Options Exercise and Settlement

How are stock options exercised and settled?

The vast majority of exercises are automatically carried out based on the closing settlement price on the contract expiration date. If you, as the option purchaser, need to exercise early or waive your rights to exercise, please refer to [How can I early exercise stock options or waive my exercise rights]

As the option purchaser, if the option is out of the money on the expiration date, the expired option will have no value and there will be no exercise taken place; if the moneyness of the option is equal to or higher than $0.01, the option will be automatically exercised, which will be completed in the form of a physical delivery.

As the option seller, when the option is exercised by the purchaser, the option clearing house will randomly match the open short position with the exercised option. If your account is assigned, you must either deliver the underlying stock (in case of a call option) or buy the underlying stock (in case of a put option).

Generally speaking, in-the-money options are exercised when they expire. If you are short an in-the-money option on the expiry date, you will most likely be assigned. The purchaser may also choose to waive the exercise rights or early exercise the option regardless of the actual moneyness.

How can I early exercise stock options or waive my exercise rights?

If you need to early exercise options or waive your exercise rights, please email your instruction to optionstrading@au.moomoo.com and ensure the following information is provided:

1. Account ID

2. Option Symbol

3. Number of contracts

4. Action (Exercise/Waive)

**Note that we can only process options waiver requests on the expiration date itself.

**Instructions need to be received before US regular session close, 4pm ET, for same day processing.

**Moomoo AU will proceed once satisfied with the investor's intention to exercise, and confirming the account purchasing power required for the exercise.

Is it possible that the exercise will not be successful?

Moomoo AU currently does not support short selling of stock. If you have in-the-money options that will lead to short positions in stock after exercise, you need to either close these option positions (either by selling or buying back) before the contract expiration day or make sure your account have enough stocks for settlement. Otherwise, moomoo AU reserves the right to liquidate these options.

At expiry, your option position may undergo the following changes: When you have a long call position that is exercised, it will become a long position of the underlying stock, and the account will deduct the cash required to establish the position. Not having enough funds for the potential exercise, will lead to the account being marked as "dangerous" from a risk control perspective. Customers should ensure the account has sufficient liquidity for option exercise via closing positions or injecting more funds.

In the case that your account is marked as "dangerous", Moomoo AU reserves the right to perform the following actions: 1) liquidate your option positions; 2) waive your right to option exercises.

Index Options Exercise

Moomoo AU currently supports trading the following index options: SPX (S&P 500 Index), VIX (The Volatility Index), XSP (Mini S&P 500 Index), DJX (1/100 Dow Jones Industrial Average Index), RUT (Russell 2000 Index), XEO (S&P 100 Index), and NDX (Nasdaq 100 Index). These options are all European-style, which means they can only be exercised at expiration.

When index options expire, the following scenarios exist:

-

Automatic exercise

-

Index options that are $0.01 or more in-the-money at expiration will be automatically exercised by the OCC. No instructions are needed.

-

Automatic lapse

-

Index options that are less than $0.01 in-the-money or out-of-the-money at expiration will automatically lapse if the position holder does not submit an exercise instruction in advance.

Since index options are settled in cash and incur no additional exercise fees, opting for instructed exercise or lapse at expiration is disadvantageous for clients holding long positions. Consequently, moomoo AU does not currently support requests for instructed exercise or lapse of such options.

Index Options Settlement

Index options are cash-settled as there are no underlying assets for delivery.

Calculation method for settlement amount:

-

Lapsed Options: settlement Amount = 0

-

Automatically exercised options:

-

Calls: Settlement Amount = (Settlement Price - Exercise Price) × Contract Multiplier × Contract Quantity

-

Puts: Settlement Amount = (Exercise Price - Settlement Price) × Contract Multiplier × Contract Quantity

The settlement amount is paid by the option seller to the option buyer.

