Moomoo Financial Inc. Fee Schedule for Non-U.S. resident

Updated on 29 August, 2025 EST

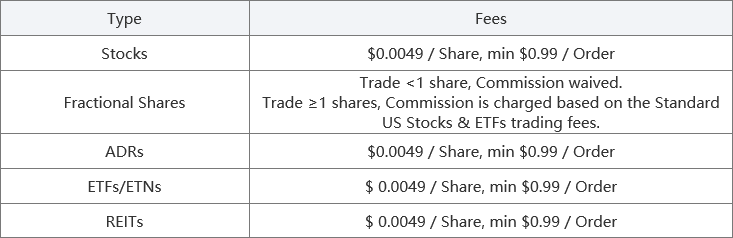

1. U.S. Stocks

1.1 Commission

Note: Stocks include individual stocks, OTC stocks, preferred stocks, etc.

1.2 Platform Fees

|

Type |

Fees |

|

Fixed (Default) |

$0.005/Share, min $1/Order |

|

Tiered |

By Tier[Note 1] |

|

Fractional Shares |

Trade <1 share, Platform Fee is 0.99% of Trade Value, capped at $0.99, Regulatory Fees waived (rounded up to the nearest $0.01/order). Trade ≥1 shares, Platform Fee are charged based on the Standard US Stocks & ETFs trading fees. |

Notes:

1. Click here to view "By Tier"

2. You can choose either method above.

1.3 Regulatory Fees

|

Type |

Fees |

|

Settlement Fee |

$0.003/Shares |

|

SEC Fee(sells only) |

$0.0000278*transaction amount, min $0.01/trade (cancelled from May 14 2025, EST) |

|

Trading Activity Fee (TAF, sells only) |

$0.000195/Share, minimum $0.01/trade, maximum $9.79/trade |

|

Consolidated Audit Trail Fees |

NMS Stocks: $0.00/Share OTC Stocks: $0.00/Share |

|

ADR Custodian Fee |

$0.01~0.05/Share |

1.4 US Corporate Action

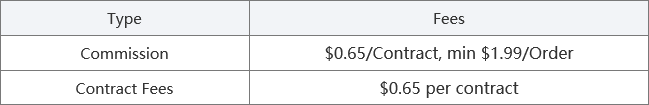

2. Options

2.1 Trading Fees

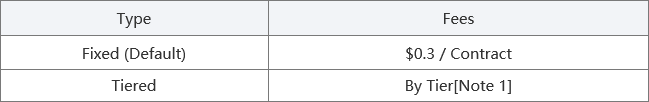

2.2 Platform Fees

Notes:

1. Click here to view "By Tier"

2. You can choose either method above.

2.3 Regulatory Fees

|

Type |

Fees |

|

SEC Fee (sells only) |

$0.0000278*transaction amount, min $0.01/trade (cancelled from May 14 2025, EST) |

|

Trading Activity Fee (TAF, sells only) |

Stock Options/ETF Options: $0.00329/Contract, minimum $0.01/trade |

|

Options Regulatory Fee (ORF) |

$0.013/Contract |

|

OCC Fees |

$0.025/Contract |

|

Consolidated Audit Trail Fees |

$0.00/Contract |

Notes:

1. The Options Regulatory Fee ('ORF') is a fee assessed by exchanges on their members. The ORF fees are typically passed-through by members to their customers. ORF is collected by The Options Clearing Corp ("The OCC") on behalf of the U.S. options Exchanges. The stated purpose of the fee is to recover a portion of the costs related to the supervision and regulation of the options markets. These activities include routine surveillance, investigations, as well as policy, rulemaking, interpretive and enforcement activities. The applicable fee rate may result in a discrepancy with the fee charged by the upstream brokers or the relevant exchanges, and any excess fee will be retained while deficiency will not be charged to clients.

2. The OCC fees are fees charged by the OCC to its members. Like the ORF, these fees are passed through from the clearing broker to Moomoo Financial Inc. to Moomoo Financial Inc.'s clients.

3. The exchange fees referenced on Moomoo Financial Inc.'s fee schedule and on trade confirmations are fees charged by the exchanges where the options was executed. These fees vary depending on a broker's exchange memberships and are difficult to ascertain promptly. For that reason, Moomoo Financial Inc. like other broker-dealers, used a blended rate that equals or slightly exceed the amount charged by the options exchanges.

4. Effective 07/23/2021, Moomoo Financial Inc. will discontinue charging "exchange fees" and will institute a fee of $0.65 per option contract.

