As long as you have growth potential, Wall Street is willing to give you a high valuation, and never stingy.

High-tech innovative companies tend to be born in the USA, and there is a reason for this.

Is NVDA's performance good or not? There is no doubt, of course, it's good!

Why did it not rise but fall? In plain terms, it's because Wall Street's valuation system believes that in the short term, NVDA's profit potential has already been basically uncovered, and its growth is not as good as Tesla's.

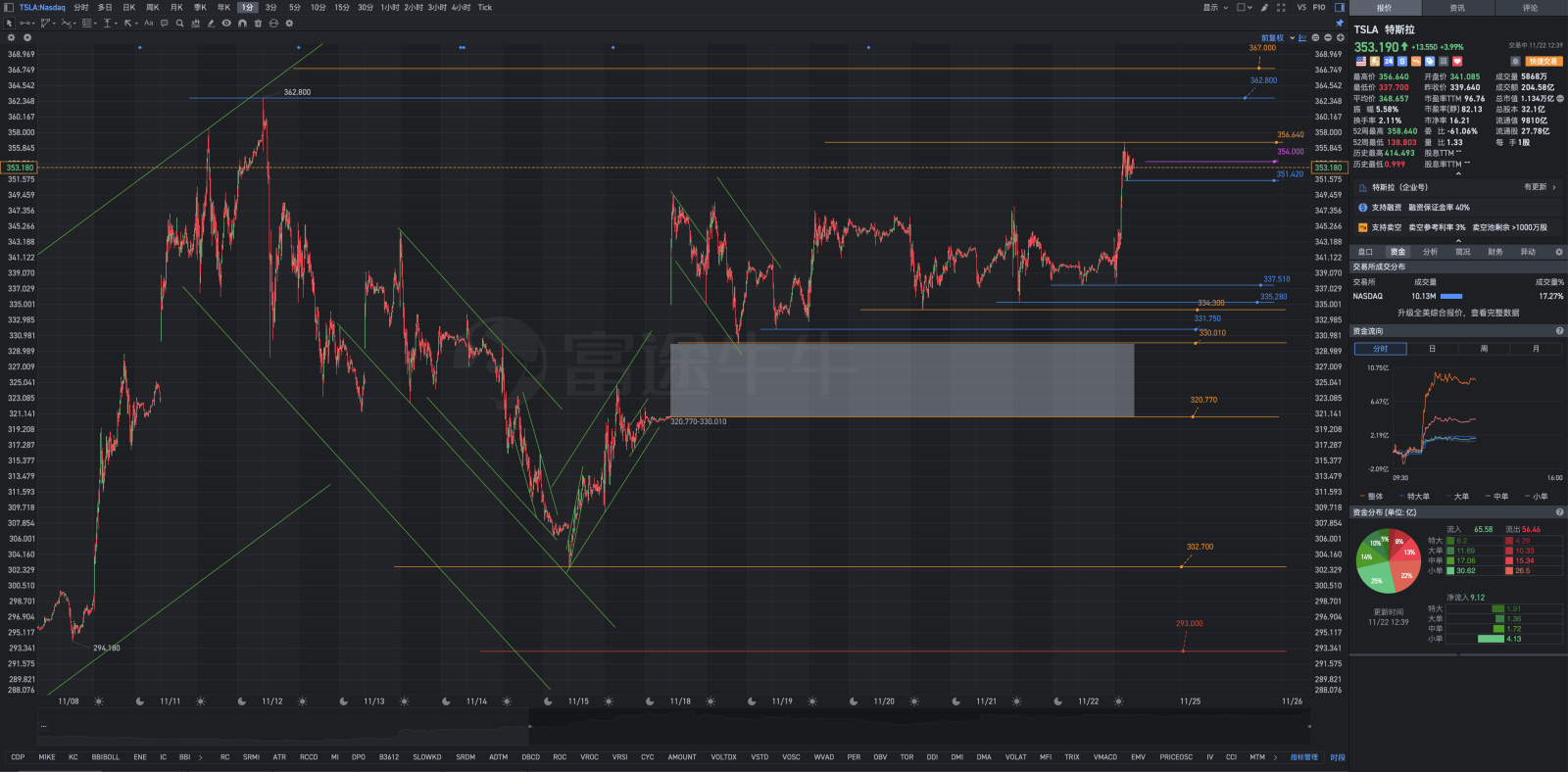

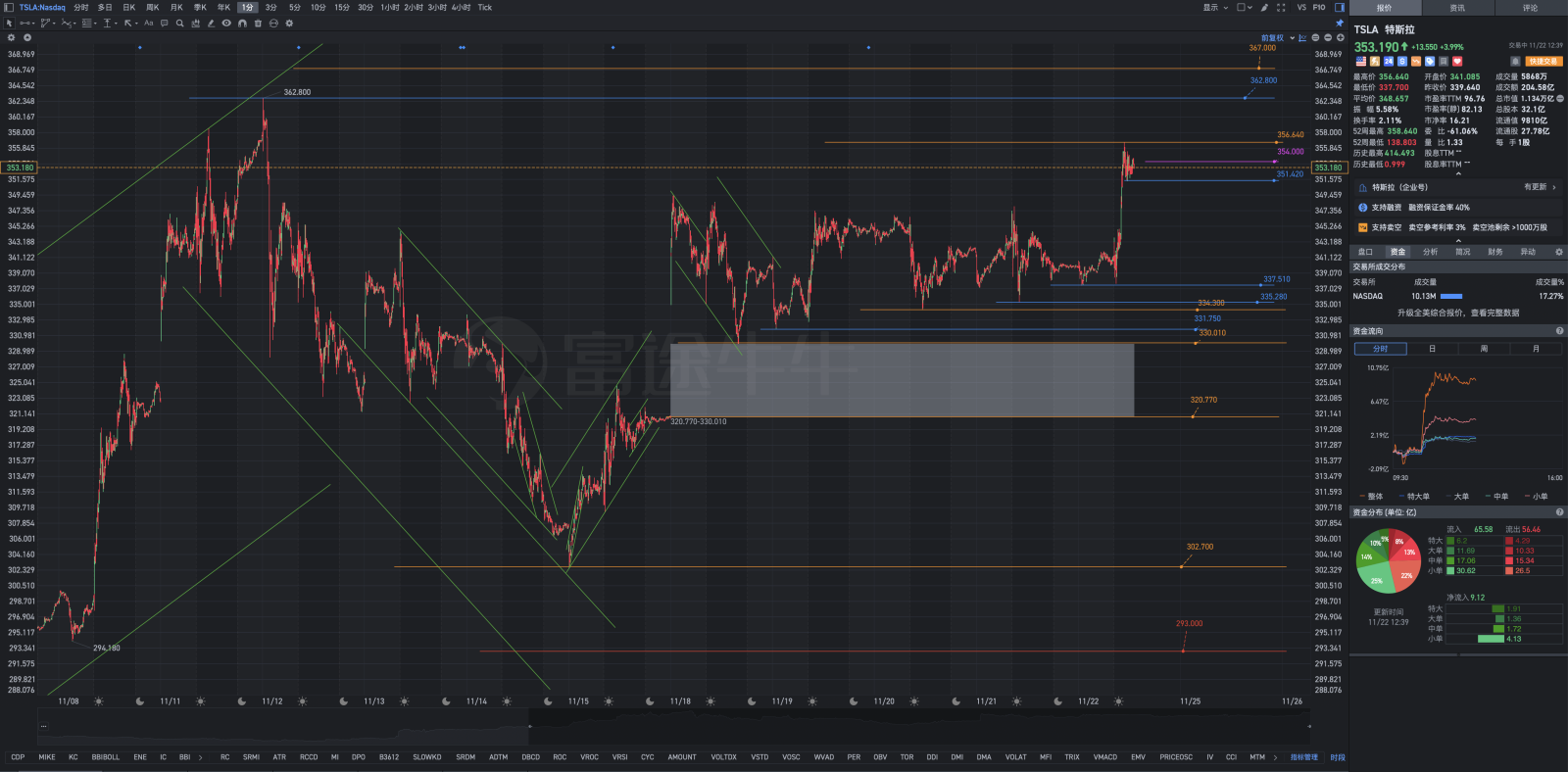

By establishing a dedicated Baum-Welch algorithm model and Hidden Markov model specifically for Tesla, quantitative analysis can be conducted: The foreseeable target for Tesla in the short term is 457.50. (For reference only, if you have always despised quantitative analysis and cannot accept Tesla, you can completely ignore it, treat it as a joke, it's all fine, I Do Not Care.)

CEO Elon Musk of Tesla introduced the pricing vision of its Optimus siasun robot&automation and Robotaxi smart driverless rental car on social media X, claiming that Tesla is currently working hard to provide corresponding products to consumers at a low price.

