US OptionsDetailed Quotes

TLT241127C92500

- 0.56

- +0.26+86.67%

15min DelayClose Nov 27 16:00 ET

0.87High0.25Low

0.56Open0.30Pre Close2.63K Volume3.80K Open Interest92.50Strike Price137.14KTurnover107.42%IV0.05%PremiumNov 27, 2024Expiry Date0.51Intrinsic Value100Multiplier0DDays to Expiry0.05Extrinsic Value100Contract SizeAmericanOptions Type0.9054Delta0.7480Gamma164.62Leverage Ratio-9.9859Theta0.0000Rho149.04Eff Leverage0.0004Vega

iShares 20+ Year Treasury Bond ETF Stock Discussion

$iShares 20+ Year Treasury Bond ETF (TLT.US)$

Hi. Anyone knows how to claim back TLT 30% Witholding Tax from MooMoo for Malaysian (Non US residents) as it's Tax Exempted.

thanks in advance

Hi. Anyone knows how to claim back TLT 30% Witholding Tax from MooMoo for Malaysian (Non US residents) as it's Tax Exempted.

thanks in advance

2

2

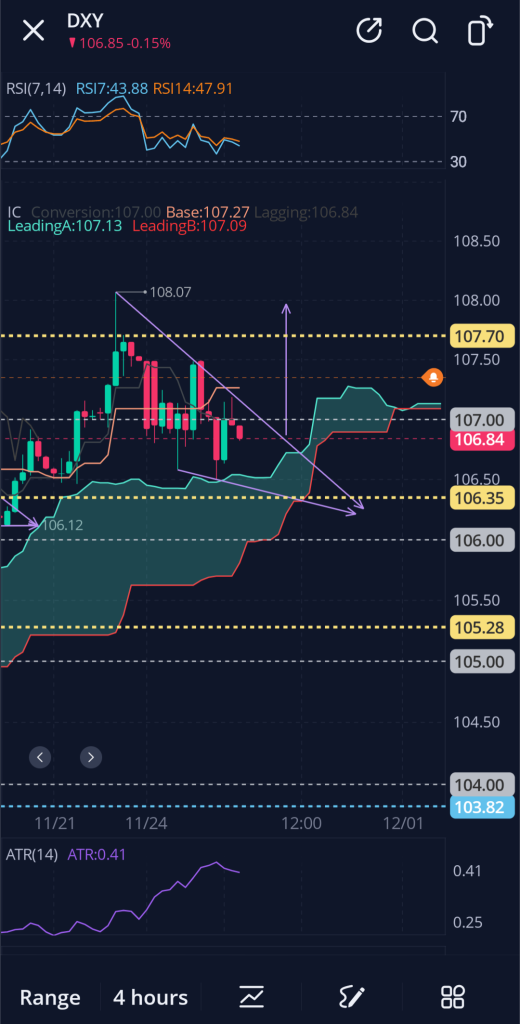

$SPDR S&P 500 ETF (SPY.US)$ $iShares 20+ Year Treasury Bond ETF (TLT.US)$ Any ForEx or TLT traders might wanna pay attention to this falling wedge on DXY, which is targeting ~108. Above IC support on both the 4-hour and daily and the apex of the pattern is targeting the top of daily support. Looks like confluence to me. This could absolutely hurt SPY/QQQ as well, at a time when SPY is about to kiss the Res that has never been broken in years, around 603.

1

$Bitcoin (BTC.CC)$ $SPDR S&P 500 ETF (SPY.US)$

The parabolic Res on BTC is holding, Sup on DXY broke, Res on TLT got busted through, SPY rejected off of main Res, and NVDA broke Sup.

I don't want a 🍪, I would just like subs so more people can benefit. 😸

The parabolic Res on BTC is holding, Sup on DXY broke, Res on TLT got busted through, SPY rejected off of main Res, and NVDA broke Sup.

