Stock, ETF & Index Options

Stock, ETF & index options: definitions and contract terms

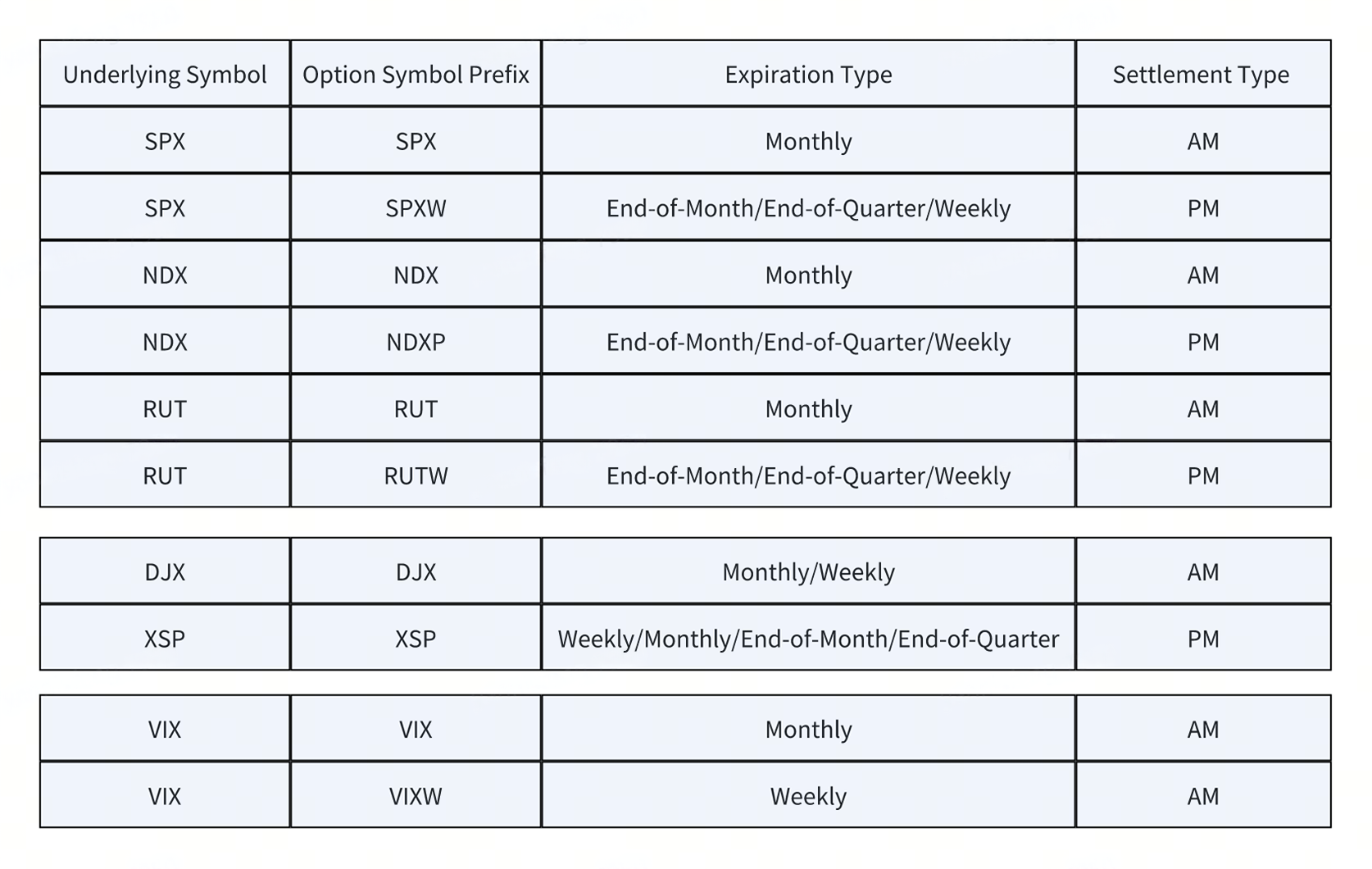

Stock options, ETF options and index options for the US market are available for trading with Moomoo AU. Moomoo AU currently supports trading US index options including SPX (S&P 500 Index), VIX (CBOE Volatility Index), XSP (Mini S&P 500 Index), DJX (Dow Jones 100 Index), RUT (Russell 2000 Index), and NDX (Nasdaq 100 Index). More index options will be available soon.This article will help you learn their definitions and the differences in their contract terms.

