No Data

TGB Taseko Mines

- 2.270

- +0.070+3.18%

- 2.280

- +0.010+0.42%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Base Metal Prices Mixed; Copper Higher on Tariffs, Smelter Cuts -- Market Talk

Will Copper prices break ten thousand? Before the tariffs, there is a rush to import, and the trend of stockpiling in the USA may trigger a global copper inventory crisis.

Citibank stated that within the next three months, copper prices will break through the $0.01 million per ton mark, and the global copper market will remain tight until the USA's import tariff policy becomes clear. Goldman Sachs indicated that by the end of the third quarter, the rise in copper prices will cause USA copper stocks to surge from the current 0.095 million tons to at least 0.3 million to 0.4 million tons, accounting for 45-60% of the global reported inventory, while copper stocks in Other regions will be very low.

Citibank: Before the tariff timeline in the USA becomes clearer, Copper prices may reach $10,000 per ton.

Citi expects that in the next three months, Copper prices will reach $10,000 per ton and stated that the Global Copper market will remain tight until the timeline for USA import tariffs becomes clearer.

Base Metal Prices Rise; Market Uncertainty Around U.S. Tariffs Persists -- Market Talk

Is Taseko Mines Limited (TGB) the Best Mining Penny Stock to Buy Now?

Base Metal Prices Mixed; U.S. Aluminum Tariffs Raise Concerns for Other Metals -- Market Talk

Comments

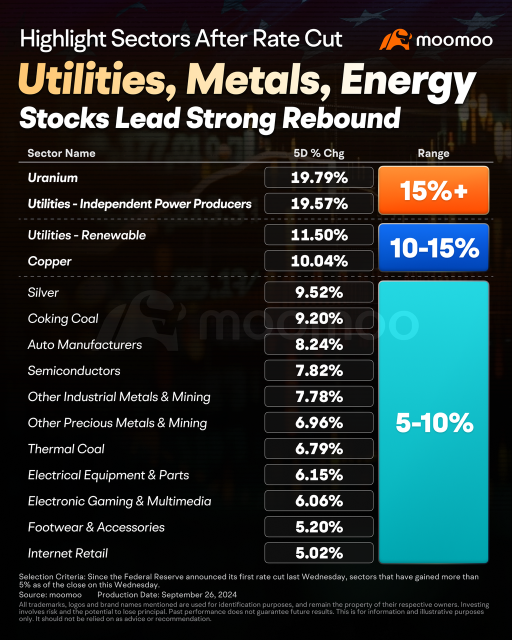

In the week following the Fed’s rate cut, utilities, metals, and energy stocks led gains in the US market. $Utilities - Independent Power Producers (LIST2462.US)$ and �����...

'Cause I can't read the number that you just gave me

赌什么亏什么 :

102875489 : One trillion