After the Election, How Will Trump's Red Sweep Transform the Market?

As Donald Trump was elected as the 47th President of the United States, the Republican Party also seized control of the Senate. Meanwhile, the latest election dynamics indicate a high probability that the Republicans will take the House of Representatives.

The Red Sweep will clear obstacles for Trump to rapidly advance his policy agenda. For instance, Trump's policy to cancel the Most Favored Nation status would be implemented through measures like the "Reciprocal Trade Act," which requires the approval of Congress, thus necessitating a "unified government." The policy changes in the White House are expected to impact global asset prices.

▶ Decoding the historical experience of "Trump trades"

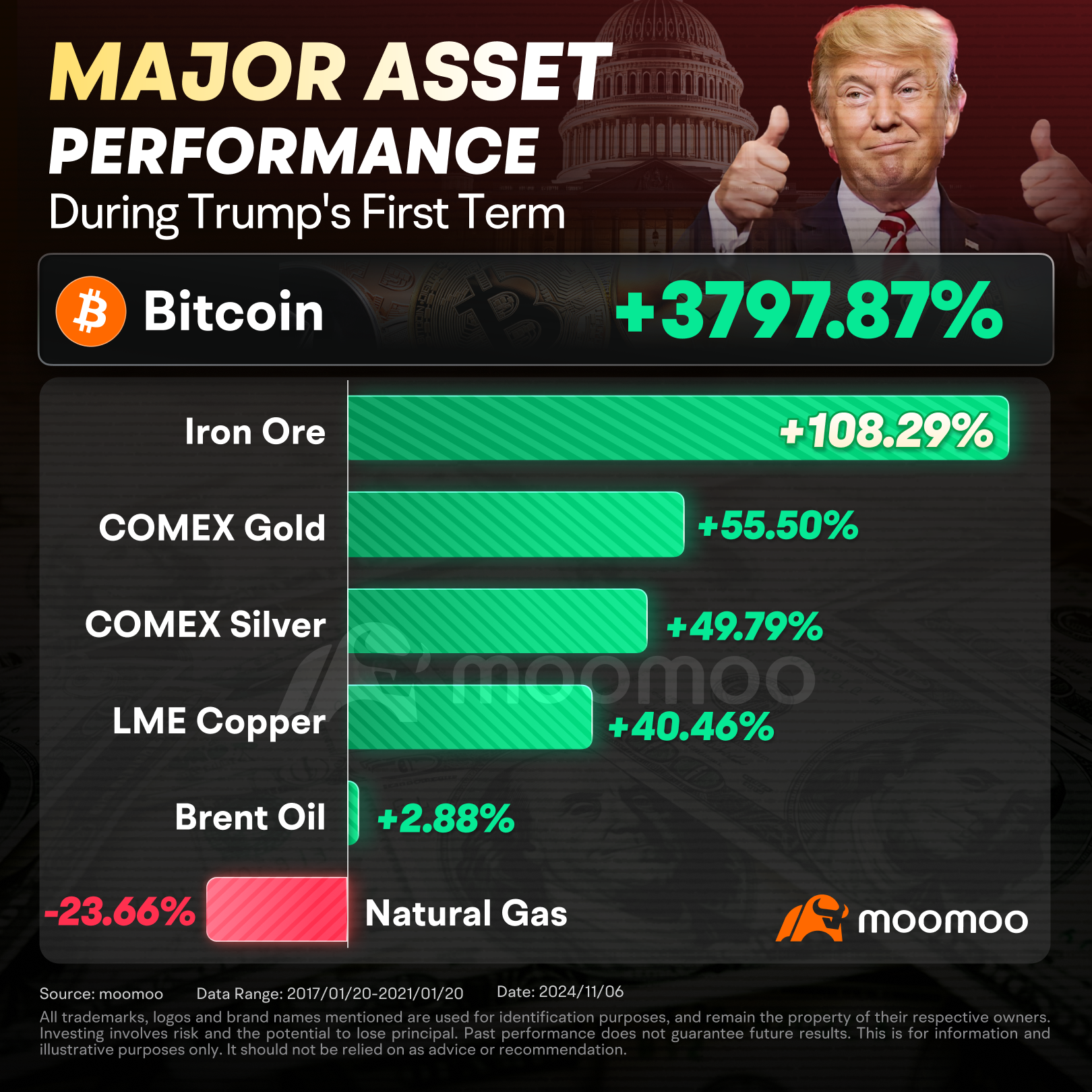

Different asset classes are affected to varying degrees by Trump's policies. Bitcoin increased 37-fold during Trump's previous term. For global stock markets, India, the U.S., and Vietnam outperformed other national stock markets. Within the U.S. stock market, the information sector performed the best, while the energy sector performed the worst. However, the stock market experienced various phases of rises and falls during Trump's first term.

1. 2017 Q2 to year-end: The "Goldilocks" period. USD weakened, US Treasury yields decreased, and risk assets performed well, with non-US markets and tech stocks standing out in equity markets.

2. 2018 Q2 to year-end: The "nightmare" for risk assets. Triple pressure from economic slowdown, monetary tightening, and trade frictions. Only some defensive sectors showed positive returns.

3. March to July 2019: Easing monetary policy mitigated trade risks. Assets showed clear characteristics of rate cuts and risk aversion. Long-duration bonds, gold, technology, consumer discretionary, and real estate stocks (interest rate-sensitive) all performed well. Under trade risks, European stocks outperformed EM.