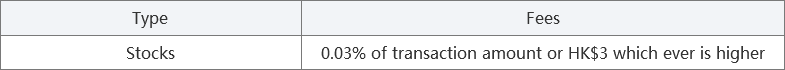

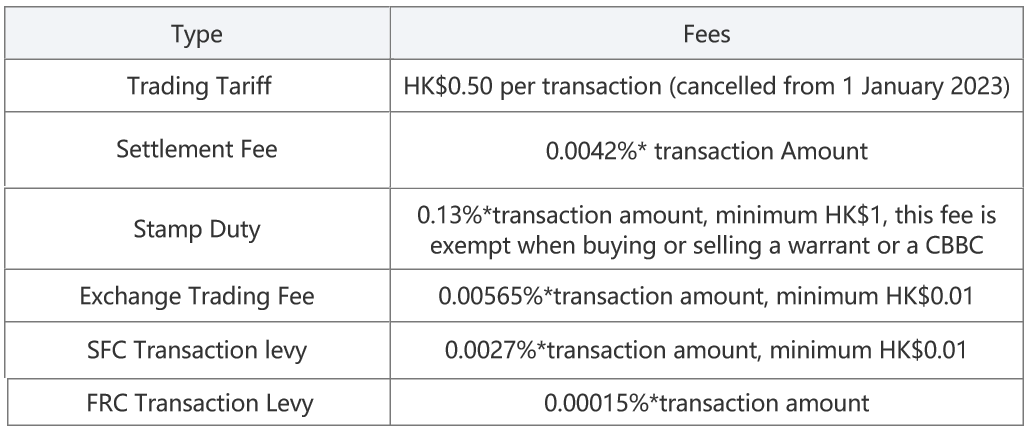

3. Hong Kong Stocks

3.1 Commission

3.2 Platform Fees

3.3 Regulatory Fees

Note: According to HKEX circular, with effect from 17 November 2023, Stamp Duty has been revised from 0.13% to 0.10%.

According to HKEX circular, effective from June 30, 2025 (HKT), the rate of settlement fee will be revised to 0.0042% with the removal of minimum and maximum charges.

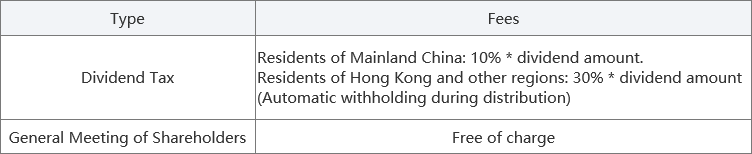

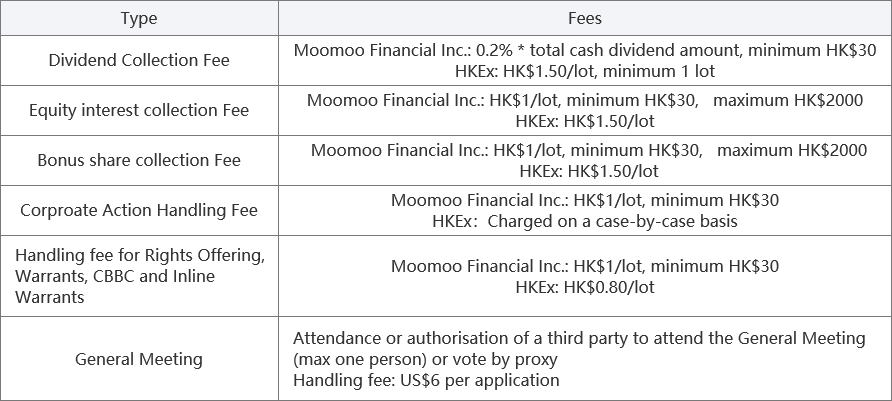

3.4 HK Corporate Action

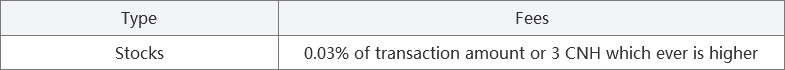

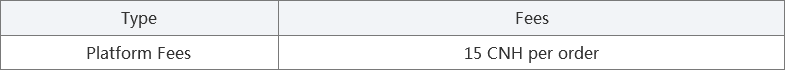

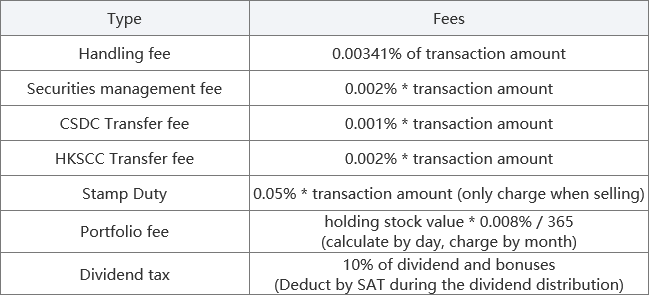

4. China A-shares

4.1 Commission

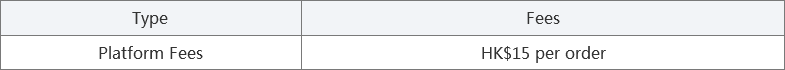

4.2 Platform Fees

4.3 Regulatory Fees

Note:

1. China A-share ETFs are exempt from Securities Management Fees, Transfer Fees(CSDC ), and Stamp Duty, and the handling fee is 0.004% of the transaction amount. Other charges are the same as the underlying shares.

