No Data

4063 Shin-Etsu Chemical

- 4468.0

- -55.0-1.22%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The Nikkei Average fell by 74 points, continuing its downward trend, while the TOPIX remains strong, rising for eight consecutive days = Afternoon session on the 21st.

On the 21st, in the afternoon session, the Nikkei Stock Average fell by 74.82 yen to 37,677.06 yen compared to the previous trading day. Meanwhile, the TOPIX (Tokyo Stock Price Index) rose by 8.20 points to 2,804.16 points, marking its eighth consecutive increase. This is the longest streak since January 15, 2024, a period of about one year and two months. In the morning, influenced by a slight decline in the NY Dow and Nasdaq Composite Index in the local U.S. stock market on the 20th, selling pressure was observed. When the Nikkei opened at 9:00 AM, it was down by 132.51 yen to 37,619.37 yen.

The Nikkei average is up about 120 yen, with positive contributions from SoftBank Group, Tokyo Electron, and Sony Group Corp ranking at the top.

As of 12:46 PM on the 21st, the Nikkei average stock price is around 37,872 yen, up about 120 yen compared to the previous trading day. In the afternoon session, the market appears slightly heavy on the sell side as trading begins. The foreign exchange market continues to fluctuate around 149.20 yen per dollar. The contribution of stocks included in the Nikkei average is positive for SoftBank Group Corp <9984.T>, Tokyo Electron <8035.T>, and Sony Group Corp <6758.T> at the top. On the negative side, Advantest <6857>.

List of conversion stocks [List of parabolic signal conversion stocks]

○ List of Stocks for Buy Change Market Code Stock Name Closing Price SAR Tokyo Main Board <1812> Kashima 3125 <1820> Nishimatsu Construction 50264816 <1946> Toenek 1011957 <1950> Japan Electric Utility 21992096 <1951> Exeo Group 17691711 <2121> MIXI 34203290 <2154> Open UP 18681756 <25

In the afternoon session, there is adjustment of holdings in anticipation of President Ueda's press conference and the outcome of the FOMC.

The Nikkei average fell for the first time in four trading days. It closed at 37,751.88 yen, down 93.54 yen (with an estimated Volume of 1.8 billion 40 million shares). Selling was driven by the weakness in U.S. stocks from the previous day, but buying continued in value stocks such as trading companies due to the influence of famous U.S. investor Warren Buffett, and after the initial selling, there was a quick bounce back. Additionally, when the Bank of Japan's monetary policy meeting decided to maintain the current policy, short-term players also engaged in Futures buying, and just before the morning close, it reached as high as 38,128.58 yen.

Yahagi Construction Industry, Kawada Technology, etc.

<1870> Yahagi Construction Industry Co., Ltd. Mitsubishi UFJ Asset Management Co., Ltd. Shareholding ratio 0.38% → 0.38% Reporting obligation date 2025/03/10 <3443> Kawada Technology Co., Ltd. Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. Shareholding ratio 0.28% → 0.01% Reporting obligation date 2025/03/10 <4063> Shin-Etsu Chemicals Co., Ltd. Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.

Nippon Steel & Sumitomo Metal Mining has updated its high prices [new high and new low stocks update].

The new high update stocks on the Main Board are Nippon Steel & Sumitomo Metal Mining <1515> and San-A <2659>, totaling 25 stocks. The new low update stocks on the Main Board are Daito Trust Construction <1878> and Shin-Etsu Chemicals <4063>, totaling 9 stocks. "Main Board" "Standard" "Growth" New highs New lows New highs New lows New highs New lows 03/14 2592029003/13 2111437303/11 1821418203/10 20733451403/07 22171.

Comments

United States

Goldman Sachs expects US companies to achieve their highest quarterly profits in 3 years, which will ultimately lead to an increase in the performance of US stock market indices.

US Labor Market Losing Steam As Unemployment Rate Climbs To 4.1%

The U.S. Department of Labor reported robust job growth in June, with non-farm payrolls increasing by 206,000, compared to an estimated 190,000. Average hourly earnings rose by 0.3% month-ove...

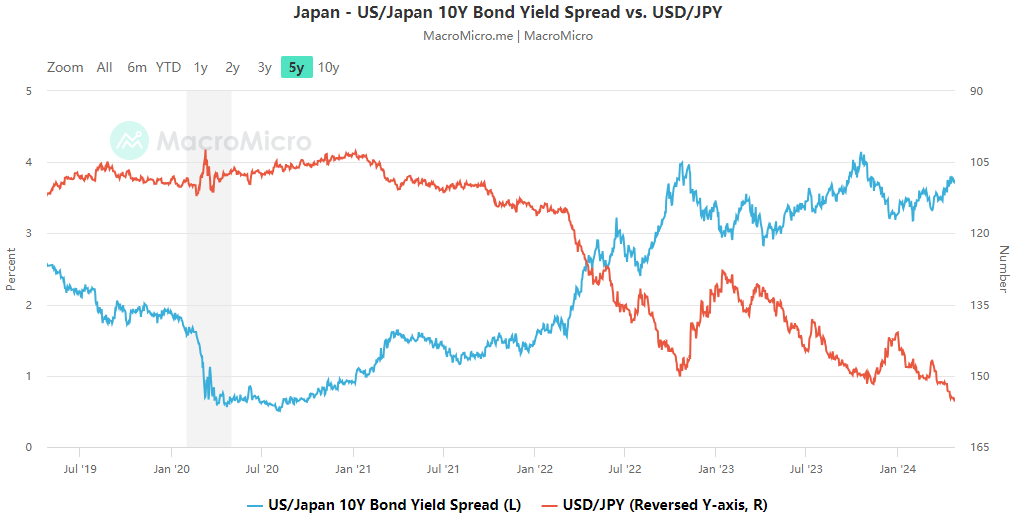

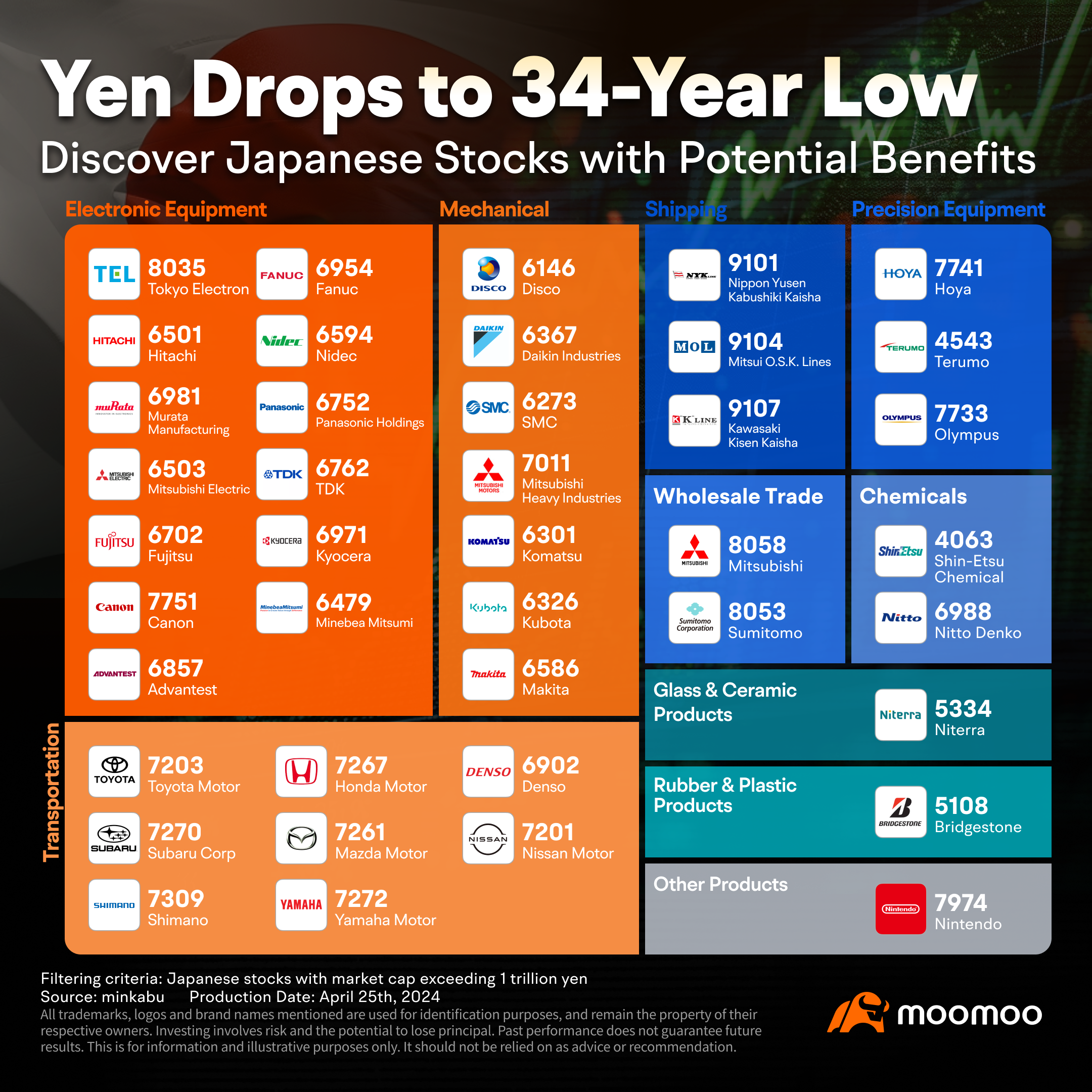

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

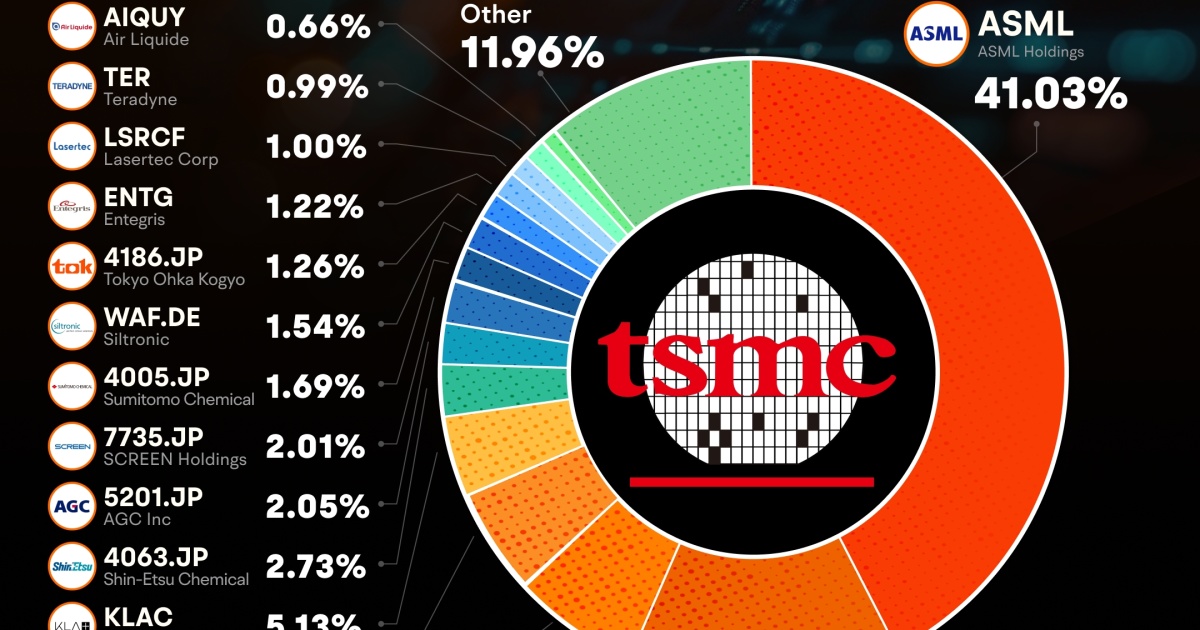

Equipment Suppliers:

$ASML Holding (ASML.US)$: A leadin...