4. August to December 2019: Economic stabilization and decreased trade risks. Market sentiment gradually became less sensitive to trade risks, while monetary easing remained a crucial factor. A notable catch-up rally occurred, with previously declining emerging market stocks showing significant recovery.

▶ A "red sweep" has had a greater boost to the stock market than a split government

"Unified government" is more favorable for U.S. stocks than "divided government." Since the 1950s, the election years featuring a "Republican President with a unified Congress" include 1952, 2004, and 2016; in these three years, U.S. stocks recorded gains of over 5% one month after the election. In contrast, in historical scenarios with a "Republican President and a divided Congress," U.S. stock performance showed greater divergence. A "divided government" increases the uncertainty of fiscal spending, especially in years when the debt ceiling is triggered, significantly raising the risk of economic downturn.

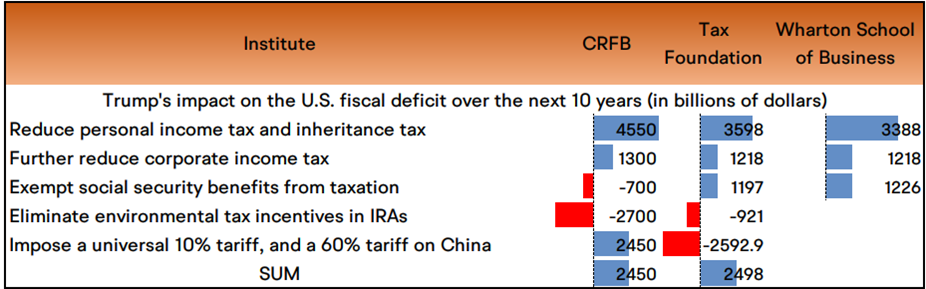

▶ Trump's policies may result in a deficit increase of over 2 trillion between 2026 and 2035

According to the Tax Foundation, the Wharton School of Business, and the Committee for a Responsible Federal Budget (CFRB), the tariffs increased by Trump are unlikely to offset the impact of tax cuts. If a global tariff of 10% and a 60% tariff on China are implemented, the estimated increase in tax revenue over the future would be 2.7 trillion. However, reducing personal income tax and corporate tax would result in a loss of over 5 trillion in revenue for the U.S. Treasury over the next 10 years. Therefore, in a neutral scenario, there could be an accumulated increase of 2.45 trillion in the fiscal deficit over a decade.