2. Handling fee revised to 0.00341% of transaction amount from 28 August 2023.

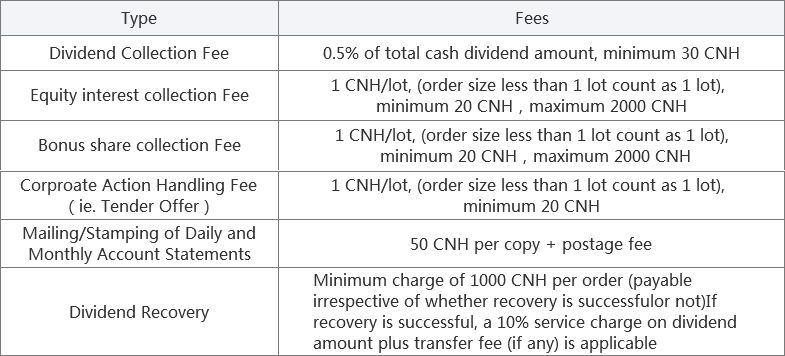

4.4 A Share Corporate Action

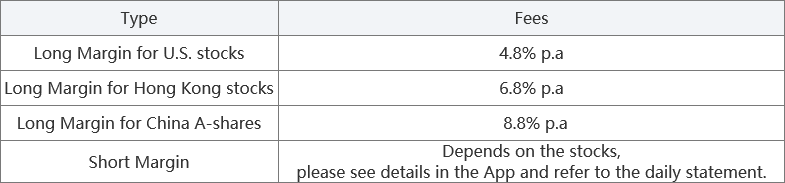

5. Margin Rate

Note: We reserve the right to amend our margin interest rate from time to time in response to changes in prevailing interest rates and other factors. The Margin Rate is subject to change without notice.

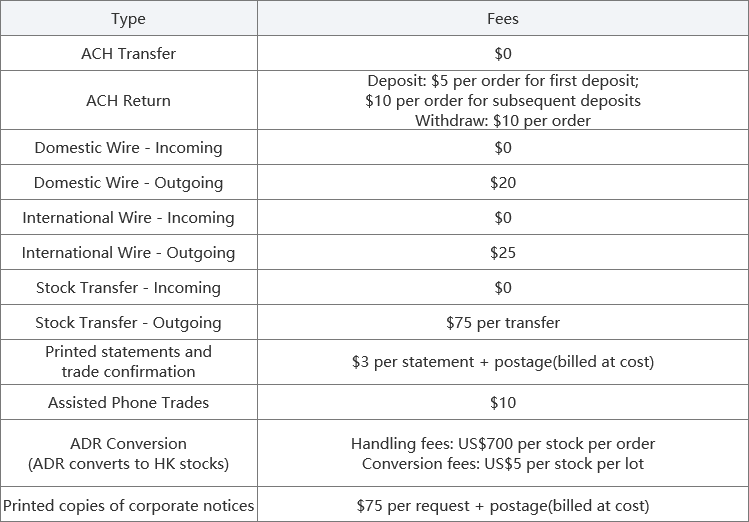

6. Service Fees

Notes:

1. Additional wire transfer fees charged by any originating, intermediary, or recipient bank may apply.

2. As of ADR conversion, one lot consists of 100 ADS, and less than one lot is rounded up to one lot. Please note that the adjusted ADR Conversion fee will take effect on November 8, 2022.

3. Per regulatory requirements, we must provide statements and confirms to clients. The printed materials involve securities offered through Moomoo Financial Inc., Member FINRA/SIPC, and are subject to fees as mentioned above.

Overview

- 1. U.S. Stocks

- 1.1 Commission

- 1.2 Platform Fees

- 1.3 Regulatory Fees

- 1.4 US Corporate Action

- 2. Options

- 2.1 Trading Fees

- 2.2 Platform Fees

- 2.3 Regulatory Fees

- 3. Hong Kong Stocks

- 3.1 Commission

- 3.2 Platform Fees

- 3.3 Regulatory Fees

- 3.4 HK Corporate Action

- 4. China A-shares

- 4.1 Commission

- 4.2 Platform Fees

- 4.3 Regulatory Fees

- 4.4 A Share Corporate Action

- 5. Margin Rate

- 6. Service Fees

- No more -