US Stock MarketDetailed Quotes

PLTR Palantir

- 41.920

- +0.360+0.87%

Close Nov 1 16:00 ET

- 41.910

- -0.010-0.02%

Post 19:59 ET

93.88BMarket Cap246.59P/E (TTM)

42.570High41.590Low33.72MVolume41.930Open41.560Pre Close1.42BTurnover1.64%Turnover Ratio465.78P/E (Static)2.24BShares45.14052wk High23.17P/B86.30BFloat Cap15.66452wk Low--Dividend TTM2.06BShs Float45.140Historical High--Div YieldTTM2.36%Amplitude5.840Historical Low42.096Avg Price1Lot Size

Palantir Stock Forum

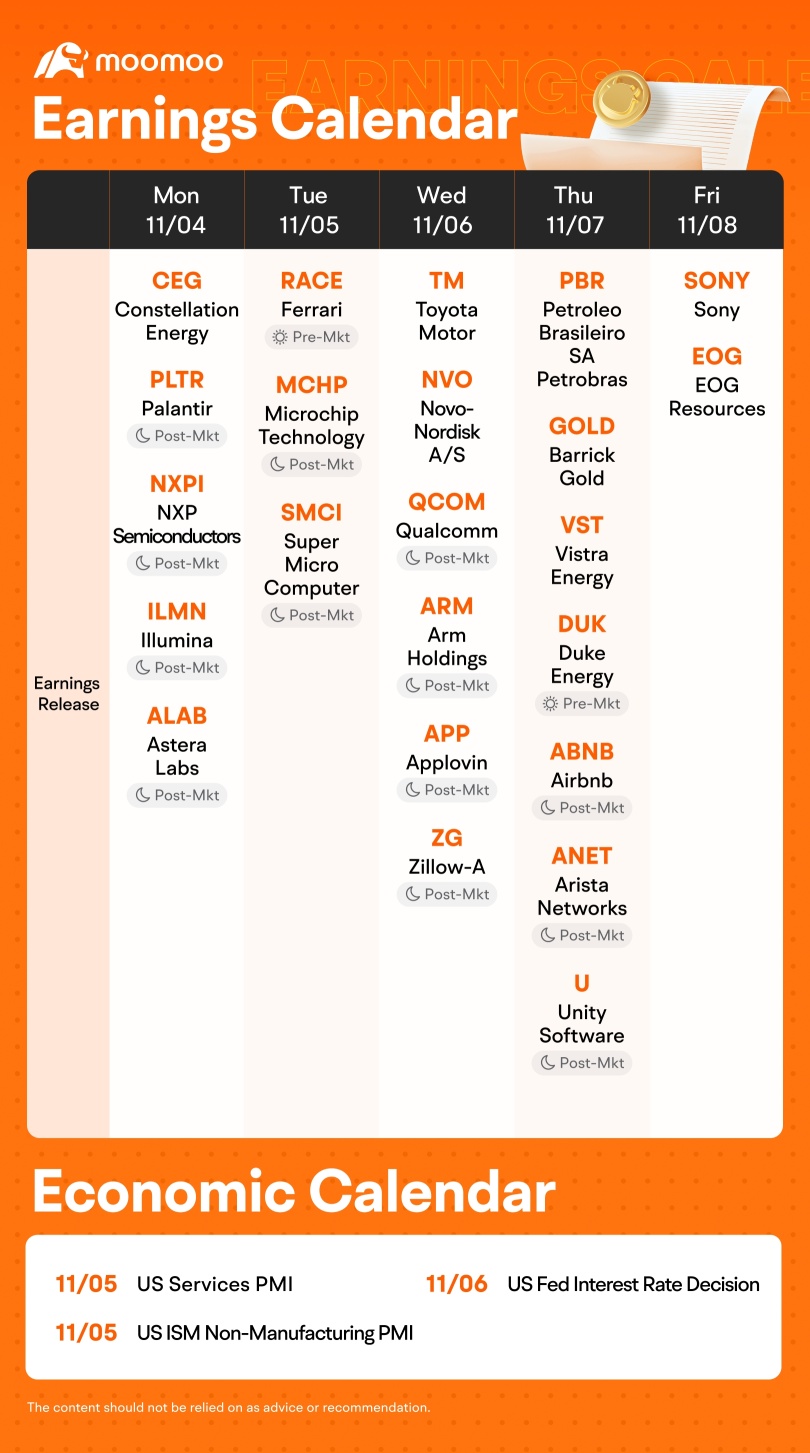

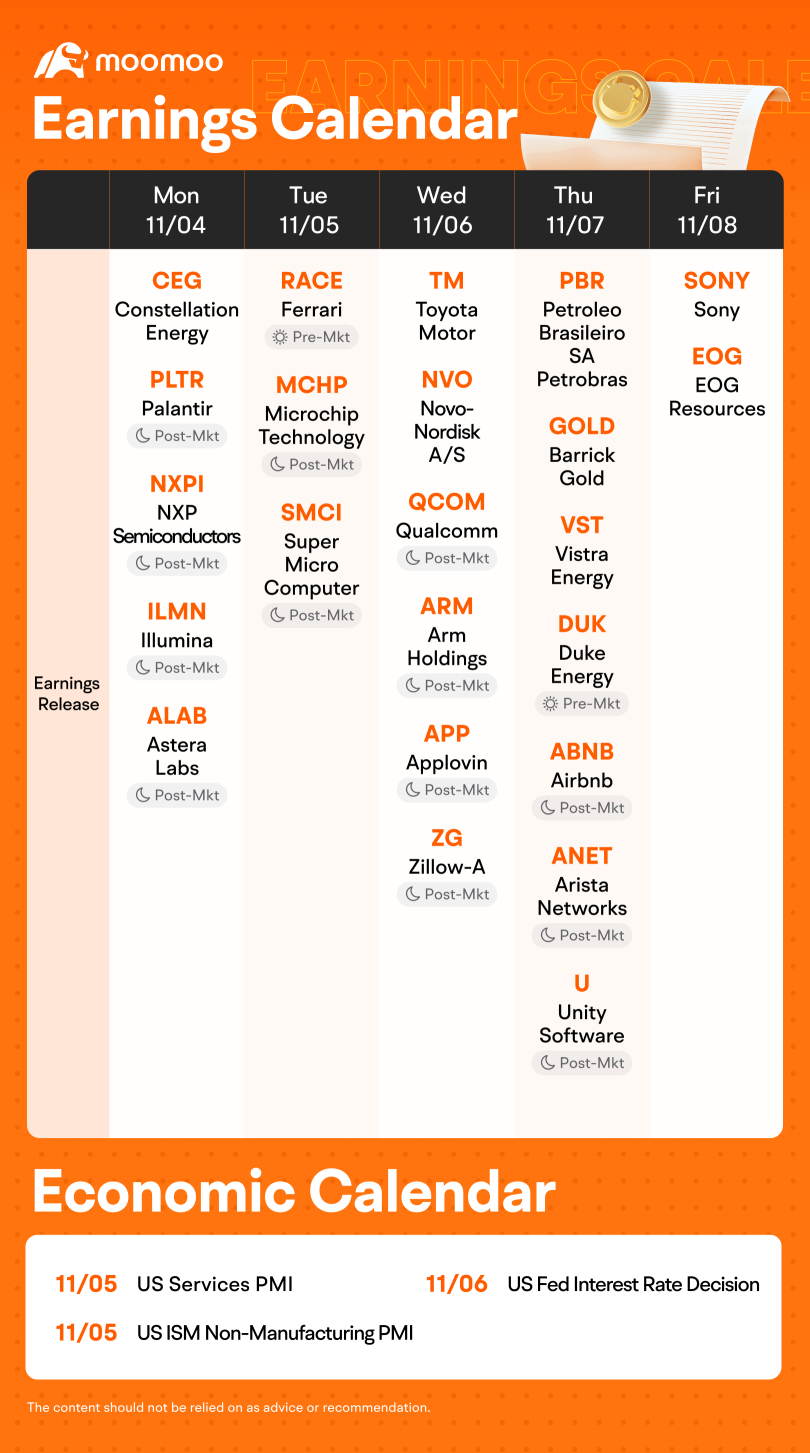

Hi mooers! ![]()

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!![]()

For more details, check out the earnings calendar and economic calendar!

