Tesla's stock split: rally lifter or bubble booster?

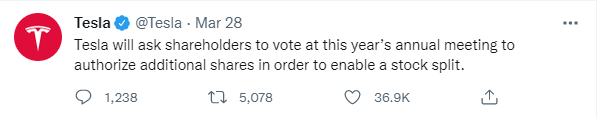

- What happened

Shares of $Tesla (TSLA.US)$ rose 8% on Monday after the company announced it would vote on a plan to split its stock in the form of a stock dividend. The rise continued during the premarket session on Tuesday.

The company last announced a stock split on Aug. 11, 2020. By Aug. 31, 2020, when the 5-to-1 split took effect, the stock was up about 78%.

The stock split is subject to board approval at its annual shareholders meeting, but Tesla has yet to announce the date of this year's annual shareholder meeting.

Tesla has soared about 40% since March 14, rebounding to $1,000 again.

Investors focused on whether the rebound could continue before the next Tesla shareholder meeting.

- What is a stock split, and how will it affect the stock price?

A stock split means that a listed company divides a share into several shares.

A stock split usually occurs when the stock price is too high, and a reverse stock split may be performed when the stock price is too low.

The stock split will not change the total value and proportion of shares held by shareholders, and the company's market capitalization will remain unchanged. But this will lower the stock price, make the stock more affordable and improve the stock's liquidity.

A split may lead to a rise in the share price, but there is no guarantee. The stock price performance of different companies may be different.

Tesla is certainly a blockbuster for the Streets and investors with many loyal fans. In Tesla's case, the herd effect may be in effect.

A potential split would bring more retail money into the most sought-after stock, many of whom would invest in Tesla because of their beliefs.

A potential split would bring more retail money into the most sought-after stock, many of whom would invest in Tesla because of their beliefs.

In addition to market sentiment based on past performance, record gas prices are driving more people to electric vehicles and Tesla is one of the beneficiaries

- Insights on the Street

Emmanuel Rosner from Deutsche Bank reiterated a Buy rating on Tesla, with a price target of $1200.00. The company's shares closed last Monday at $1091.84.

In a March 21 report, Wedbush also maintained a Buy rating on the stock with a $1,400.00 price target.

It's really just adding excitement to its name.

We have the stock ranked buy, so we're optimistic on its performance in the coming 12 months. By the company splitting its shares and introducing its dividend, will now broaden its appeal to income oriented investors.”

—— Sam Stovall, chief investment strategist at CFRA

Tesla's desire to pursue a stock split doesn't change the fact that its stock is still trading at a valuation completely disconnected from fundamentals.

A Tesla stock split would dramatically reduce the price of Tesla’s stock, which would make it even more attractive to unsuspecting retail investors. This could further fuel the bubble in Tesla’s stock that has been brewing over the past two years.

—— David Trainer, CEO of New Constructs

You might also like:

How do analysts think about Tesla's stock split plan?

What is a Stock Split?

For more investment knowledge and trends, moomoo Learn is always here.

How do analysts think about Tesla's stock split plan?

What is a Stock Split?

For more investment knowledge and trends, moomoo Learn is always here.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Talklili : The split brings a great opportunity to Tesla, which means that it will generate more cooperation and, of course, have the effect of a booster.

Giovanni Ayala : Guasap Elon Musk I'm waiting for you too Sponsor me

102746587 : it split to how many?

Milk The Cow : Omg after reading I realised how conservative I'm.

I realised how conservative I'm.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

WTH...

"Wedbush also maintained a Buy rating on the stock with a $1,400.00 price target."

Milk The Cow 102746587 : We don't know.

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) .

.

Assuming TP 1400 USD, I guess about 3-5 :1

I mentioned before that it's under progressing for stock split as a warning to newbie investors.

(Practice precaution/ DCA)

You need knows what is going on, the facts.

Don't get me wrong, I bullish on $Tesla (TSLA.US)$ .

Having that said, I also believe a split is possible but I never expect it so soon

Not going deep into the reason why.

Moomoo Learn OP 102746587 : No further info for now. More need wait for company announcement.

CraCra665 : mo $$$ fo sure it was a good call in my mind. a very good move. time for those who invest to tally up.

eksp2 :

Wafelwood : This is a classic pump then dump trade. The reduced cost per share will always give a boost to the stock price initially but since it has no bearing on the company fundamentals the stock price jump will be short lived.

富贵健康 : When the stock is broken up, the small loose people can afford to buy it, and the liquidity of the stock becomes flexible, which will boost the stock price, just like last time.

View more comments...