US OptionsDetailed Quotes

HYG241220C79500

- 0.01

- 0.000.00%

15min DelayClose Dec 20 16:15 ET

0.00High0.00Low

0.01Open0.01Pre Close0 Volume10.69K Open Interest79.50Strike Price0.00Turnover130.76%IV1.18%PremiumDec 20, 2024Expiry Date0.00Intrinsic Value100Multiplier-1DDays to Expiry0.01Extrinsic Value100Contract SizeAmericanOptions Type0.0452Delta0.1765Gamma7858.00Leverage Ratio-2.4269Theta0.0000Rho355.39Eff Leverage0.0004Vega

Ishares Iboxx $ High Yield Corporate Bond Etf Stock Discussion

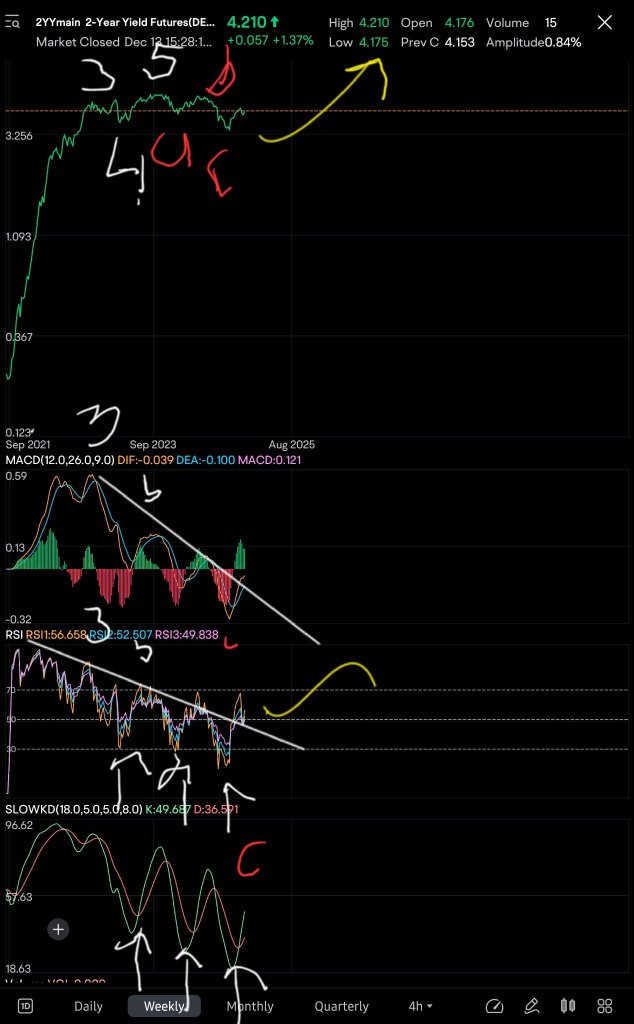

All things must end. It has been a long time since I have done any update, so it may seem odd to make one last update after such a long break. I have over 40 written incomplete Updates that I never got to post. I have a blockage with completing them...

On one of my last posts, I explained why I was ending. I said the path was set, Powell had chosen -

(from my post with this 👇)

In that post i highlighted some stocks (tesla) that did quite well. But that cycle has ende...

On one of my last posts, I explained why I was ending. I said the path was set, Powell had chosen -

(from my post with this 👇)

In that post i highlighted some stocks (tesla) that did quite well. But that cycle has ende...

+7

10

5

2

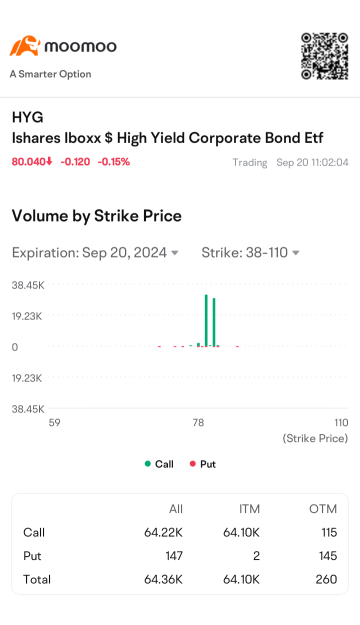

$Ishares Iboxx $ High Yield Corporate Bond Etf (HYG.US)$ is this going up or down after the repo news I'm confused

$Ishares Iboxx $ High Yield Corporate Bond Etf (HYG.US)$ potential break out tomorrow.

$Ishares Iboxx $ High Yield Corporate Bond Etf (HYG.US)$ forming beautiful cup and handle may retest highs

$Ishares Iboxx $ High Yield Corporate Bond Etf (HYG.US)$ 79.56 would be strong support level on the ma20 line

1

Good morning, good morning, gooooood morning everyone and welcome back to another Options Screener Recap post! I hope all your options are in the money, portfolios in the green, and withdrawls ready to hit the routing number.

In the previous article we talked about what a Screener is, what the purpose of the Screener is, and the goal I want to achieve with the Options Screener. If you happened to miss that post, you can read it here:

Options Screener Recap

N...

In the previous article we talked about what a Screener is, what the purpose of the Screener is, and the goal I want to achieve with the Options Screener. If you happened to miss that post, you can read it here:

Options Screener Recap

N...

+30

17

1

9

No comment yet

TWIMO (151403908) : interesting read. how long have you been worried and when did that worry increase?

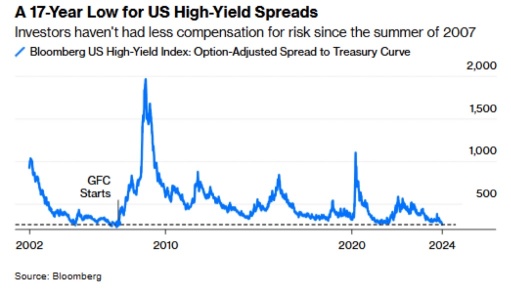

iamiam OP TWIMO (151403908) : I have been worried for a long time, but not bearish. my worry increased in the summer, that's when I sold my longs.

TWIMO (151403908) iamiam OP : I ask around and listen to get a feel. Some are earning from entry years ago. Some are earning from knowing. Some are earning by hiding losses. Some only announced their wins. Most are carrying bags

103706768 : Rule number 1 of bond trading, u dont trade using TA. Magical squiggly line TA indicators and so on doesnt work on bonds its dependent on FED rates and treasury auctions, bond yeilds are going up due to lack of demand at treasury auction. Currently bond yeilds have alrd inverted but the long awaited recession has yet to occur worse of all market is pricing in inflation going back up due to hot CPI/ consumer data while stocks are all going for all time high (this isnt normal yeild and stock tend to have counter relation). Now we can only wait and see is it the bond market thats wrong or the stock market thats wrong.

iamiam OP 103706768 : what does your comment offer?![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

I trade bonds based on squiggly lines and do quite well. I can draw squiggly lines and trend anything. whether you agree or not, that's on you and your 'rules'

enjoy your day