I don't want a 🍪, I would just like subs so more people can benefit. 😸

From YouTube

11

Expand

Expand 30

3

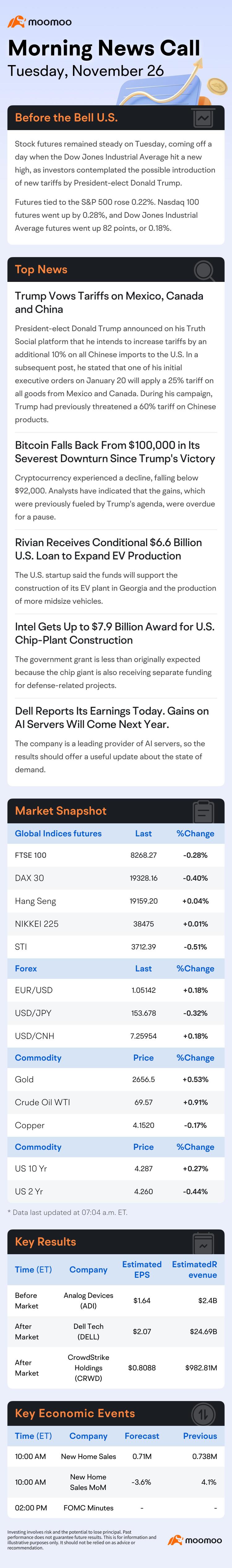

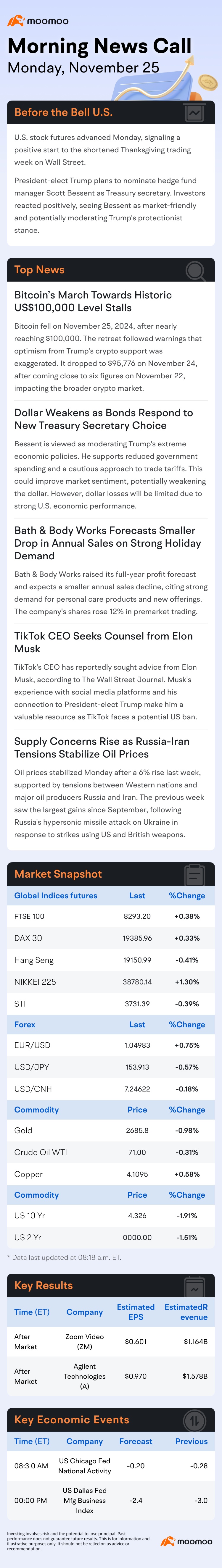

Weekly Market Recap: What happened and things to look out for!

Market Performance Overview

Last Thursday, the stock market had a big rally, with the $Dow Jones Industrial Average (.DJI.US)$ jumping over 570 points. This was mostly thanks to $NVIDIA (NVDA.US)$ strong earnings for Q3 2025, which showed impressive growth in both revenue and profit; as well as strong bull run from $Tesla (TSLA.US)$. Additionally, sectors tied to broader economic recovery—like industria...

Market Performance Overview

Last Thursday, the stock market had a big rally, with the $Dow Jones Industrial Average (.DJI.US)$ jumping over 570 points. This was mostly thanks to $NVIDIA (NVDA.US)$ strong earnings for Q3 2025, which showed impressive growth in both revenue and profit; as well as strong bull run from $Tesla (TSLA.US)$. Additionally, sectors tied to broader economic recovery—like industria...

+1

16

1

$iShares 20+ Year Treasury Bond ETF (TLT.US)$ The thick blue and purple lines are crucial right now. If it can break above the blue resistance it could establish a new uptrend - - first resistance would be around 93, second Res around 97, then 100. Alternatively, if it breaks below support it could fall multiple points lower - - first main support would be around 86, then if that didn't hold ~80 would be next. Volatility is coiling, and I would anticipate a breakout/breakdown within the next wee...

5

2

$iShares 20+ Year Treasury Bond ETF (TLares 2 DXY - - Either pattern target actually would meet either a main resistance or support level. It's squeezing. If this fires up I expect TLT to pull back sharply, and the reverse would be true if it breaks down.

3

President Joe Biden had allowed Ukraine to use US weapons to strike inside Russia.

In response, Putin has warned that Russia would consider using such nuclear weapons if they were met with "with the use of conventional weapons that created a critical threat to their sovereignty and their territorial integrity."

Seems like Biden doesn’t want to do a good handover to Trump.

Geopolitical tensions are rising again, and are weighing on investors’ sentiment. Futures are trading ...

In response, Putin has warned that Russia would consider using such nuclear weapons if they were met with "with the use of conventional weapons that created a critical threat to their sovereignty and their territorial integrity."

Seems like Biden doesn’t want to do a good handover to Trump.

Geopolitical tensions are rising again, and are weighing on investors’ sentiment. Futures are trading ...

From YouTube

3

4

No comment yet

102785019 : +1

For Non US residents right?

I would like to know How too

Moomoo Buddy : Dear Customer,

Pursuant to U.S. tax regulations, a non-U.S. person is subject to a withholding tax on all U.S. source income, which is payable to Internal Revenue Service (IRS). Most types of U.S. source income received by a non-U.S. person are subject to U.S. tax of 30%. A reduced rate, including exemption, may apply if there is applicable tax treaty between the non-U.S. person's country of residence and the U.S.

As Malaysia does not have a tax treaty with the U.S., the withholding tax is generally applied to Malaysians at a prevailing rate of 30% on the U.S. source income, including interest and dividends.

As Moomoo MY does not provide any tax advice, please consult professional tax adviser should you have questions in relation to the withholding tax.

For more information , please refer to the IRS website: Tax withholding types | Internal Revenue Service