AU ETFDetailed Quotes

SEMI Global X Semiconductor ETF

- 15.130

- +0.170+1.14%

20min DelayNot Open Apr 1 16:00 AET

15.290High15.020Low

15.290High15.020Low38.31KVolume15.020Open14.960Pre Close580.54KTurnover19.00452wk High0.21%Turnover Ratio18.57MShares13.89452wk Low--EPS TTM281.00MFloat Cap19.004Historical High--P/E (Static)18.57MShs Float6.892Historical Low--EPS LYR1.81%Amplitude0.60Dividend TTM--P/B1Lot Size3.95%Div YieldTTM

$Advanced Micro Devices (AMD.US)$

March 11, 2025

1️⃣ Part 1: Multi-Timeframe Analysis & Market Structure

---

1. Main Trend:

Since 2016, AMD has been in a long-term bullish trend.

An all-time high of $164.46 was reached in November 2021, followed by a correction down to $72 in 2022, then a partial rebound.

Since mid-2023, a consolidation phase between $98 and $132 has been observed, with a slightly bearish bias.

AMD operates in the semicon...

March 11, 2025

1️⃣ Part 1: Multi-Timeframe Analysis & Market Structure

---

1. Main Trend:

Since 2016, AMD has been in a long-term bullish trend.

An all-time high of $164.46 was reached in November 2021, followed by a correction down to $72 in 2022, then a partial rebound.

Since mid-2023, a consolidation phase between $98 and $132 has been observed, with a slightly bearish bias.

AMD operates in the semicon...

19

6

4

$Advanced Micro Devices (AMD.US)$

March 4, 2025

1️⃣ Part 1: Multi-Timeframe Analysis & Market Structure

---

📊 Monthly Chart (Long-Term View)

📌 Main Trend:

AMD has been in a long-term bullish trend since 2016.

After reaching its all-time high (ATH) of $164.46 in November 2021, a correction brought the price down to $72 in 2022, followed by a partial rebound.

Since mid-2023, AMD has been in a consolidation phase between $98 and $132, with a...

March 4, 2025

1️⃣ Part 1: Multi-Timeframe Analysis & Market Structure

---

📊 Monthly Chart (Long-Term View)

📌 Main Trend:

AMD has been in a long-term bullish trend since 2016.

After reaching its all-time high (ATH) of $164.46 in November 2021, a correction brought the price down to $72 in 2022, followed by a partial rebound.

Since mid-2023, AMD has been in a consolidation phase between $98 and $132, with a...

26

6

5

China's closely watched third plenum, held twice a decade to set structural reforms, takes place this week, Monday to Thursday, bringing commodities and chips into focus.

China's plenum is historically pivotal for unveiling new economic policies, this plenum is expected to consolidate President Xi Jinping's policy direction, focusing on new growth engines.

With China's Q2 GDP softer than expected at 5% (down from 5.3%...

China's plenum is historically pivotal for unveiling new economic policies, this plenum is expected to consolidate President Xi Jinping's policy direction, focusing on new growth engines.

With China's Q2 GDP softer than expected at 5% (down from 5.3%...

1

Looking back at the first half of this year, the Australian stock market performed well, with the ASX index repeatedly reaching historic highs, as investors cheered better-than-expected half-year corporate results and held high hopes for interest rate cuts later this year. As of the close on June 27th, the $S&P/ASX 200 (.XJO.AU)$, which mirrors the trend of...

13

3

$Advanced Micro Devices (AMD.US)$

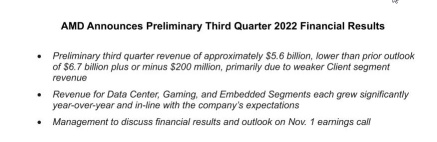

I wish I would have seen this SEC filing in after-hours the night before. Today was historically one of the best day trade short opportunities in this name. The market reacted very negatively to this news during after-hours. And the bearishness continued in a big way the next day when the market was selling off big time. AMD was one of the biggest losers in the market compared to all of the other mega-cap tickers symbols.

$NVIDIA (NVDA.US)$ $iShares Semiconductor ETF (SOXX.US)$ $Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$ $ON Semiconductor (ON.US)$ $Qualcomm (QCOM.US)$ $Micron Technology (MU.US)$ $Texas Instruments (TXN.US)$ $Intel (INTC.US)$ $Global X Semiconductor ETF (SEMI.AU)$ $PHLX Semiconductor Index (.SOX.US)$

���������...

I wish I would have seen this SEC filing in after-hours the night before. Today was historically one of the best day trade short opportunities in this name. The market reacted very negatively to this news during after-hours. And the bearishness continued in a big way the next day when the market was selling off big time. AMD was one of the biggest losers in the market compared to all of the other mega-cap tickers symbols.

$NVIDIA (NVDA.US)$ $iShares Semiconductor ETF (SOXX.US)$ $Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$ $ON Semiconductor (ON.US)$ $Qualcomm (QCOM.US)$ $Micron Technology (MU.US)$ $Texas Instruments (TXN.US)$ $Intel (INTC.US)$ $Global X Semiconductor ETF (SEMI.AU)$ $PHLX Semiconductor Index (.SOX.US)$

���������...

