No Data

IWO241115C275000

- 15.30

- 0.000.00%

- 5D

- Daily

News

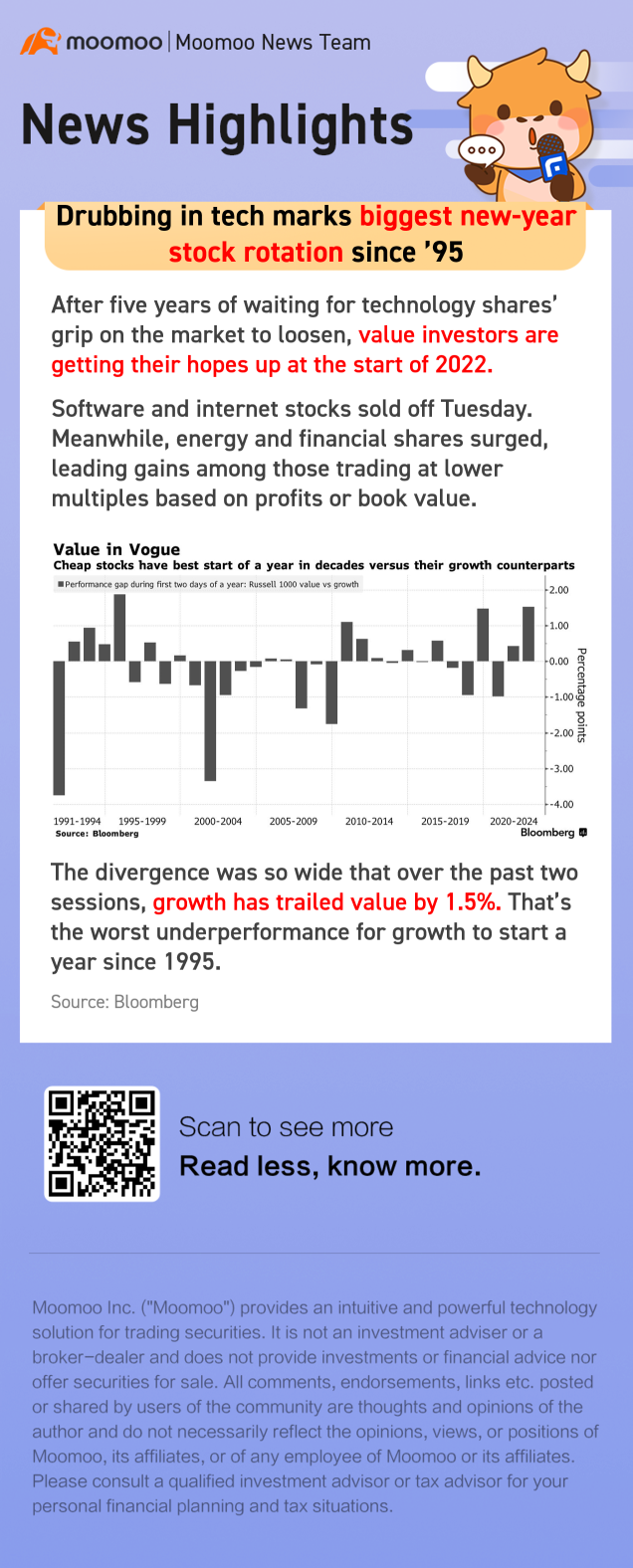

Taking history as a lesson: After the ultimate two options for the U.S. president, where will the U.S. stock market go?

①Taking a lesson from history, the USA stock market usually rises after a presidential election, but investors need to be prepared for some short-term fluctuations first; ②This means investors should not expect the USA stock market to immediately rise on Wednesday or the following days.

No matter who becomes president, goldman sachs trading department: regardless of the outcome, CTA will sell stocks this week.

Last week, CTA has already sold $8 billion worth of global equity. goldman sachs trading department predicts that in the market's decline, the E-mini s&p 500 index will experience an outflow of $11.2 billion, and will have an outflow of $0.94 billion in the case of an increase.

For a decade, the US stock market's 'passive rise' has brought about what changes to the market?

Goldman Sachs stated that looking at the US stocks as a reference, the real estate industry has the highest passive holding proportion, while the energy industry has the lowest. The passive holding proportion of large-cap stocks is relatively small, and the impact of passive holding on the s&p 500 index stock trend is not significant. s&p 500 index stocks with high passive holdings do not consistently outperform stocks with low passive holdings.

The USA election vote is imminent, and the market is facing a huge shake-up! Traders are all adopting a wait-and-see attitude.

Traders are discussing various possibilities of the USA election, constantly checking the latest polls and trends in the gambling market, in order to predict whether the Republican Trump or the Democrat Harris is leading, and what this means for their asset allocation.

Stay put or cut interest rates as planned? Tonight's PCE will add fuel to the direction of next week's Fed decision.

The latest performance of the inflation index favored by the Federal Reserve is about to be released, the US Department of Commerce will release the US September Personal Consumption Expenditure Price Index (PCE) tonight, a key data disclosed before the Fed's interest rate decision next week.

