No Data

KARS Kraneshares Tr Electric Vehicles And Futr Mblty Idx Etf

- 21.910

- -0.230-1.04%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Tech stocks in the US stock market are experiencing a strange phenomenon: exceeding expectations in performance is no longer impressive, investors want more.

1. For investors, the performance of large technology companies in the US stock market has exceeded expectations and can no longer satisfy them; 2. This week, technology companies have successively released quarterly financial reports, with most exceeding revenue and profit expectations, yet the market response has been brutal; 3. Some opinions believe that the dismal stock prices are due to overly high market expectations, while others claim it is a technical profit-taking pullback.

Tesla Can Make Cybercab For The Same Money It Takes Waymo To Install Lidar Sensors On Its Robotaxi, Says Ark Analyst

Movement of risk avoidance due to the decline in US high-tech stocks and the appreciation of the yen.

The Nikkei average fell significantly. It closed at 38,053.67 yen, down 1,027.58 yen (volume approximately 1.9 billion 90 million shares). Following the selling of tech stocks in the previous day's U.S. market, semiconductor-related stocks and others lost value, as well as the yen temporarily strengthened to the 151 yen per dollar range, putting pressure. Selling spread to export-related stocks as well. Furthermore, in the afternoon session, profit-taking selling ahead of the three-day weekend starting tomorrow and caution ahead of next week's U.S. presidential election caused selling pressure after the holiday.

Cathie Wood Bets Big On Mark Zuckerberg: Ark Pours $19M Into Meta Shares, Dumps Palantir And Tesla Stock

Apple, Amazon, Intel, Peloton, And Tesla: Why These 5 Stocks Are On Investors' Radars Today

November 1st [Today's Investment Strategy]

[FISCO Selected Stocks] [Material Stocks] SCREEN Holdings <7735> 10,030 yen (10/31) Engaged in semiconductor manufacturing equipment such as wafer cleaning equipment. The earnings forecast for the fiscal year ending March 2025 has been revised upward. Operating profit is expected to be 113.5 billion yen (an increase of 20.5% from the previous year). It has been raised by about 8% from the previous forecast. This is the second upward revision of the full-year forecast for this fiscal year. The upward revision was due to factors such as the first-half operating profit of 58.2 billion yen (a 51.1% increase from the previous year), exceeding the previous forecast of 53 billion yen. "Year

Comments

📊⚡️📊

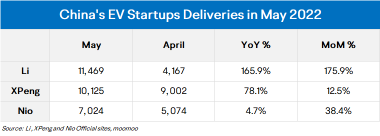

Shares of Chinese electric-vehicle startups have rebounded from losses in May as of Wednesday, June 8. $NIO Inc (NIO.US)$, among other names, has retaken about 75% from the recent bottom of $11.67 on May 12, 2022.

China's electric-vehicle startups reported stronger delivery figures in May and expect continued growth in June as supply chains and output begin to recover from a Covid-19 induced slump.

$NIO Inc (NIO.US)$ , �������...

Low-carbon living is the first step to make it happens =

1. Reduced global warming

2. Better air quality = better health

3. Less pollution (Is it even considered? Of course is = < burning 🔥 oil 🛢? = < waste 🗑 pollutant to the world 🌎)

"As a survey showed, 72% of Singaporeans are environmentally, socially and governance (ESG) ...

MARKET-TEST-DUMMY : Lil uptick started

Bob Ray MARKET-TEST-DUMMY : china's money is comming in

EZ_money : Chinese stocks will fly

p

p

Krystian 1983 : Shit just going down

Stock_Drift OP Krystian 1983 : It’s 10/1.

View more comments...