This week, various companies including $Palantir (PLTR.US)$ , $Super Micro Computer (SMCI.US)$ , $Arm Holdings (ARM.US)$ and $AMC Entertainment (AMC.US)$ are releasing their earnings. How will the market react to the companies' re...

Need a quick update on this week's events? Check out moomoo's fresh earnings & economic calendars to start this week!

For more details, check out the earnings calendar and economic calendar!

This week, various companies including $Palantir (PLTR.US)$ , $Super Micro Computer (SMCI.US)$ , $Arm Holdings (ARM.US)$ and $AMC Entertainment (AMC.US)$ are releasing their earnings. How will the market react to the companies' re...

4

1

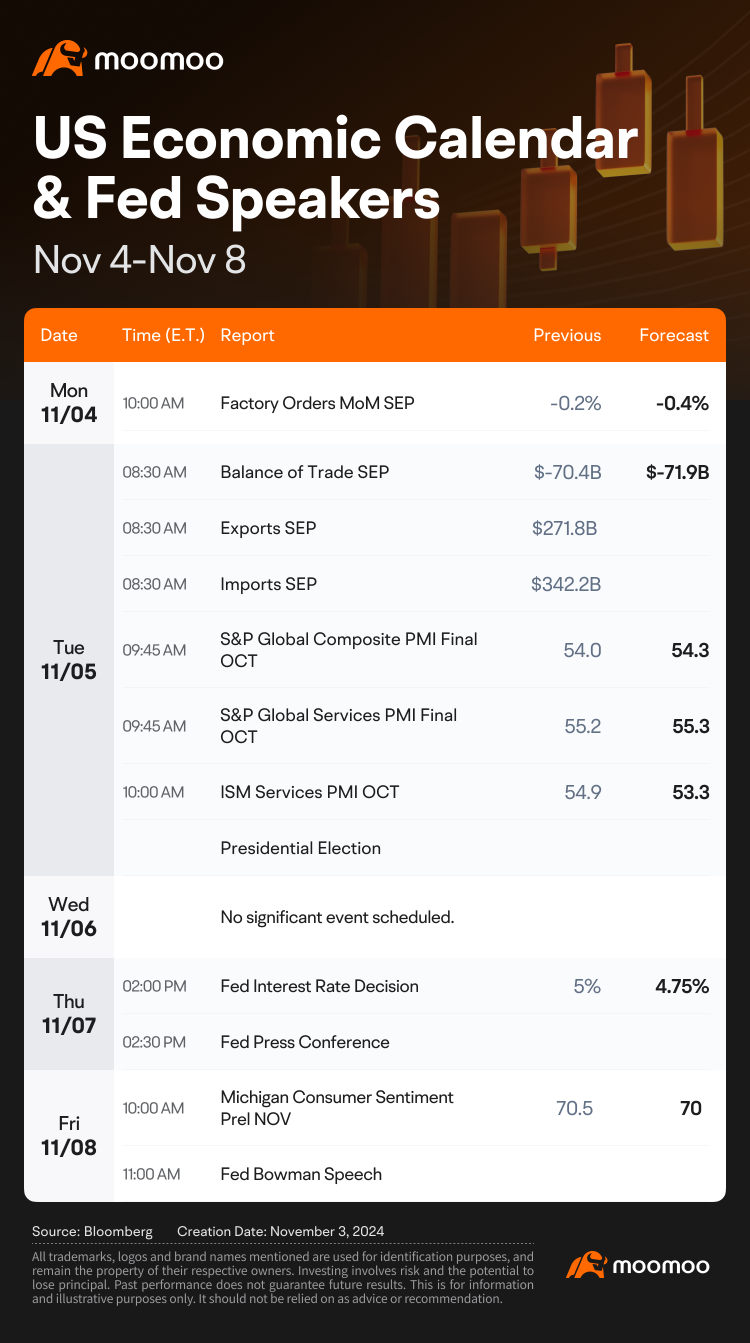

This is going to be a pivotal week. Investors from all around the world will likely be watching and anticipating the outcome of the US presidential election that is taking place on Tuesday. Their respective policies could affect companies’ growth trajectories. Anyway, it’s gonna be a very tight contest.

In addition, the Federal Reserve will be meeting on Wed and Thurs. On the second day, the central bank will announce their decision on the interest rate cut. Market expect it to be a...