Is there a hidden mystery in the US stock earnings conference? Bank of America: A key word frequently appearing sends a major bullish signal.

①As the third financial reporting season of the US stock market continues, more than one-third of US stock companies have already released their third-quarter financial reports; ②Bank of America has conducted a detailed analysis of the wording used by executives of US stock companies during the third quarter earnings conference calls, and has interpreted a significant signal: US stock company profits will increase significantly in 2025.

Comments

1) Borrow rates spiked for some popular shorts (often a sign of shorts pressing).

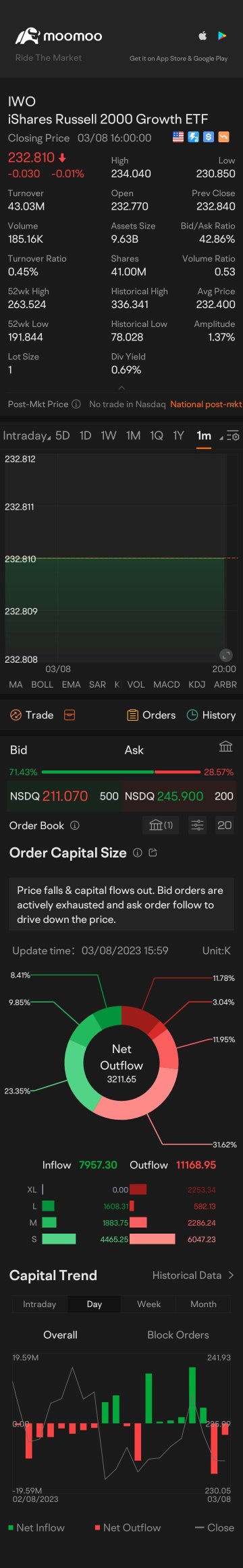

2) Legit small-cap growth stocks (some heavily shorted, some not) sold off en masse in tandem with heavily-shorted junk ( $iShares Russell 2000 Growth ETF (IWO.US)$ was down 1.2%) . When this has happened in the past, these stocks have often later moved higher in tandem.

Throw in rates fallin...

Key Points

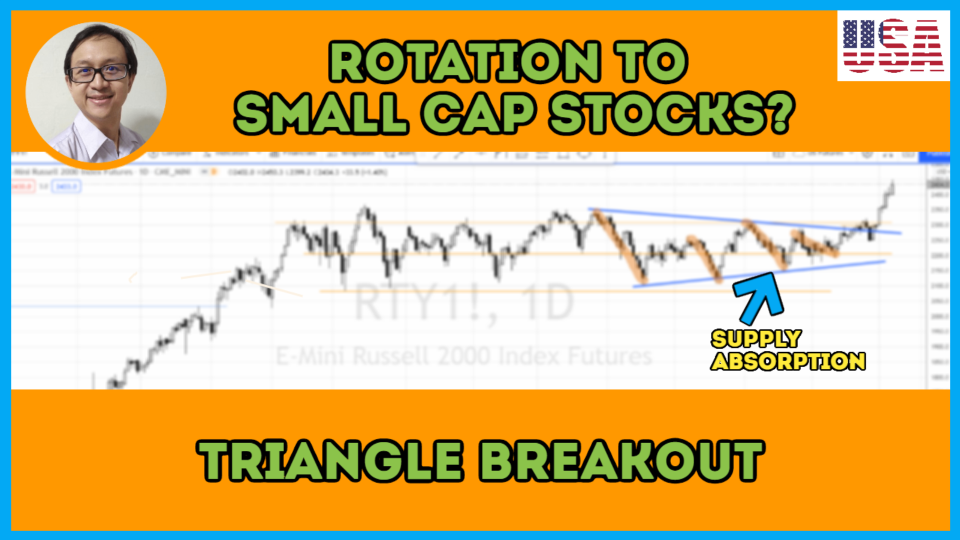

- Why there is heavy accumulation in Russell 2000 ( $iShares Russell 2000 ETF (IWM.US)$ ) via the apex formation.

- How to anticipate if a potential rotation will happen from $S&P 500 Index (.SPX.US)$ , $Nasdaq Composite Index (.IXIC.US)$ into $Dow Jones Industrial Average (.DJI.US)$ and $Micro E-mini Russell 2000 Index Futures(DEC4) (M2Kmain.US)$

- Why the indices could be in a vulnerable condition and what to expect.

- Using Wyckoff's law — efforts vs results to interpret the supply absorption and judge the timing of the up swing.

- Sector ETF to focus: $Industrial Select Sector SPDR Fund (XLI.US)$ $Invesco WilderHill Clean Energy ETF (PBW.US)$ $iShares US Home Construction ETF (ITB.US)$ and watch out for the extensive run in $VanEck Semiconductor ETF (SMH.US)$

- For small cap, feel free to explore $iShares Russell 2000 Growth ETF (IWO.US)$ $iShares Russell 2000 ETF (IWM.US)$ $Ishares Russell 2000 Value Etf (IWN.US)$

Watch the video below