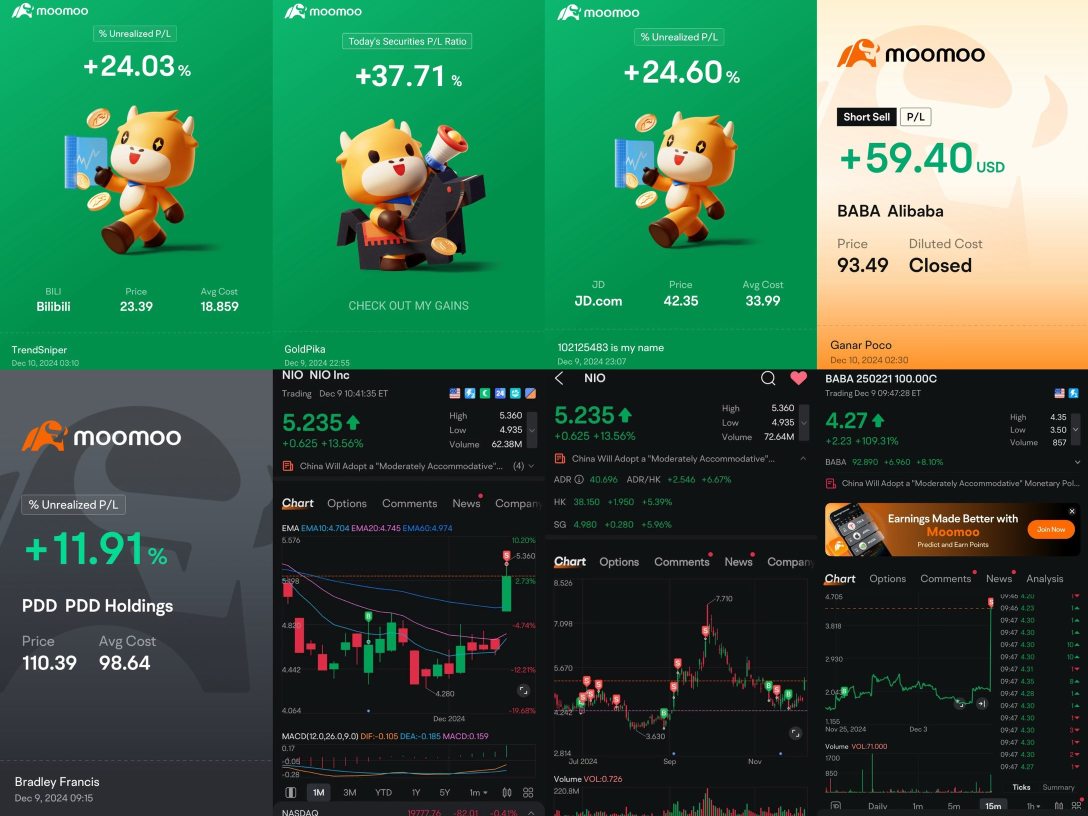

Top Gap Ups and Downs on Friday: NVO, BABA, INFY and More

HSBC Continental Europe Enters Into a Memorandum of Understanding Regarding Potential Sale of HSBC Assurances Vie (France) to Matmut Société D'Assurance Mutuelle

On December 19, HSBC Holdings (00005) spent 0.196 billion Hong Kong dollars to repurchase 2.632 million shares.

HSBC Holdings (00005) announced that on December 19, 2024, the company will spend 0.196 billion Hong Kong dollars...

HSBC Buys Back 9 Million Shares

Top Gap Ups and Downs on Thursday: ACN, MU, VRTX and More

HSBC expects the dollar to remain strong, while the euro is likely to fall below parity.

HSBC stated in a report on Thursday that there are no conditions for the dollar to weaken like it did when Donald Trump first took office in 2017. A strong dollar means that the euro will fall below parity next year, and the yen will drop toward 160. Analysts led by Paul Mackel, the head of Global Forex Research at HSBC in London, stated in the report that risks from the trade war, relatively higher yields on US government bonds, and the divergence of the global growth cycle should continue to support the dollar. Fiscal, monetary, and Forex policies are 'just right' for the dollar, but 'not so' for the euro. It is not just the dollar, but it is expected that by 2025.

Comments

Here’s the gist:

1️⃣ Boost consumer spending (yes, they’re serious about it)

2️⃣ Push tech innovation and industrial upgrad...

$ANZ Group Holdings Ltd (ANZ.AU)$ $HSBC Holdings (HSBC.US)$ $National Australia Bank Ltd (NAB.AU)$

At its core, bloc...

Yeize : First time looking at leveraged ETFs—are they worth the risk? Kinda nervous but don’t wanna miss the rally.

Spinee OP Yeize : Yeah, leveraged ETFs can definitely bring some excitement—but remember, with the market mix today, it’s good to stay cautious. If you’re not comfortable with the risk, maybe stick to a one-time leveraged option for now.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

JacobAhearne : I'm thinking it's about turn for the worst pretty quickly... the Swiss have forecasted the potential for negative growth and the ECB are suggesting potential of cutting rates by 50 basis points post haste.

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

I'm starting to get worried.

if it's rally big I'll be clean rocking the clean house, and selling up.