AI as "Artificial Inflation"

Finance people like data. Data that is factual, non-faked, auditable and verifiable from multiple angles. Data scientists like data: data that is accurate, sortable (author is a fan of "exportable to CSV"), and without ads or paywalls. For most businesses that operate in jurisdictions of governments, the government is responsible for using its collection of tax dollars to publish "without favoritism for any State, private or publicly-traded entity" ALL of the taxpayer-funded data without ads or paywalls. The entities that publish data with various iterations of sortable, or as "data mashups" don't necessarily have to have ads or paywalls, though many do. The barrier to entry on starting any online business with public data is very low.

Many people can do their own research and avoid paywalls and advertisement-funded sites entirely.

And thus we arrive at today's Acronym Inception AI™️: AI as Artificial Inflation.

AI as "Artificial Inflation"

Where quality investors and ethical data scientists discover faked or "Artificially Inflated" metrics or data in their due diligence, they often feel obligations to warn other people (vulnerable populations) that could be scammed when misled by the faked data. Examples include: older / aging people whose eyesight is "not as good as it used to be", and they missed the fine print and clicked on that ad instead of the `.gov` site. Young people whose brains are not yet fully developed are another vulnerable population; brains continue to grow and remap neural pathways out of youthful mistakes most actively until about 26-27 years of life.

Dr. Angeline Stanislaus is the Chief Medical Officer for the Missouri Department of Mental Health. She says that, while it may seem like an 18, 20, or 22-year-old is able to make adult decisions, they are not developmentally ready just yet. This is because the brain’s frontal lobe, especially the prefrontal cortex, isn’t fully mature until around age 25.

Investors should be especially careful about trusting immature companies whose neural pathways are nowhere near halfway to maturity.

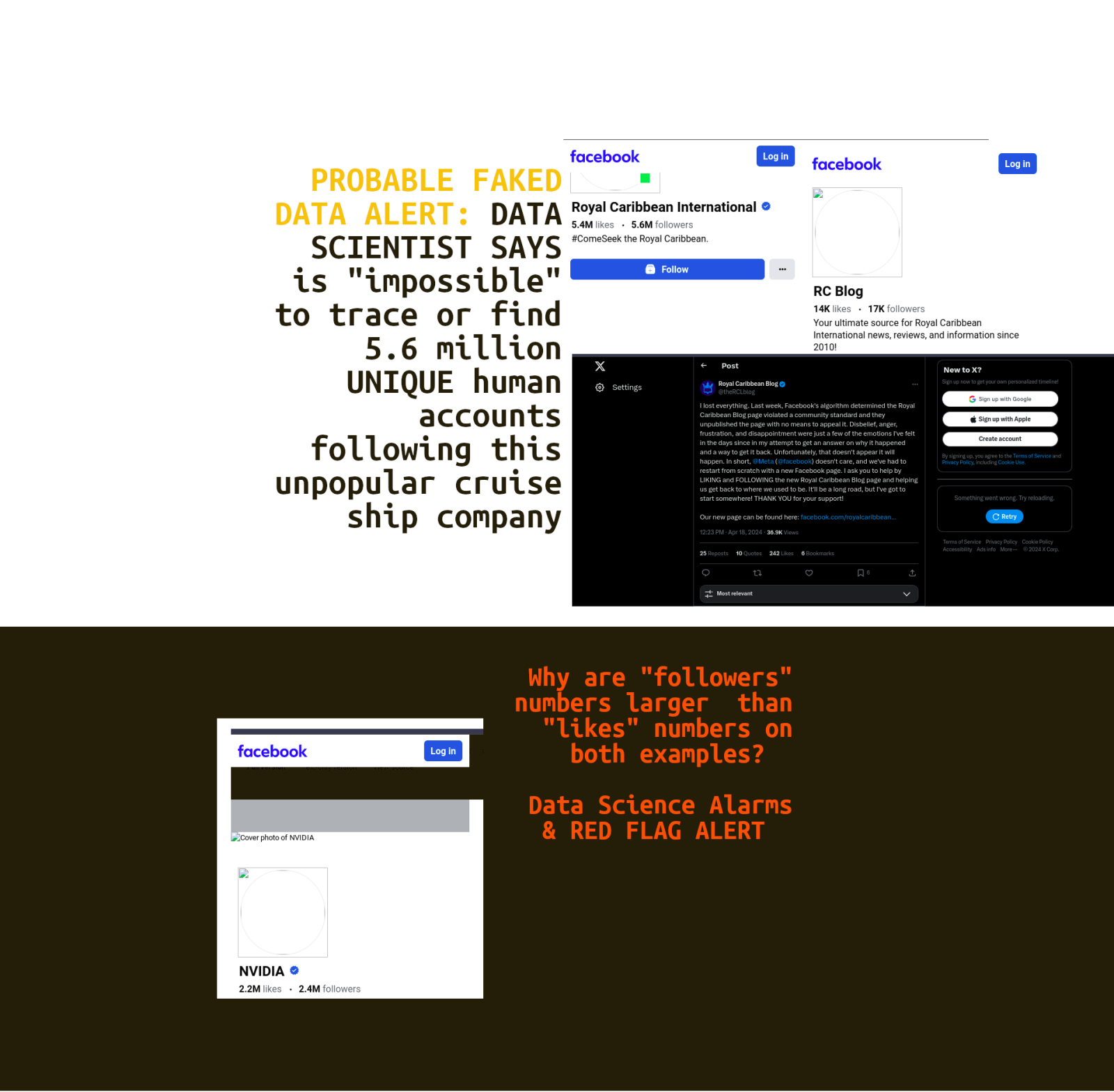

Faked followers counts often indicate fraudulent financial accounting

"And it's almost never worth it trying to make it work with a narcissist". In haste to grow up his company too quickly, college dropout CEO -- whose résumé had one and only one bullet point of experience when he became CEO: "experience buying whatever he wants" -- he hit a bit of a spat. As it turns out, people do not "like" being used to fund criminals seeking to avoid criminal penalties for fraudulent financial accounting:

Over 28 million people filed a class action, and there was a tsumani-like wave where 90 percent of the smart people I know quit Facebook when it was "leaked" that the college dropout CEO abused the trust-based relationship with everybody that ever went near his company.

The administrator in charge of vetting claims has received more than 28 million applications for a payment, said Lesley Weaver, co-lead counsel for the plaintiffs in the case. "As far as we can tell that’s the largest number of claims ever filed in a class action in the United States,” Weaver said.

I mentioned in Documentation is exquisite how I was one of those people who, in 2021, deleted her account, published in multiple places proof I deleted my account, and is owed a payout -- a PAYMENT which is STILL MISSING by the way.

A final infographic for your day before you call your 401K broker to Dump college dropout CEO

596 words

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Malik ritduan :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

山芭佬 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Brandon Bennett332 : Guess I never really thought of it like that.