How to Use Global Variables

1. What is a global variable

A global variable is a custom variable that can be created in multiples. There are two types of global variables:

1. Numeric global variables: This kind of global variable can be used to record integers or decimals. When setting parameters in conditions/operations, numeric global variables can be used to assign values. For example, create a numeric global variable "a" and set it to "Buy 'a' shares of Apple (AAPL.US)" in the Order Conditions.

2. Symbol global variables: You can directly select the symbol in other conditions/operations without repeatedly searching symbols. For example, if you create a symbol global variable "a" and designate it as Tesla (TSLA.US), it will be set directly to "Buy one share of 'a'" in the Order Conditions.

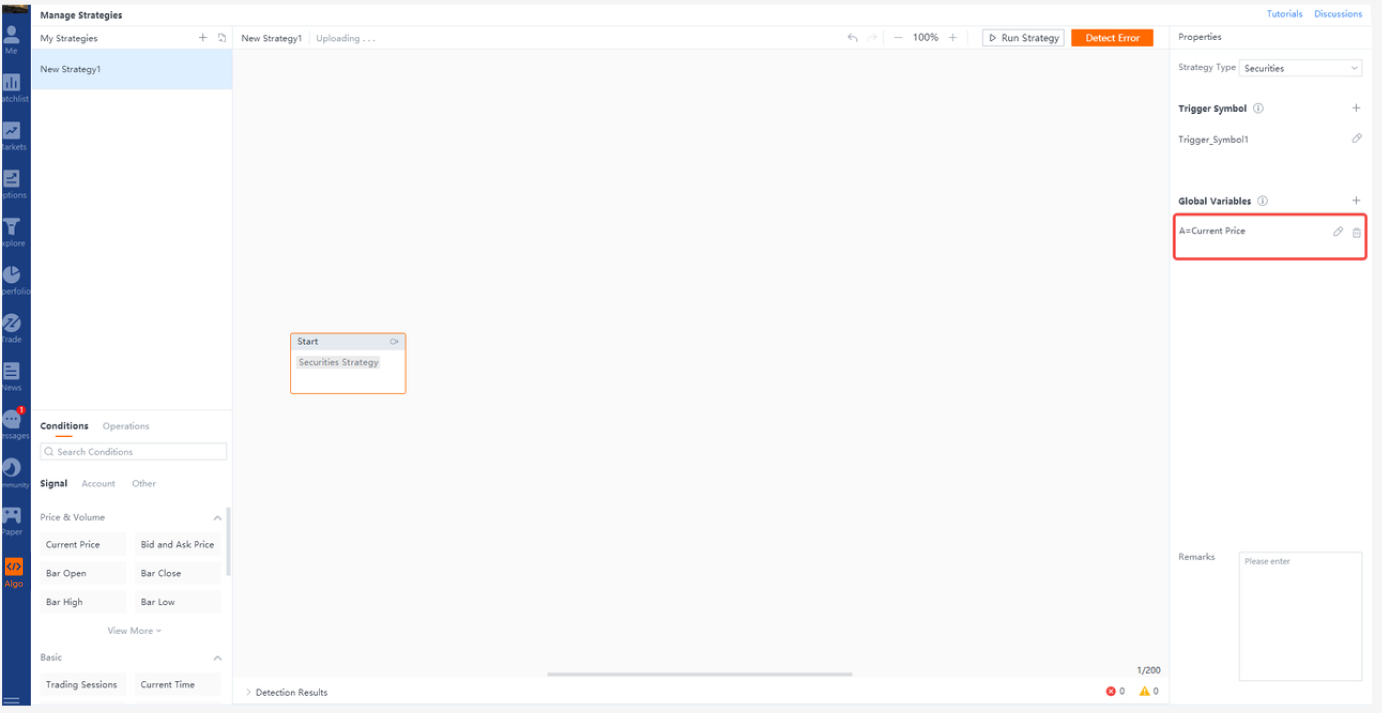

2. How to create a global variable in a strategy

Create a variable A in the "Start" properties, with an initial value of the stock's latest price. Please note that global variables are only assigned an initial value when the strategy starts, which is the current stock price.

Any images provided are not current and any securities shown are for illustrative purposes only and are not recommendations.