▶ How do tariffs affect the U.S. economy?

Trade conflicts during Trump's last term impacted U.S. production, investment, and consumption. Tariffs took effect in July 2018, after which the U.S. industrial production index, intentions for manufacturing capital expenditures, and the growth rate of real personal consumption turned downward.

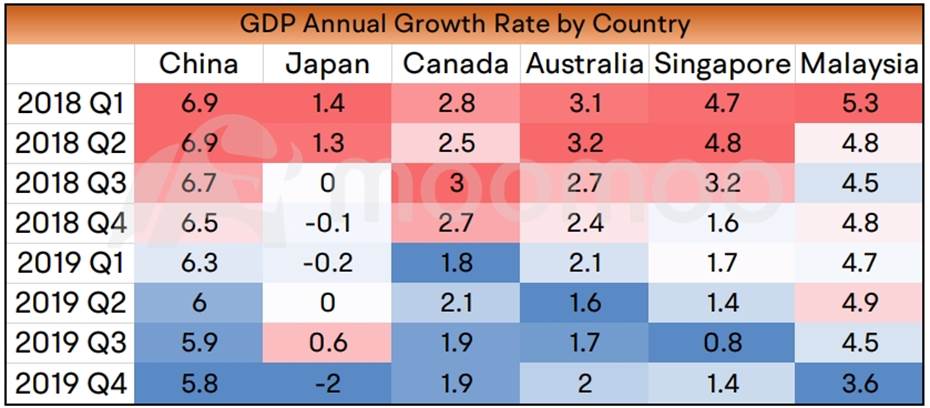

However, imposing tariffs enhanced the "comparative advantage" of the U.S. economy. From the second half of 2018 to 2019, the actual GDP growth of major economies in the Asia-Pacific region slowed down.

▶ Estimated pace of Trump's policies: first cut taxes, then raise tariffs

1. If Trump imposes tariffs using Sections 301/232, no Congressional vote is required; the President and the Cabinet have the authority to decide, making it highly likely to be implemented. However, if the President wishes to terminate Permanent Normal Trade Relations (PNTR) or revoke Most Favored Nation (MFN) status, a Congressional vote is needed, which makes it difficult to pass and less likely to be implemented.

2. Under the scenario of a "Trump + Unified Congress," pushing a new tax cut bill will be a focus for Trump in 2025, as he might lose control of Congress after the midterm elections. Therefore, Trump might delay initiating tariff policies that do not require a Congressional vote (except for changes to MFN status, which do require a Congressional vote).

3. If tariffs are to be imposed through a "Section 301 investigation," the process from initiating the investigation to the enforcement of tariffs takes about six months to a year. In the U.S., a "Section 301 investigation" begins with the President submitting a petition to the Office of the U.S. Trade Representative (USTR), which has 45 days to decide whether to initiate an investigation. Once it is deemed appropriate, the investigation must be completed and results issued within 12 months, followed by punitive actions within 30 days. Referring to the timeline of trade events from 2018 to 2019, it took nearly 11 months from the start of the investigation to the implementation of tariffs.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Jean L Marc : Everything changes in the world market when selecting a new president with different priorities, ideas, and agendas

葡萄山 : Trump himself is not the most outstanding leader, this depends on whether the people he hires are outstanding enough to pave the way for him and break through obstacles.

71732910 : Hopefully he can keep his mouth shut this time and do what has to be done for EVERYONE!

Z00Moo : The people have spoken. Capitalism was saved by electing Mr. Trump. Congratulations.

GingleCash : Simply put…He will save the republic. Bringing oil, industry and manufacturing back to a lucrative America!

francis kowalski Z00Moo : agree

francis kowalski 71732910 : you got that right

72655922 : hey.. Haters head for the border before he closes it..

och88och 71732910 : Leopard never changes its spots

och88och GingleCash : Good luck. Self help better . Manufacturing jobs as America knows it in the past

View more comments...