3

4

1

$Global X Semiconductor ETF (SEMI.AU)$ SEMI released a report on the global semiconductor equipment market and pointed out that in the second quarter of 2021, global semiconductor manufacturing equipment shipments amounted to US$24.9 billion, an annual increase of 48% and a quarterly increase of 5%, setting a record high

1

No comment yet

PAUL BIN ANTHONY : good job

10baggerbamm : an in-depth analysis avoid the stock

times the simplest case is the best case scenario

20 day moving average has been a resistance line going back to Midway last year.

any of deaths of financial futures have been lost in this stock believing this is the bottom it can't go any lower, it can only go up.. the biggest problem is that Lisa cut q1 guidance by 7% in the data center GPU that's their most state-of-the-art recent GPU that they released during the dog and pony show you know last year when the stock was 172 and it fell five dollars that day because nobody cared for it and that was the indication that they're selling a commodity at this point they're not the market leader they sell a solution and they've got to compete on price and that's why the margins suck at 52%

Kevin Matte OP 10baggerbamm : I completely understand your perspective, and I agree with several points you mentioned regarding the stock’s past performance. Indeed, the 20-day moving average has acted as a major resistance for a long period, limiting any attempts at a bullish recovery. I also agree that the launch of the GPU for data centers did not have the expected impact on the market, leading to a negative investor reaction at the time. Additionally, the downward revision of revenue forecasts naturally weighed on the stock and contributed to investor caution.

However, conditions have changed, and several factors suggest a bullish recovery.

-The Macroeconomic Context is Evolving

The Fed appears to be approaching a pause or even a rate cut, which is generally positive for the tech sector.

Massive investments in artificial intelligence and data centers are not slowing down, and demand for next-generation GPUs remains strong.

-Fundamentals Remain Strong Despite Margin Pressure

Yes, margins are under pressure at 52%, but compared to some direct competitors, this performance remains competitive in an environment where price wars are intensifying.

The stock’s P/E ratio (Price-to-Earnings) is starting to become attractive, which could encourage institutional investors to revisit the stock.

-A Technical Reversal is Taking Shape

The 20-day moving average is still a resistance level, but a breakout with volume would be a strong signal for a bullish reversal.

A decline in short sellers is observed, suggesting that bearish pressure is starting to weaken.

Sentiment indicators, particularly the put/call ratio, show that extreme pessimism could actually be a contrarian signal favoring a rebound.

-The Market is Reassessing its Expectations for the Company’s Guidance

Certainly, Lisa Su revised Q1 revenue guidance down by 7%, but this revision has already been priced in for some time.

The key now is to watch whether the company can deliver positive surprises in the upcoming earnings reports.

Conclusion: A Strategic Entry Point for Rational Investors

You are right that the past has been challenging and that the company has faced difficulties. However, the market is fundamentally a forward-looking machine, and long-term investors focus more on future prospects rather than past mistakes.

If the 20-day moving average is broken with volume, there will be a shift in technical dynamics. With stabilized outlooks and a more favorable environment for tech, I believe the risk-reward ratio is now much more attractive for buying rather than selling.

In short, bearish arguments were valid, but it's crucial to adapt to new data. In my view, the probabilities are now in favor of a rebound!

10baggerbamm Kevin Matte OP : the bad weather they cut rates or not is a nothing sandwich in the short term because the earliest cut would come in June it would be a quarter point the downside risk between March to June is enormous

a coalition the data center build-out is a known event everybody knows about it everybody knows about the $500 billion everybody knows about the subsequent investments are going to be done by Apple everything is known about Taiwan semi's investment in the US that's a known event meaning it is a non-factor in every stock for example Nvidia everybody knows who they're hyperscalers are everybody knows how much meta increased their prior estimates from last quarter to the earnings conference call everybody knows and that's built into the model of revenue earnings and profit margins

what needs to happen that will cause in a reversal is all of the tariffs are in place and there's no more retaliatory responses and we're nowhere close to that we're only dealing with right now two countries and a pissing contest Mexico and Canada China is actually understanding they've got very very smart leaders XI is on the same level as Trump and they respect one another and ex I understand that their country is a net exporter and they need the us more than any other country so they can't go toe to toe with Trump because they'll be on the short end of the stick and they can only devalue their currency by inflating and printing like the US did for so long..

so everything that you said is a known event what is AMD going to change internally operationally that will improve their profit margins because 52% sucks if Lisa were to come out and say this is what we're doing and our margins will go to 62% almost a 20% increase the stock will reverse that would be something that you can sink your teeth into and get excited about that means they have pricing power pricing control over their customers and they do not have it now.

so there needs to be something that's different to change the course of the sinking ship called advance micro devices

Kevin Matte OP 10baggerbamm : I understand your perspective, and you raise valid points, especially regarding AMD’s margins, which remain a real issue. As long as Lisa Su doesn’t present a concrete plan to improve them, it will limit the stock’s upside potential.

You’re also right that investments in data centers and AI are already well known to the market, so they are not immediate catalysts.

However, where I disagree is that the market always anticipates ahead of time. If AMD starts showing signs of improvement, even gradual ones, investors will react well before margins reach 62%.

Additionally, the risks related to trade tensions are significant, but they don’t block AMD. The company continues to gain market share, and if it proves it can compete with Nvidia in AI, the stock will move higher.

So yes, your analysis is relevant, but too pessimistic. Margins are a challenge, but not a dealbreaker. And the market won’t wait for everything to be perfect before pushing the stock back up.

View more comments...