No Data

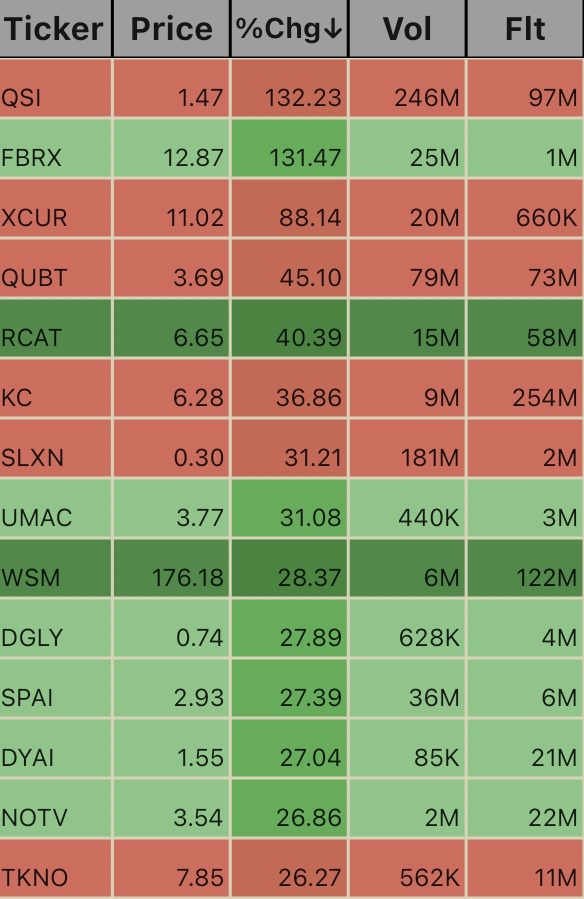

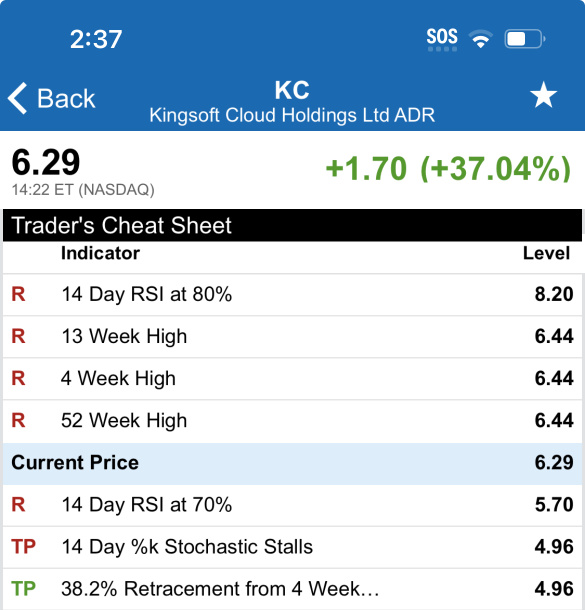

KC Kingsoft Cloud

- 5.790

- -0.740-11.33%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Asian Equities Traded in the US as American Depositary Receipts Decline

On November 21, southbound funds net bought over 4.6 billion Hong Kong dollars: increased positions in Kuaishou and alibaba, with outflows from sunac and kingsoft cloud.

① The southbound capital transacted approximately 51.5 billion Hong Kong dollars that day. Which stocks are seeing continued inflow? ② Kuaishou experienced an inflow of over 0.6 billion Hong Kong dollars. How is the stock price performing?

Cautious Optimism for Kingsoft Cloud Amid AI-Driven Growth and Cash Flow Challenges

Hang Seng Index fell 0.13% in the morning session, with obvious structural market trends.

Boyaa Interactive (00434) rose by more than 10%, bitcoin price surpassed $0.095 million, company's holding positions floating profit has exceeded $0.1 billion.

Bocom Intl: Maintains a 'buy' rating on Kingsoft, with the target price raised to 33 Hong Kong dollars.

Bocom Intl released a research report stating that based on the profit expansion of Kingsoft's (03888) gaming business and the valuation increase of Kingsoft Cloud (03896), the target price for Kingsoft has been raised by 10% from HKD 30 to HKD 33, maintaining a "buy" rating. The bank expects Kingsoft's gaming revenue for the full year of 2024 to increase by 30% year-on-year, while operation in the fourth quarter may weaken quarter-on-quarter. There are five new games planned for 2025, three of which have already obtained approval numbers, and it is expected that the new games will offset the high base effect of old games. WPS may increase its overseas promotional efforts in 2025. The report indicated that Kingsoft's third-quarter performance exceeded expectations, with total revenue increasing year-on-year.

[Brokerage Focus] Open Source Securities maintains a 'buy' rating for Kingsoft (03888), pointing out that Kingsoft Cloud is expected to benefit from the Xiaomi ecosystem and AI-driven initiatives, which may enhance its valuation.

Kingsoft Financial News | According to research from Open Source Securities, the office software business of Kingsoft (03888) experienced a year-on-year revenue growth of 12.5% in Q3 2024, with the monthly active users of major products increasing by 4.9% year-on-year and accelerating quarter-on-quarter. The revenue from personal subscription services grew by 17.2% year-on-year, and WPS AI 2.0 provided a more convenient creative experience, enhancing paid stickiness and conversion rates. The revenue from institutional subscriptions remained flat year-on-year and increased by 23.8% quarter-on-quarter. The institution estimated that the impact of the shift in subscription model (from annual billing to monthly billing) has significantly diminished, while the company actively expands into state-owned and private enterprise markets, with contracts.

Comments

Revenue +16% to $268.7 million (BEAT vs. $268.3 est.)

Adjusted EPS -$0.62 (MISS vs. -$0.15 est.)

Metrics:

Gross profit +54.6% to $43.2 million

Non-GAAP EBITDA of $26.4m vs. -$6.4m YoY

Non-GAAP EBITDA margin of 9.8% vs. -2.8%

AI accounted for 31% of public cloud revenue

Public cloud rev +15.6% to $167.5m

Enterprise cloud rev +16.7% to $101.2m

Outlook:

For the fourth quarter of 2024, thanks to the parallel two drivers of both public cloud and ente...

📊⚡️📊

Analysis

Price Target

No Data

No Data

Sponge investor OP : Even insiders know this