In addition, the Federal Reserve will be meeting on Wed and Thurs. On the second day, the central bank will announce their decision on the interest rate cut. Market expect it to be a...

From YouTube

1

$Palantir (PLTR.US)$ will announce its Q3 financial results on 04 Nov 2024 after market close. We are seeing analysts reported to expect a 40% drop in PLTR stock price after its earnings.

There are some points that might sound reasonable, but I think we need to look at how companies who are in the AI business (either hardware or software) who have reported their quarterly earnings so far, none of them who continued to sell and have incre...

There are some points that might sound reasonable, but I think we need to look at how companies who are in the AI business (either hardware or software) who have reported their quarterly earnings so far, none of them who continued to sell and have incre...

+5

7

$Palantir (PLTR.US)$ Feels like they only just recently had their earnings released 😂

1

1

Earnings Preview

Chipmakers $NXP Semiconductors (NXPI.US)$, $Arm Holdings (ARM.US)$, and $Qualcomm (QCOM.US)$ are anticipated to deliver a varied set of earnings, as suggested by the subdued results from their industry counterparts, $ASML Holding (ASML.US)$ and $ON Semiconductor (ON.US)$. Given the continued weak demand from the automotive, mobile, and industrial sectors, Qualcomm will ...

Chipmakers $NXP Semiconductors (NXPI.US)$, $Arm Holdings (ARM.US)$, and $Qualcomm (QCOM.US)$ are anticipated to deliver a varied set of earnings, as suggested by the subdued results from their industry counterparts, $ASML Holding (ASML.US)$ and $ON Semiconductor (ON.US)$. Given the continued weak demand from the automotive, mobile, and industrial sectors, Qualcomm will ...

+4

77

12

$Palantir (PLTR.US)$ Bought a put of PLTR with the TP of 40. Let's see.😌

1

6

The market had a busy week with many top companies revealing their earnings, driving fluctuations in key indexes. Despite record highs earlier in the October, all major indexes ended October down:

• $S&P 500 Index (.SPX.US)$ dropped 1.37%,

• $Dow Jones Industrial Average (.DJI.US)$ slipped by 0.15%,

• $NASDAQ 100 Index (.NDX.US)$ fell 1.5%.

Similarly, crude oil $Crude Oil Futures(DEC4) (CLmain.US)$ prices also dropped, down 5% this week after a ...

• $S&P 500 Index (.SPX.US)$ dropped 1.37%,

• $Dow Jones Industrial Average (.DJI.US)$ slipped by 0.15%,

• $NASDAQ 100 Index (.NDX.US)$ fell 1.5%.

Similarly, crude oil $Crude Oil Futures(DEC4) (CLmain.US)$ prices also dropped, down 5% this week after a ...

22

3

$PLTR Stock Price vs. Quarterly Revenue

Chart patterns are great, but when you have the fundamental growth to support it...

THAT is when you get the parabolic moves. 🎢

Chart patterns are great, but when you have the fundamental growth to support it...

THAT is when you get the parabolic moves. 🎢

4

$Palantir (PLTR.US)$ how far this stock can up?

3

1

No comment yet

Analysis

Price Target

No Data

Heat List

Overall

Symbol

Latest Price

% Chg

No Data

104712493 : Palantir's earnings prospects have several positive aspects:

Strong Demand for Data Analytics: As organizations increasingly rely on data-driven decision-making, Palantir's software solutions are positioned well to meet this growing demand.

Diverse Client Base: The company serves a range of sectors, including government, healthcare, and finance, which can help mitigate risks associated with reliance on a single industry.

Long-Term Contracts: Palantir often secures long-term contracts with government agencies and large enterprises, providing stable and recurring revenue.

Innovative Technology: Their advanced analytics platforms, like Foundry and Gotham, are continually evolving, allowing them to stay competitive and attract new clients.

Expansion into Commercial Markets: Palantir has been making strides to expand its commercial business, which could lead to significant revenue growth outside of government contracts.

Positive Cash Flow: The company has demonstrated the ability to generate positive cash flow, which is a good indicator of financial health and sustainability.

Strategic Partnerships: Collaborations with major companies and organizations can enhance their product offerings and expand their market reach.

These factors contribute to a generally optimistic outlook for Palantir’s earnings potential in the coming years.