US OptionsDetailed Quotes

X250103P29000

- 0.01

- 0.000.00%

15min DelayClose Jan 3 16:00 ET

0.00High0.00Low

0.00Open0.01Pre Close0 Volume13.55K Open Interest29.00Strike Price0.00Turnover0.00%IV20.75%PremiumJan 3, 2025Expiry Date0.00Intrinsic Value100Multiplier-17DDays to Expiry0.01Extrinsic Value100Contract SizeAmericanOptions Type--Delta--Gamma3658.00Leverage Ratio--Theta--Rho--Eff Leverage--Vega

United States Steel Stock Discussion

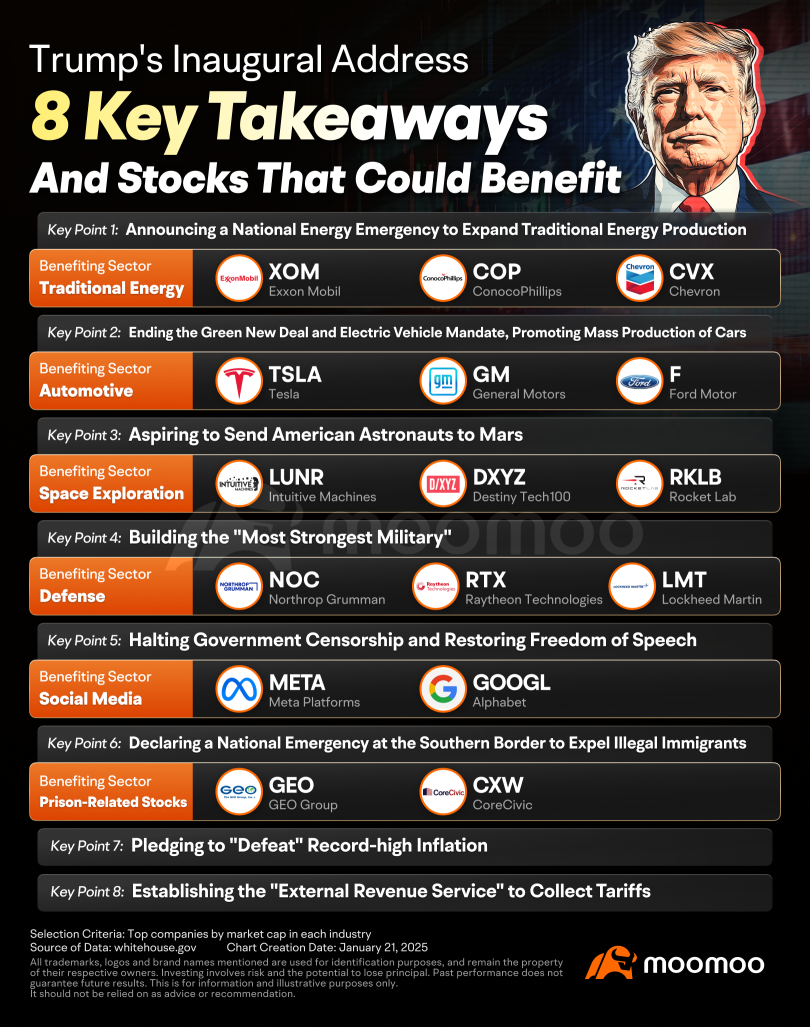

Donald Trump's second term began with bold declarations and swift action. His inaugural address emphasized an "America First" agenda, tackling inflation, energy independence, and border security. On day one, he signed executive orders and outlined policies that set the tone for his presidency. But what does this mean for the markets? Let's break down his priorities and the stocks that ...

73

18

60

Hey there, long time no see! With Trump back in office, let’s dive into some stocks that could ride the wave of his legislation.

If you’re hungry for more updates, join our community of over 700 members! Everyone’s welcome—check it out here: Join the server Trader’s Tavern with us

Alright, let’s get into it! Here are a few small-cap stocks I’ve got my eye on for the next few months.

$The GEO Group Inc (GEO.US)$ - A real estate investment trust specializing in the design and managem...

If you’re hungry for more updates, join our community of over 700 members! Everyone’s welcome—check it out here: Join the server Trader’s Tavern with us

Alright, let’s get into it! Here are a few small-cap stocks I’ve got my eye on for the next few months.

$The GEO Group Inc (GEO.US)$ - A real estate investment trust specializing in the design and managem...

8

2

6

Grab your popcorn, folks - Donald Trump is back, and this time, he's setting his sights on Wall Street. The man who brought us “Make America Great Again” is now rolling out a sequel: Make the Stock Market Great Again! So, what does this mean for the stock market, and more importantly, how it affects us in the stock market? ![]()

Don't get me wrong, we do have great year of 2023 and 2024 with amazing returns in stock market. I have gotten about $250k profi...

Don't get me wrong, we do have great year of 2023 and 2024 with amazing returns in stock market. I have gotten about $250k profi...

+4

115

21

10

$United States Steel (X.US)$

$Cleveland-Cliffs (CLF.US)$

this is shit scary 😟

if they can say that i wonder how much bid they can do for the fellow american company….

$Cleveland-Cliffs (CLF.US)$

this is shit scary 😟

if they can say that i wonder how much bid they can do for the fellow american company….

1

3

$United States Steel (X.US)$ captailism is already dead, but you will officially admit it is if you let CLV buy this for $30 a share

We all know that Trump's policies have stirred up quite a lot of waves on the economic chessboard. Today, I'd like to chat with you guys about the investment opportunities hidden in the tourism, aviation and manufacturing industries under the influence of his policies.

Aviation Industry: Potential Stocks Driven by the Travel Boom

Once Trump took office, he made considerable efforts to ease regulations ...

Aviation Industry: Potential Stocks Driven by the Travel Boom

Once Trump took office, he made considerable efforts to ease regulations ...

+2

12

No comment yet

J Servai (JLAPT) : $Petroleo Brasileiro SA Petrobras (PBR.US)$

10baggerbamm : you're incorrect saying that drill baby drill benefits oil companies. they're underlying commodity with an increase in supply will result in significantly lower prices it's economics 101. it's exact same thing that happened during the Trump first administration and if you look at the performance of large oil companies and intermediate oil companies they were down between 30 and 70% under Trump's first term.. I think you should go look at history and see the impact on these companies stock prices as a result of lower oil prices

YZRolling 10baggerbamm : While increased supply can lead to lower commodity prices, large oil companies often offset this with operational efficiencies, diversification, and downstream operations (refining and chemicals), which benefit from cheaper crude. On the other hand, stock prices aren't solely tied to oil prices. Broader economic trends, geopolitical events, and company-specific factors (like debt management and cost control) also influence performance.

A Humble Mooer : I get people WANT to view this positively. I'm trying to find opportunities in Trumps actions too.

This analysis though is so positive it borders on a little delusional.

10baggerbamm A Humble Mooer : well you have to look at it very basic if you're operating a company in one of your biggest expenses is fuel and that price goes down everything else being equal your margins and profits go up.

so that's your cruise liners all your cruise companies pick the best one because as long as discretionary income increases and it will when oil prices fall you have more money people are going to accelerate they're bookings for cruise ships. the cost of their fuel is going to go down significantly. I would tell people to look at that before airlines airlines have a lot of other problems unions at the top of the list Boeing aircraft but the cruise ships don't have to deal with that issue you just have to worry about another epidemic potentially.

additionally you have Federal Express and UPS UPS is played with surprisingly enough union problems Federal Express doesn't have that issue to contend with same thing their profit margins are going to go up when the cost of jet fuel goes down which means the stock price will go up. so go down the list of companies that use the most fuel it's a very basic approach but it absolutely will work.

lastly is the trade that I have a large position in I'm going to be buying every week and it's going to be for me a multi-million dollar position.

I believe what Trump said he will do promises me promises kept

red or blue oil prices will fall that is a fact no they're not going to fall to what they were in the first term because of coded where it went negative $22 a barrel.

you will have oil prices in the low 50s maybe high 40s at some point in time.

DRIP

this is a leveraged ETF that's a inverse ETF to the price of oil. does oil falls and natural gas falls and as the stocks start having their margins deteriorate because the commodity that they're producing is worth less. Lowe's stocks fall and this ETF goes straight up.

this is going to be a slow grind it is not going to spike $2 $3 in a day. it will move up a few pennies and we'll move down a few pennies but if you believe what president Trump said that within 12 months of my inauguration that would be yesterday oil prices will be down 50%.

this ETF will be in the twenties

View more comments...