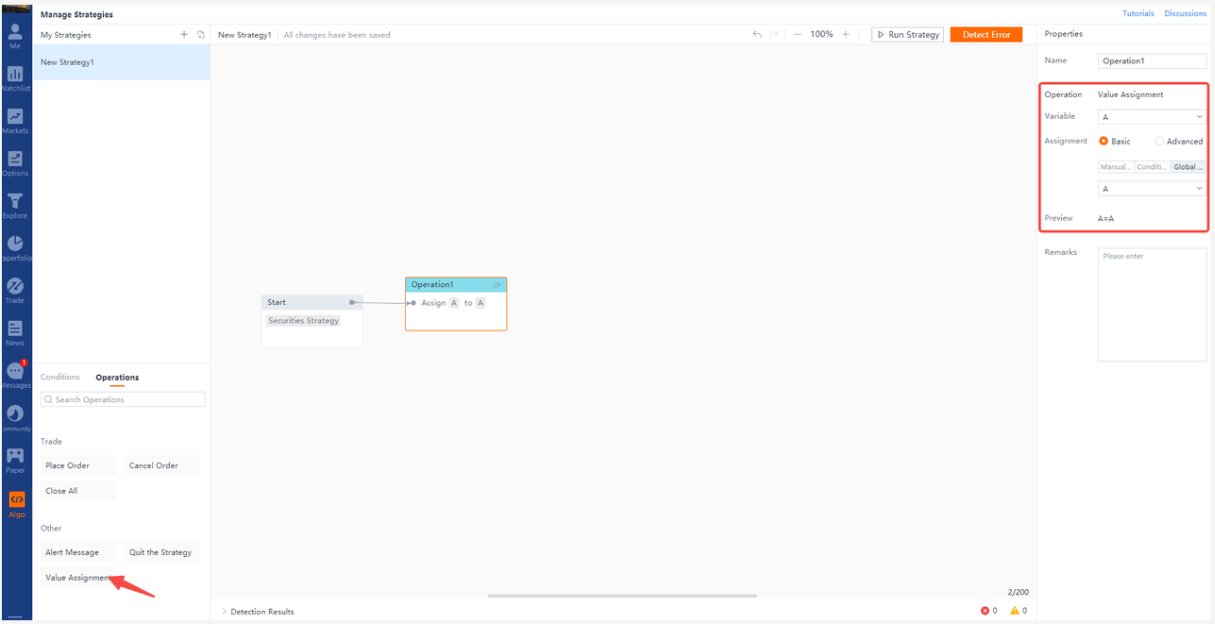

You can assign the value A to the global variable A with the "Value Assignment" card and then print the value of the global variable in the Running Log on the Backtest page.

Any images provided are not current and any securities shown are for illustrative purposes only and are not recommendations.

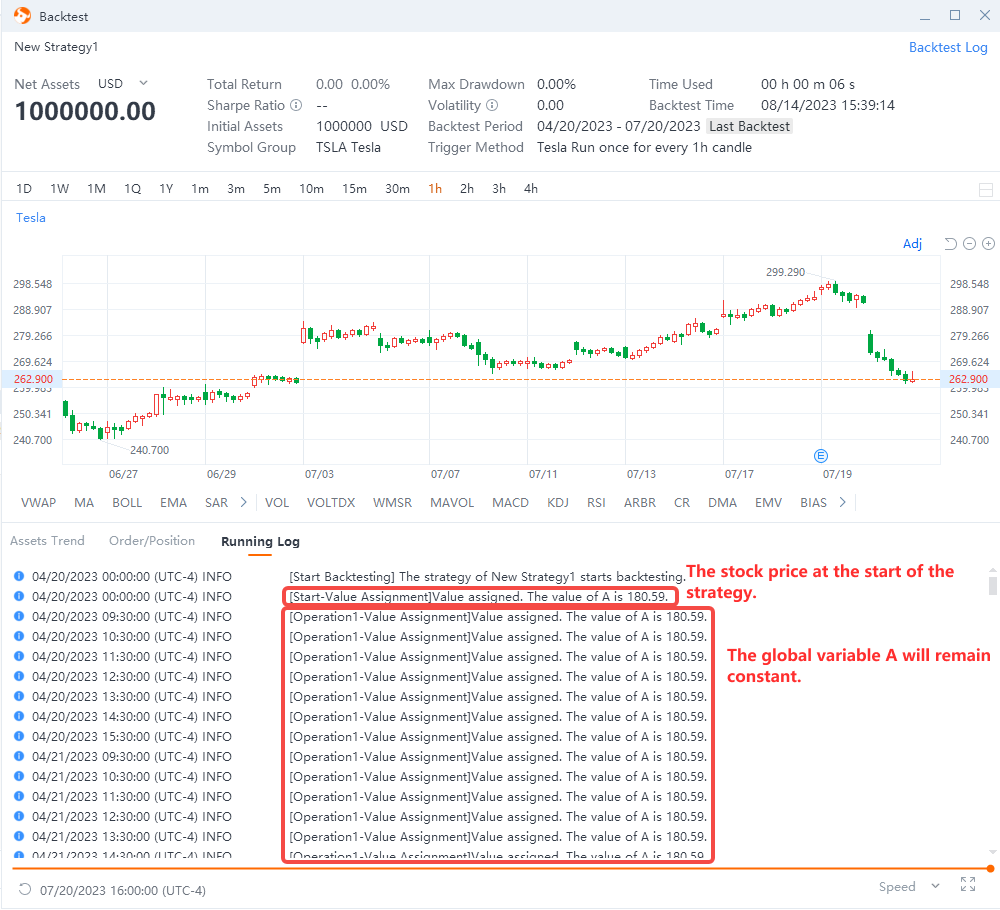

The value of the global variable A is displayed in the running log, and it will always be a constant value (see below).

