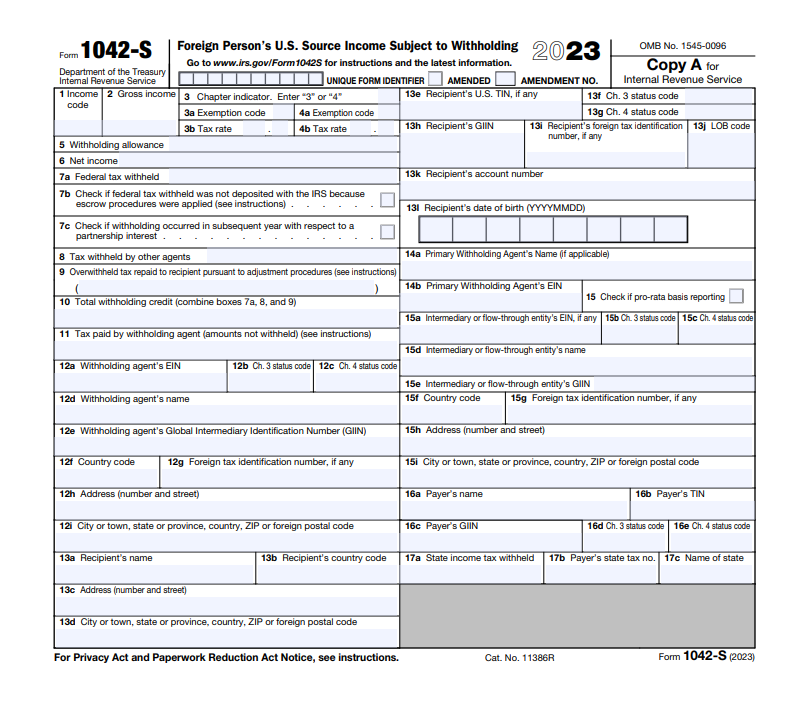

What is Tax Form 1042S?

Tax Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding, is filed by withholding agent to report amounts paid to foreign persons that are described under Amounts Subject to NRA Withholding and Reporting, even if withholding is not required on the payments.

A separate Form 1042-S is required for:

● Each recipient regardless of whether or not tax was withheld

● Each type of income that was paid to the same recipient

● Each tax rate (if withholding occurred at more than one tax rate) of a specific type of income paid to the same recipient.

Market Insights

Fed Rate Cut Beneficiaries Fed Rate Cut Beneficiaries

The list includes stocks that are expected to benefit from a Federal Reserve rate cut, covering companies from technology, cryptocurrency, real estate, and high-dividend sectors. The list includes stocks that are expected to benefit from a Federal Reserve rate cut, covering companies from technology, cryptocurrency, real estate, and high-dividend sectors.

View More

Promotions Promotions

Best Growth Stocks Best Growth Stocks

Spot stocks with huge growth potential and solid financial standing. Spot stocks with huge growth potential and solid financial standing.

No. Symbol 20D % Chg

Sign up to unlock

View More

Hot Topics Hot Topics

The Week Kicks Off: Earnings Season Hype Is No Cooling Down, Jobs Report and More

Market wrap-up: $Bitcoin (BTC.CC)$ falls below 80,000; $XAU/USD (XAUUSD.CFD)$ and $XAG/USD (XAGUSD.FX)$ Tumble on Friday; Show More

In One Chart

Dec 1, 2025 13:36

December's Must-See Financial Events: FOMC Meeting, Jobs and Inflation Data, Santa Claus Rally, and More

Moomoo Insights

Dec 24, 2025 22:09

U.S. E-commerce vs. Traditional Retailers: Is a Battle Inevitable? A Comparison of Amazon and Walmart

Star Tech Companies Star Tech Companies

Featured Tech Stocks represent leading technology companies with strong market presence, influential in their industries, and notable for robust innovation and profitability. These firms are market leaders, significantly affecting the tech sector and broader economy. Featured Tech Stocks represent leading technology companies with strong market presence, influential in their industries, and notable for robust innovation and profitability. These firms are market leaders, significantly affecting the tech sector and broader economy.

No. Symbol 20D % Chg

Sign up to unlock

View More

- No more -