No Data

MCO Moody's

- 443.980

- -6.310-1.40%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Moody's Facing Potential Upside Mid-Term Despite Near-Term Issuance Headwinds, RBC Says

If You Invested $100 In This Stock 20 Years Ago, You Would Have This Much Today

Market observers: Wall Street's wealth engine has stalled, which is not a good sign for the USA economy.

Since the Federal Reserve's MMF tightening policy peaked in 2023, Wall Street traders experienced the largest cross-asset losses last week. The culprits include Trump's Trade policy, economic slowdown, and the potential recovery in Europe, among others. Bulls hope the situation can improve. There is also a small group of market observers who are quite vocal about their concerns, fearing it may impact the overall economy of the USA. The problem is that in recent years, the stock market's rise has played a significant role in enhancing Americans' sense of wealth, helping to support Consumer spending. According to the Federal Reserve's data, last year, stock holdings accounted for 64% of American households' financial Assets, setting a record.

Don't Ignore The Insider Selling In Moody's

Peering Into Moodys's Recent Short Interest

Live Stock News: Hard Week Reaching an End, AVGO Shows Semi's Are not Going Down Without a Fight

Comments

he said when this crosses $500 it's gone he says Berkshire owns 13%, the estimates are going to go through the roof on this company and the stock is unstoppable when it crosses 500 look at this vertical move

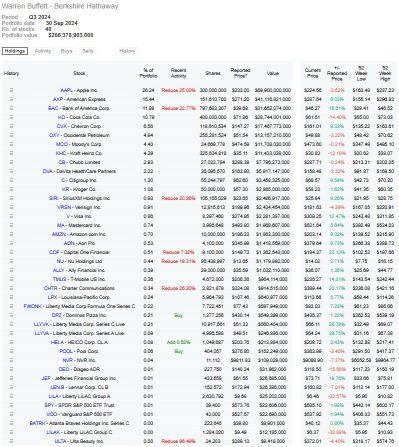

Top Holdings:

1. $Apple (AAPL.US)$ 26.2% of the portfolio, valued at $69.9 billion. Despite recent trimming of the stake, Apple remains the largest holding.

2. $American Express (AXP.US)$ 15.4%, valued at $41.1 billion.

3. $Bank of America (BAC.US)$ 11.9%, worth $31.7 billion, though the stake was reduced by 23% in Q3.

4. $Coca-Cola (KO.US)$ 10.8%, va...

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Apple (AAPL.US)$ $American Express (AXP.US)$ $Bank of America (BAC.US)$ $Coca-Cola (KO.US)$ $Chevron (CVX.US)$ $Occidental Petroleum (OXY.US)$ $Moody's (MCO.US)$ $Citigroup (C.US)$ $Visa (V.US)$