Any images provided are not current and any securities shown are for illustrative purposes only and are not recommendations.

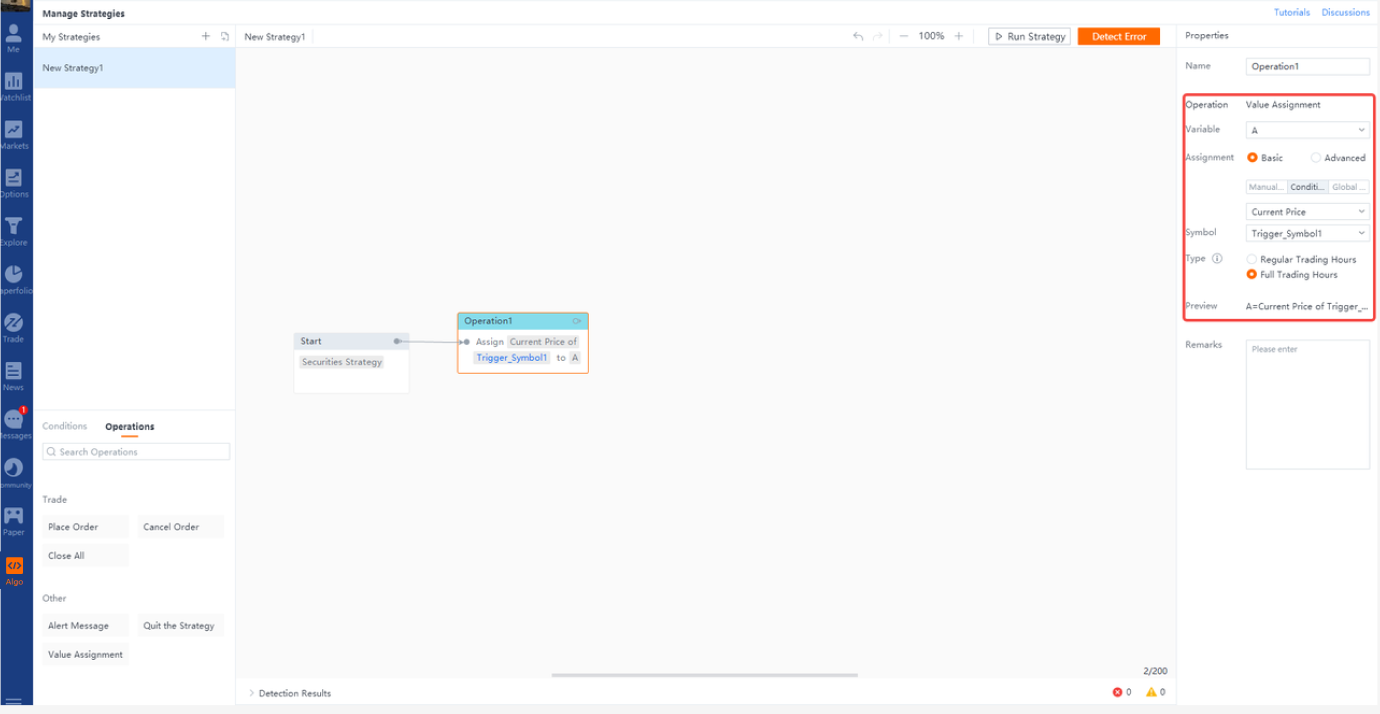

3. How to keep a global variable always at the latest stock price when a strategy is running

Suppose you want to keep the value of the global variable A to be the latest stock price when the strategy is running. In that case, you can assign the latest stock price to variable A with the "Value Assignment" card.

Any images provided are not current and any securities shown are for illustrative purposes only and are not recommendations.

This way, the global variable A will hold the updated latest price value.

Any images provided are not current and any securities shown are for illustrative purposes only and are not recommendations.

Losses can happen more quickly with quant and algorithmic trading compared to other forms of trading. Trading in financial markets carries inherent risks, making effective risk management a crucial aspect of quantitative trading systems. These risks encompass various factors that can disrupt the performance of such systems, including market volatility leading to losses.

Moreover, quants face additional risks such as capital allocation, technology, and broker-related uncertainties. It's important to note that automated investment strategies do not guarantee profits or protect against losses.

The responsiveness of the trading system or app may vary due to market conditions, system performance, and other factors. Account access, real-time data, and trade execution may be affected by factors such as market volatility.

Risk Disclosure This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose of the above content.

Overview

- No more -