Definitions

• Single Stock options: These are options contracts on a single underlying stock. An example would be an options contract on Apple Inc. where the underlying is AAPL shares. The contracts are usually settled in shares of the underlying stock.

• ETF options: These are options contracts where the underlying is a single exchange traded fund, or ETF. Since an ETF is traded on an exchange, the contracts are usually settled in shares of the underlying ETF when exercised. The underlying ETF may also be structured to track a market index. An example is SPX ETF Options where the underlying is the SPDR S&P 500 ETF Trust (Symbol "SPY") that tracks the performance of the S&P 500 Index.

• Index options: These are options contracts where the underlying is an index. The contracts are based directly on the index, not a specific stock or ETF traded on an exchange. So an index option can only be settled in cash based on the changes in the basis points of the index. An example is SPY Index Options where the underlying is the S&P 500 Index.

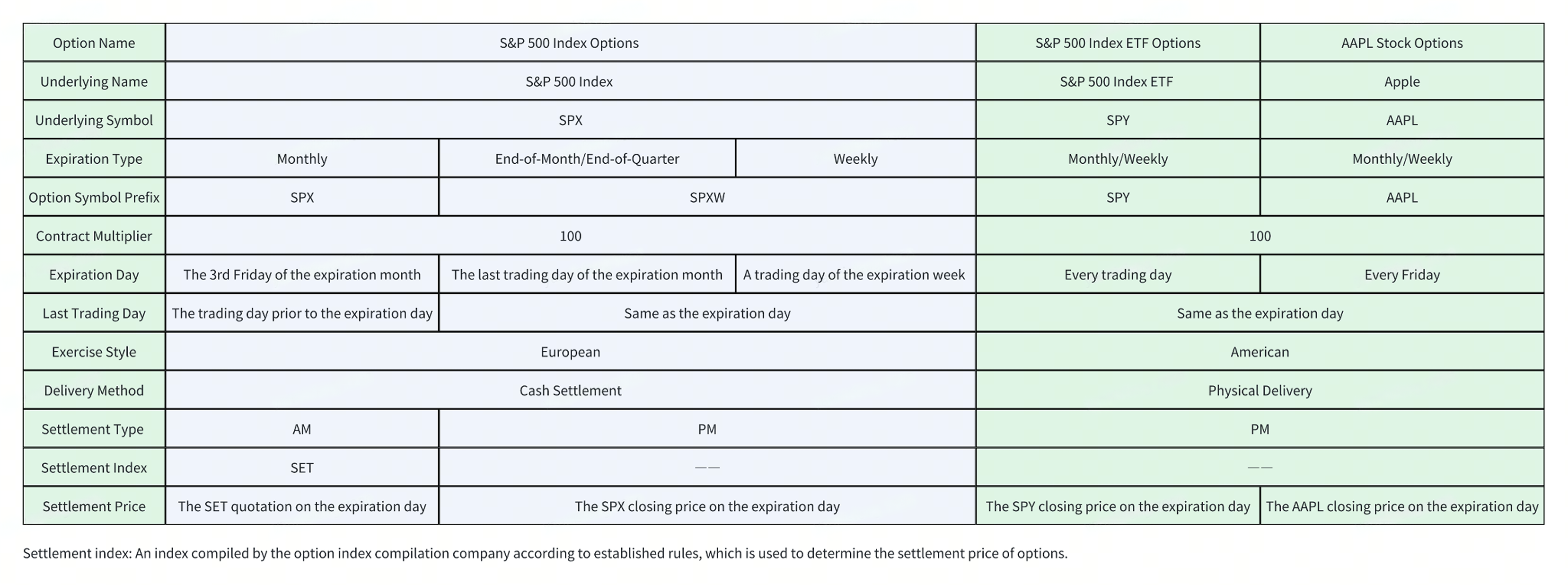

The table below includes more details on the contract terms for SPX, SPY, and AAPL options examples.

Index options vs ETF options

An index option always tracks a specific index. However, an ETF option may cover a specific industry, sector or a market index. ETF options where the underlying is an ETF that tracks a market index such as the S&P 500 will have similar exposure to market changes as an index option, but with these key differences:

• Index options directly track a stock index instead of a specific stock or ETF. Index options are always settled in cash.

• ETF options may indirectly track an index by using an underlying ETF made up of stocks that represent the index. The contract can be settled in shares of the underlying ETF that is traded on the exchange.

Exercise style: American vs European

Index options differ from single stock options and ETF options in how they can be exercised or assigned.

• Index options: The majority of index options are European style options that can't be exercised or assigned early. Currently, we only support trading European-style US index options.

• Single stock options & ETF options: Are usually American style options that can be exercised or assigned early.

Delivery method: Physical delivery vs cash settlement

Index options differ from single stock options and ETF options because the underlying is an index, which is can't be traded on an exchange.

• Index options: The delivery method for index options is always cash settlement, as they are non-tradable. The settled amount is calculated using the contract value after the option is exercised based on the strike price and settlement price.