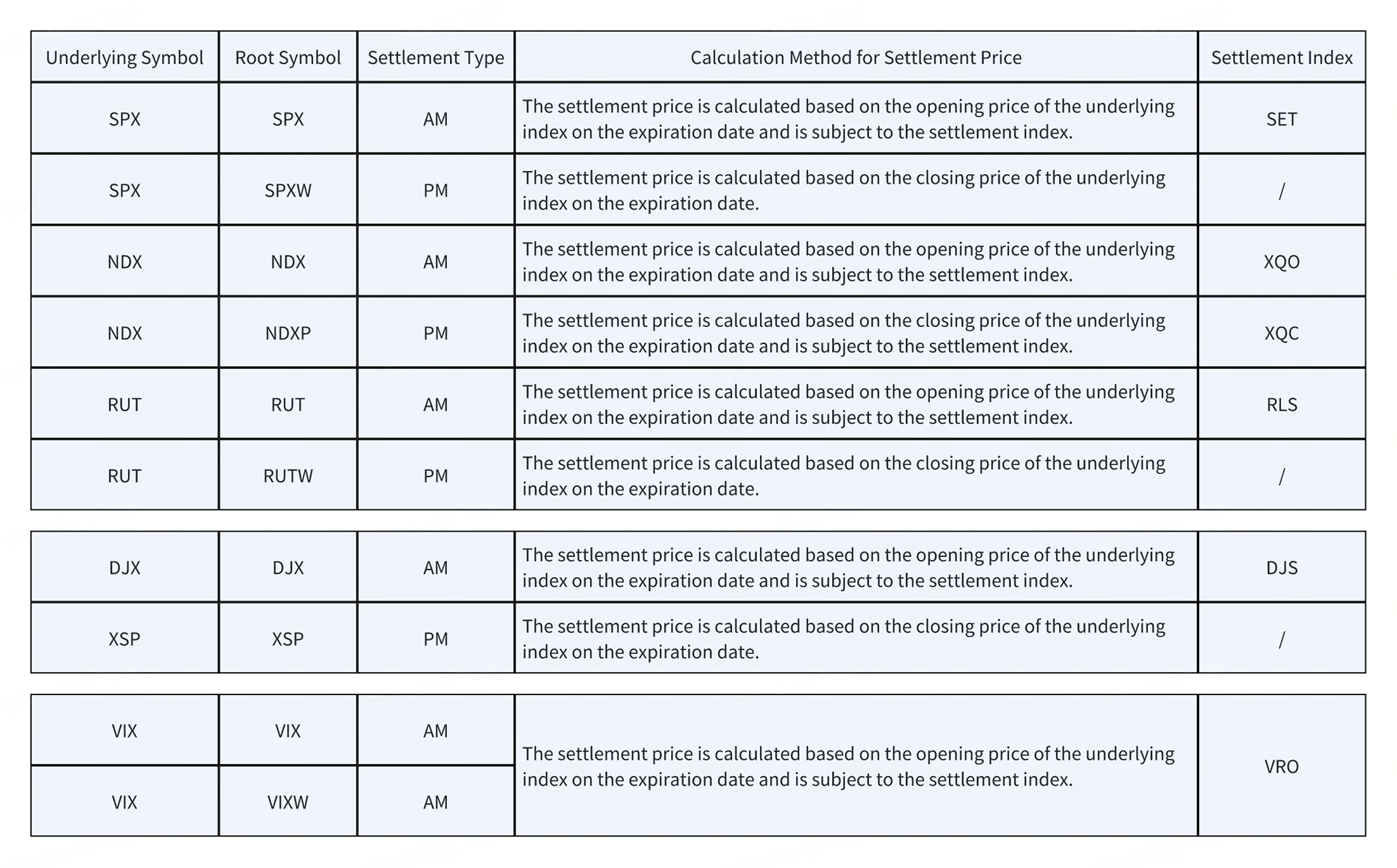

The settlement prices of index options are determined by their settlement types. Details are as follows: