No Data

US ETFDetailed Quotes

XLU Utilities Select Sector SPDR Fund

- 74.440

- +0.330+0.45%

Close Aug 16 16:00 ET

74.695High73.870Low

74.695High73.870Low6.76MVolume74.190Open74.110Pre Close502.69MTurnover2.93%Turnover Ratio--P/E (Static)230.87MShares75.56052wk High--P/B17.19BFloat Cap53.38352wk Low2.19Dividend TTM230.87MShs Float75.560Historical High2.95%Div YieldTTM1.11%Amplitude24.125Historical Low74.347Avg Price1Lot Size

Intraday

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Unit: --

Capital Trend

IntradayDayWeekMonth

No Data

News

NextEra CEO Talks Up Florida Property Market: A Sunshine State Ray Of Hope?

NRG Energy Was the Most Shorted S&P 500 Utilities Stock in July

Dow, S&P, Nasdaq Hover Flat Lines After Downbeat Housing Data but Weekly Wins in Sight

NextEra Energy Analyst Ratings

Nasdaq, S&P, Dow Drive Higher up as Retail Sales, Jobless Claims Ease Growth Worries

Bridgewater Adds to Amazon, Microsoft, Exits Intel, Devon, Others in Q2

Comments

Throughout the recent couple of weeks, the stock market has experienced some really goofy price action spurred by mostly unusual or insufficient interest rate decisions.

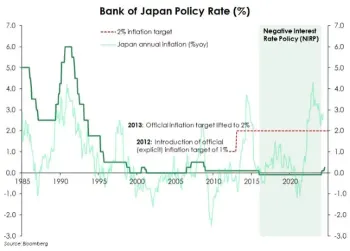

Firstly, the BOJ decided to hike Japan interest rates for the first time in years, with an interest rate close to 0 in the past.

This allowed investors to carry trade, where they borrow yen for basically free and exchange for USD to purchase US equity.

You can see how the interest rate was l...

Firstly, the BOJ decided to hike Japan interest rates for the first time in years, with an interest rate close to 0 in the past.

This allowed investors to carry trade, where they borrow yen for basically free and exchange for USD to purchase US equity.

You can see how the interest rate was l...

+2

39

1

[Interview] Leigh Goehring On The Present State of The Energy Markets

came across this superb writeup and accompanying video. THE PDF is also detailed and informative.

Exciting developments are unfolding in the global oil and North American natural gas markets, presenting a unique opportunity for investors willing to take a contrarian approach. We believe there is substantial profit potential in both sectors, with promising outcomes expected by the end of this decade.

In a...

came across this superb writeup and accompanying video. THE PDF is also detailed and informative.

Exciting developments are unfolding in the global oil and North American natural gas markets, presenting a unique opportunity for investors willing to take a contrarian approach. We believe there is substantial profit potential in both sectors, with promising outcomes expected by the end of this decade.

In a...

4

The trend is your friend. At least until it is not. To me, that means that I have to remain, or get long gold, the traditional hedge against inflation, physical gold or the SPDR Gold Shares ETF (GLD). If Bitcoin is your thing, that may be generational. There is good reason for that, beyond just being old fashioned. While Bitcoin probably has the potential to "out-return" gold in US dollar terms, it also has the potential for far greater volatility than does gold. A younger person mi...

11

3

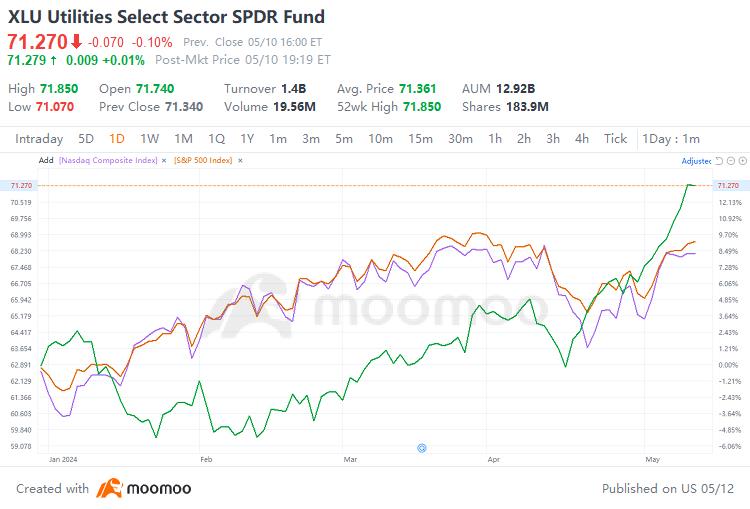

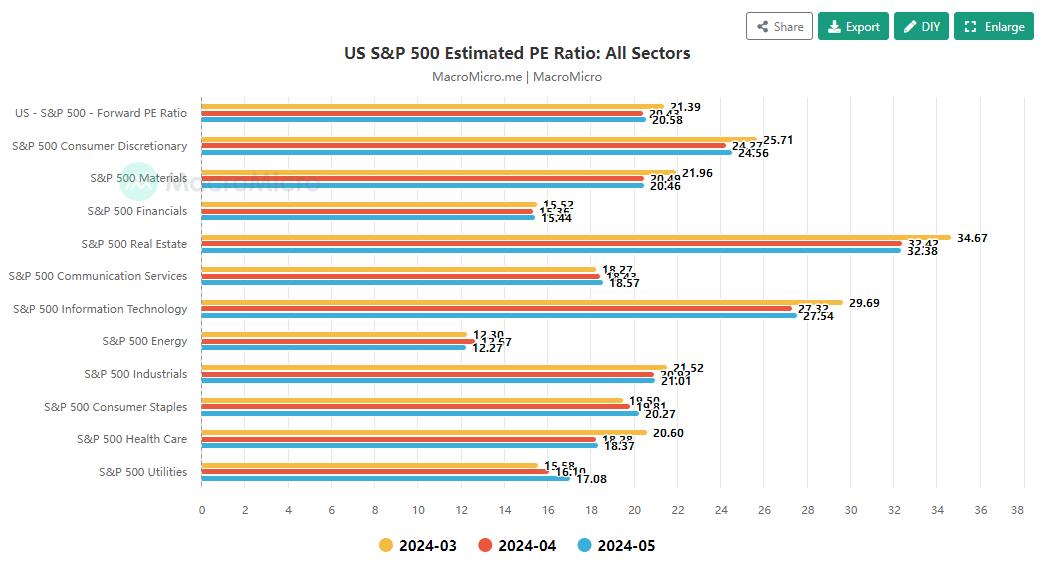

As global investment preferences shift, the Utilities SPDR ETF ( $Utilities Select Sector SPDR Fund (XLU.US)$) led the US stock market in May, recording a 6.79% gain this month, with a year-to-date return of 13.47%, outperforming the S&P 500 and Nasdaq and propelling the utility sector to be the best-performing sector so far this year.

The US stock market has accelerated its rebound from the April slump, but there has...

The US stock market has accelerated its rebound from the April slump, but there has...

30

1

Read more

FinanceCalculus : Look at the name i am definitely not a follower