US OptionsDetailed Quotes

SQQQ241220C36000

- 0.01

- -0.02-66.67%

15min DelayClose Dec 20 16:00 ET

0.02High0.01Low

0.02Open0.03Pre Close11 Volume1.21K Open Interest36.00Strike Price12.00Turnover4592.93%IV17.11%PremiumDec 20, 2024Expiry Date0.00Intrinsic Value100Multiplier-1DDays to Expiry0.01Extrinsic Value100Contract SizeAmericanOptions Type0.0137Delta0.0165Gamma3075.00Leverage Ratio-40.7384Theta0.0000Rho42.13Eff Leverage0.0000Vega

ProShares UltraPro Short QQQ ETF Stock Discussion

$ProShares UltraPro Short QQQ ETF (SQQQ.US)$ what in the shit is going on here, ain't pce data suggests like the rates should not be lowered as much? ![]()

1

I think

@Warren Buffed your day may come soon.

was your average like 35?, the worst case possible,

$ProShares UltraPro Short QQQ ETF (SQQQ.US)$

45.00 maybe possible, lets see…

@Warren Buffed your day may come soon.

was your average like 35?, the worst case possible,

$ProShares UltraPro Short QQQ ETF (SQQQ.US)$

45.00 maybe possible, lets see…

4

18

$ProShares UltraPro Short QQQ ETF (SQQQ.US)$ go bear and we can buy back tesla on 2025 after cny

1

1

$ProShares UltraPro Short QQQ ETF (SQQQ.US)$

We need some free money to stand firm here😂

We need some free money to stand firm here😂

3

1

$ProShares UltraPro Short QQQ ETF (SQQQ.US)$ we need to remember all the good things that come from the rest of the world. Asian massage parlors, European food and South American gold. none of these places are know for being more intelligent than we the people of America

6

6

No comment yet

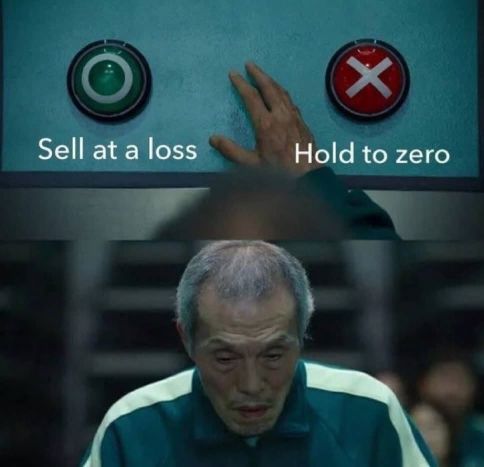

WarlockofWallstreet : this helped me out a lot and puts things into perspective. it's best to cut losses asap rather than have big losses. At minus 97%, you will need 3222% gains to break even.

ex: you have a 10k account. You only use 10% =1000$ per trade. Cut losses at -10% to max -20%. that's 1% to 2% of your account.

JaydenTan : Everyone has their own styles of playing. I'm a fan of SQQQ but I had let it go at 30 at a loss when I saw it might go down to 28, 27. It did.

When I saw it will go up to 30 again and possibly higher. I get in again. I hold it till 33+ . When I see it should come down soon, I let go again.

Now the price is pretty cheap again, I shall study it again and gets in anytime if there is any potential. That is how I play this counter.