• Single stock options & ETF options: The delivery method is usually by physical delivery of the underlying shares.

For example, the strike price for an SPX index call option is $4,420:

• If its settlement price upon expiration is $4,432, the settlement value of the option: ($4,432 – $4,420) * 100 = $1,200.

• If its settlement price upon expiration is $4,418, the settlement value of the option will be $0.

Note: “100” is the contract multiplier, see Contract size below for more details.

Settlement type: AM vs PM

All single stock options are PM-settled options, whereas index options can be either AM-settled or PM-settled.

• AM-settled options:

• The last trading day is usually the trading day prior to the expiration date.

• The settlement price is calculated based on the opening price of the underlying index on the expiration date, and is subject to the settlement index.

• PM-settled options:

• The last trading day is the same as the expiration date.

• The settlement price is calculated based on the closing price of the underlying index on the expiration date.

Note: The settlement index is calculated based on the actual prices of the underlying assets of the contract at a specific time during the trading day. The final settlement price may differ from the closing price of the underlying asset.

Contract size

An option's contract size is based on the contract multiplier and the strike price. Usually, the contract size of index options is larger than that of its corresponding ETF option.

For example, the contract size of an SPX index option is about 10 times that of the SPY index ETF options.

Contract size = Multiplier * Strike Price

Overview

Market Insights

Star Tech Companies Star Tech Companies

Featured Tech Stocks represent leading technology companies with strong market presence, influential in their industries, and notable for robust innovation and profitability. These firms are market leaders, significantly affecting the tech sector and broader economy. Featured Tech Stocks represent leading technology companies with strong market presence, influential in their industries, and notable for robust innovation and profitability. These firms are market leaders, significantly affecting the tech sector and broader economy.

View More

Affordable trading at your fingertips Affordable trading at your fingertips

Warren Buffett Portfolio Warren Buffett Portfolio

Buffett's holdings are the latest portfolio from Berkshire Hathaway. Regarded as a top investor, his trades often signal the market and influence the industry. Buffett's holdings are the latest portfolio from Berkshire Hathaway. Regarded as a top investor, his trades often signal the market and influence the industry.

No. Symbol 20D % Chg

Log In for the Full List

View More

- No more -