No Data

US ETFDetailed Quotes

SHY iShares 1-3 Year Treasury Bond ETF

- 82.050

- +0.180+0.22%

Close Jan 15 16:00 ET

82.050High82.010Low

82.050High82.010Low3.69MVolume82.040Open81.870Pre Close303.09MTurnover1.33%Turnover Ratio--P/E (Static)277.40MShares82.19052wk High--P/B22.76BFloat Cap78.64552wk Low3.21Dividend TTM277.40MShs Float82.190Historical High3.91%Div YieldTTM0.05%Amplitude54.352Historical Low82.038Avg Price1Lot Size

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Unit: --

Capital Trend

IntradayDayWeekMonth

No Data

News

Fed's Williams Wants More Progress Toward Inflation Target

Treasury Yields Nudge Higher From 9-day Lows on Cooler Inflation Data; Retail Sales up Next.

2-year Yield Plunges by Most Since September on Mild Core CPI Inflation Reading

U.S. Treasury Market Seen as Best Option for International Bond Investors -- Market Talk

Stocks Surge on Inflation Data. Trump, Bond Yields Hold the Key to What's Next.

Stocks and Bonds Rally After Inflation Data, Strong Bank Results -- WSJ

Comments

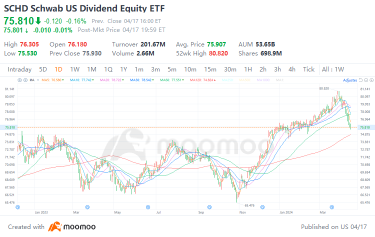

$iShares 20+ Year Treasury Bond ETF (TLT.US)$ $Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ It isn't just the major banks. Bonds are sniffing out something really stinky. 🦨

4

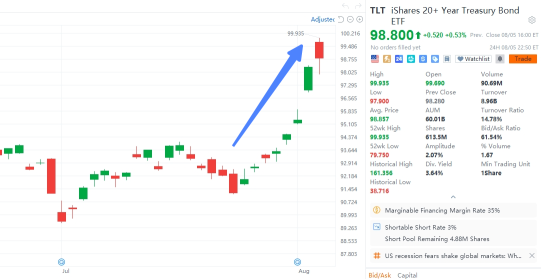

In early August, global stock markets plummeted, sparking fears of an economic recession and a looming bear market. Meanwhile, the bond market quietly surged, with the $iShares 20+ Year Treasury Bond ETF (TLT.US)$ achieving an eight-day winning streak by August 5th.

Data is as of August 8 and is for illustrative purposes only and does not constitute any investment advice or guarantee.

Why did bonds attract investment while stocks were falling? Bonds benefi...

Data is as of August 8 and is for illustrative purposes only and does not constitute any investment advice or guarantee.

Why did bonds attract investment while stocks were falling? Bonds benefi...

+5

285

79

111

With recent turbulent changes on the world stage, it is difficult to predict what may happen. Conflict in the Middle East continues to escalate, while the Horn of Africa faces severe humanitarian crises. The resurgence of left-wing politics in Latin America is met with right-wing opposition, and economic and security challenges in Asia present a shifting landscape. The ongoing conflict between Russia and Ukraine remains unresolve...

+10

61

4

32

With recent turbulent changes on the world stage, it is difficult to predict what may happen. Conflict in the Middle East continues to escalate, while the Horn of Africa faces severe humanitarian crises. The resurgence of left-wing politics in Latin America is met with right-wing opposition, and economic and security challenges in Asia present a shifting landscape. The ongoing conflict between Russia and Ukraine remains unresolve...

+10

4

4

Read more

Georgehx : What do you mean?

Derpy Trades OP Georgehx : JP Morgan and at least one other major bank are selling off while Treasury yields are falling. That tends to be a strong sign of flight to safety.

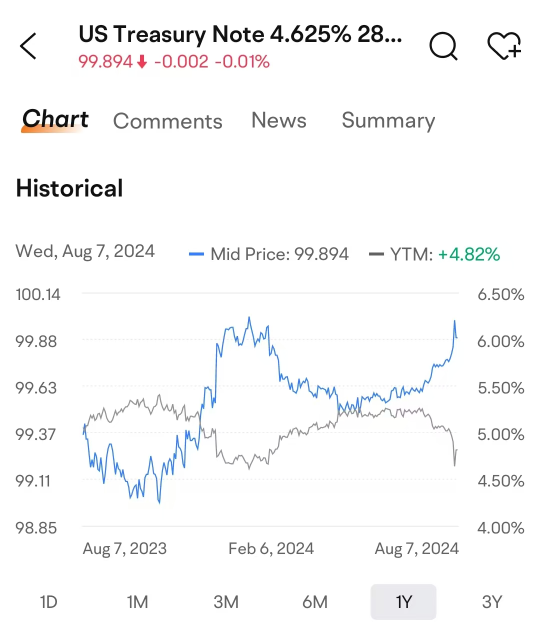

Georgehx Derpy Trades OP : You’ve got a valid point but I’m holding mainly bonds atm bcz of the volatility in market rn & bonds tend to rise when interest rates fall so doesn’t really matter 25 or 50 basis points, bonds esp longer ones will do well am I right to say that?

Derpy Trades OP Georgehx : The bond market is very complex, and so that is a very difficult question to answer. In most scenarios bonds will rally when or even in anticipation of rate cuts, but if there were ever a black swan event in which the Fed had to monetize our government's debt, long-term interest rates would likely skyrocket and bonds would depreciate quickly.