No Data

QQQ241220C548000

- 0.01

- 0.000.00%

- 5D

- Daily

News

What does the collapse of the "breadth" of the US stock market tell the market?

Morgan Stanley stated that the market breadth, which has been at historically "worst levels" over the past week, anticipates that the Federal Reserve may not provide as much easing as the market expects. This is because expensive yet unprofitable growth stocks and low-quality cyclical stocks may be the most affected by a reduction in liquidity.

What does the Federal Reserve's "Skip" mean for the market?

Citi Research found that during the period when the Federal Reserve pauses interest rate cuts, the U.S. stock market usually performs well, but the sustainability of the rise depends on whether economic weakness leads to a restart of policy easing; U.S. Treasury rates usually rise at the pause or end of the cycle; for the dollar, if the interest rate cuts are only paused, the dollar performs laterally, if it is the last interest rate cut, the dollar will rise; after the pause, regardless of whether the easing cycle continues, Gold prices usually rise.

Forget the Stock-market Tumble - the Fed Made the Right Move in a Wild Week

Christmas Market Hours, Housing Data, and More to Watch This Week

An M&A Boom May Be Coming. Investors, Beware

House Passes Funding Bill With Just Hours Left to Avert a Government Shutdown

Comments

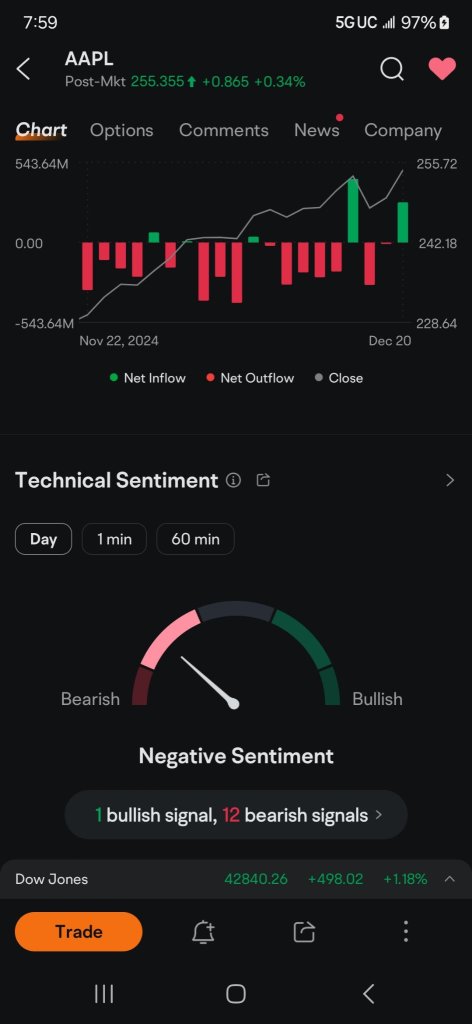

I dare somebody to find 5 weeks on this chart. For the past many years that have the most perfect candles as these in the gold box..... And they all coincide with major outflow and perfect weekly resistance..... I hate to be conspiracy theory here, but this is a bit ridiculous....

Ultratech : right here. see the grey dot under current price line. that's where the new line of green dots appears afterwards. it means it will continue to rally bullish unless price falls infront of it.

Ultratech : third chart the 2 hr shows consecutive 9s up are not complete

102231410 : Technical analysis is the most accurate tool, does it mean that it’s going to come down to the 24x level ?

102231410 Ultratech : resistance?

Ultratech : charts lie. technical analysis is inaccurate and unreliable. trying to time a downturn is very difficult. you can look at trends all day but intraday is impossible to predict. going short and pumping nonsense in comments won't change stock price either