April PCE Price Index Preview: Inflation May Show Positive Developments as Personal Spending Wanes

The Bureau of Economic Analysis will release the Personal Consumption Expenditure and the price index at 8:30 ET on Friday. Bloomberg economist Stuart Paul noted the Federal Reserve's preferred indicator may signal "encouraging progress" as consumer spending decelerates.

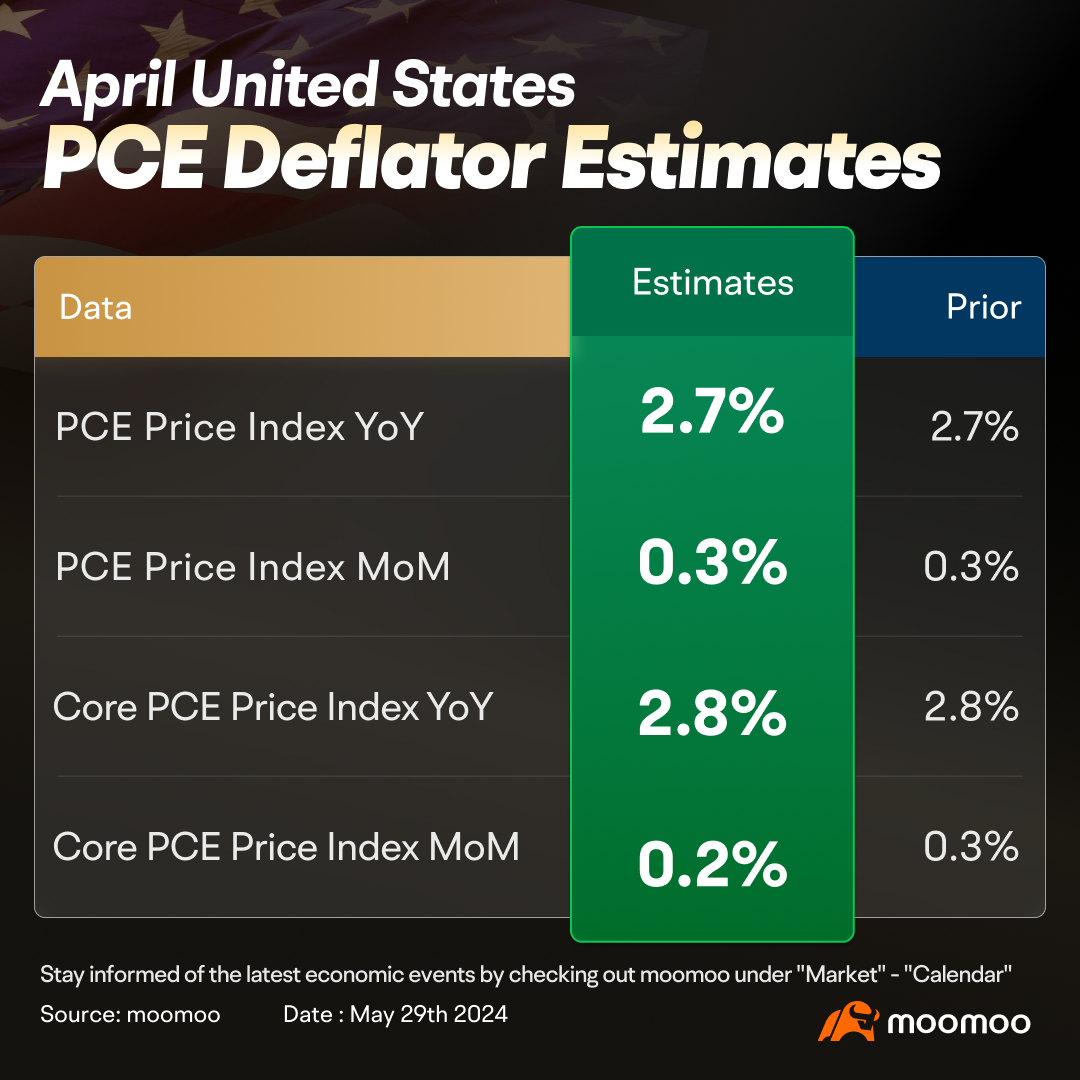

The monthly increase in PCE inflation is projected to remain at 0.3%, which would keep the annual headline inflation rate at 2.7%. Core PCE inflation will likely come in at a rate of 0.2% (down from 0.3%); on an annualized basis, the index is expected to remain unchanged or decline slightly.

Employment growth is cooling, and consumers are exercising more caution, factors that are expected to contribute to a continued trend of disinflation in the near future. Nevertheless, the pace of disinflation is advancing slowly, suggesting that the Federal Reserve may need more time before it feels confident enough to lower interest rates.

■ Core services inflation is anticipated to alleviate

Stuart Paul noted that the most significant drop is expected to be in the core services sector, excluding housing costs, where the rate of inflation is likely to ease to a monthly 0.26% in April (down from 0.39% previously).

The anticipated deceleration is thought to stem largely from a significant fall in the fluctuating costs of air travel. When comparing April 2024 prices versus April 2023, U.S. airfares are down 5.8%.

Prices for lodging away from home — including hotels and motels in U.S. cities — increased 1% month-over-month, though they are slightly down from last year, falling by 0.4% versus April 2023.

■ Personal income and spending are likely to cool in April

Looking ahead, the process of disinflation may gain support from a slowing in the rates of both job creation and personal income growth. Economists estimate that the personal income increased by a mere 0.2% or 0.3% in April (a downturn from 0.5% in the prior month), which can be attributed to the reduced pace of hiring.

Consumer behavior is showing signs of slowing down.As income growth slows in response to a cooling employment market, consumers are starting to feel the pinch, which should continue to exert a disinflationary force for the remainder of the year.

Retail sales in the US were unchanged month-over-month in April 2024, following a downwardly revised 0.6% gain in March and defying market forecasts of a 0.4% rise, suggesting consumer spending has slightly eased. 7 out of 13 categories posted declines. Major falls were seen in sales at nonstore retailers (-1.2%), sporting goods, hobby, musical instrument, & book stores (-0.9%), motor vehicles & parts dealers (-0.8%), and furniture stores (-0.5%). On the other hand, sales were up at gasoline stations (3.1%), and electronics and appliances stores (1.5%).

Accordingly, the growth rate of personal spending is expected to slow down to 0.4% (from the previous 0.8%).

■ Residential costs stabilized in April but could tick up in H2

Zumper National Rent Report unveiled this week showed rents were nearly unchanged in recent months but started to rise since May, marking the first time that monthly growth rates of over 1% since October 2022. Zumper CEO Anthemos Georgiades said, “This notable rise in rent coupled with the current persisting inflation suggests that there will be even more pressure put on the CPI and PCE in the coming months.”

■ What's the implication for the Fed?

In essence, the April PCE report may provide some encouraging signs that the disinflationprocess has not completelycome to a halt,although any moderation in inflation is expected to be a gradual process throughout the year.

The CME FedWatch tools showed that the probability of a rate cut in September is lower than a month ago, but the probability of a rate cut in November is greater than a month ago.

Even though the PCE results might not be low enough to convince the Fed to cut rates soon, they may still inject confidence into the market at this stage, as reversal may occur after inflation constantly exceeded expectations from January to March.

Source: CME, Bureau of Labor Statistics, Bloomberg, Zumper

By Moomoo US Team Calvin

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

affable Blobfish_403 : As long as the data is real, then it is worth referring to.