Musk said Tesla's Optimus robot / Robotaxi taxi is priced at 0.02-0.03 million dollars, but it must ensure an annual output of over 1 million units.

Musk claims that Optimus will be priced at 0.02 million to 0.03 million US dollars, while the selling price of Robotaxi is also around 0.03 million US dollars (currently about 0.217 million Chinese yuan). These two products are expected to be officially launched to consumers within 2 years, but may also be delayed to 2027 or even 2030 depending on specific circumstances.

The valuation systems of large institutions on Wall Street are complex and multi-dimensional, as well as very discerning. For high-tech growth companies, as long as you have growth potential, they are willing to give you a high valuation without hesitation. Therefore, a very high PE ratio is often the standard allocation for these companies.

Focusing too much on short-term gains, short-term trend returns, and short-term profit margins is an important watershed for measuring whether Wall Street is made up of heroes or clowns.

Similarly, people have short-sighted views, they like rising and dislike falling, only caring about short-term trends and arbitrage of short-term trends, using the short-term trend of buying stocks as the sole criterion to measure the correctness of investment trades. It is destined to have difficulty making significant achievements in the financial markets.

The founder of Renaissance Technologies LLC, James Harris Simons, is often quoted as saying that the success of his company is mainly based on statistics and probability. This statement indeed reflects the quantitative methods used in the company's trading strategies.

Renaissance Technologies LLC, especially through its Medallion Fund, uses complex mathematical models and algorithms to analyze a large amount of data, identify patterns, and predict market trends. The emphasis on statistics and probability highlights the company's reliance on empirical data and quantitative analysis, rather than traditional fundamental analysis.

Although Simons' statement may seem simple, it summarizes a complex reality, where advanced statistical techniques, machine learning, and probability theory play a crucial role in devising trading strategies. The success of Renaissance Technologies LLC proves the effectiveness of this approach, as they have consistently outperformed the market over the years.

In summary, Simons speaks plainly, but the methods behind it are very complex, involving not only basic statistics and probability.

Core Tips🔔Principles of increasing shareholding and expanding stocks: transitioning from electric auto manufacturers to Artificial Intelligence deep development application companies.Artificial Intelligence deep development application company+Energy storage company+Self-driving FSD+RoboTaxis (siasun robot&automation) software company+Optimus (Optimus Prime) humanoid robot companyThis is led by Elon Musk.Tesla vows to change the world., is alsoBulls believe the world will be changed.You have the right to continue to believe that Elon Musk is making empty promises for the purpose of fundraising. However, once Tesla perfects the self-driving FSD+RoboTaxis software, it will mark the beginning of Tesla's skyrocketing stock price. When you cannot coexist with uncertainty, deny, and reject new emerging entities that are still at a nascent stage, you also forfeit the future. Investors can handle their trades according to their own situations. Manage your stock accounts for investment trades just like Vanguard handles individual retirement accounts (IRAs) and 401(k) fund accounts. Eventually, the consequences of enjoying rallies and chasing highs will emerge. Having slightly over 60% long positions, there is no need to be anxious about stock price increases. Going all in is a completely different matter and very unwise; a person without long-term planning and who does not prioritize the psychological health of investment trading will not go far. Even if Tesla has the potential to challenge the range of 271.000–299.290–314.800, or even the higher range of 414.490–515.000, you won't be able to hold on to the chips that could have brought you greater returns.

Buy on dips and declines, systematically and gradually, in stages, with a discrete random variable approach for position building.

Operate your USA stocks account like Vanguard does, instead of gambling recklessly and impulsively.

The most important and core thing is to overcome the torment of time and space, especially in large downward fluctuations, with unwavering faith. This is where the difference between stock market heroes and clowns lies.

Market clown: When stock prices rise, buy quickly, buy buy buy; when stock prices fall, sell quickly, run run run.

Founded in 1975, The Vanguard Group is known in history for its indexing investment and contrarian investment style. It issued the world's first index fund tracking the S&P500 index, as well as being the largest mutual fund provider and the second-largest exchange-traded fund (ETF) provider globally. It is the operator of the US government-designated Individual Retirement Account (IRA) and the famous 401(K) account. Besides Elon Musk, it is Tesla's largest shareholder and is known as the first compass of Wall Street.

The Vanguard Group is the world's largest no-fee mutual fund family, managing over $3.7 trillion in assets worldwide, serving more than 10 million investors. The company now provides competitively designed investment management, a variety of fund products, and minimal fund operating expenses for its growing customer cohort.

Short-term (high probability event will be achieved within the year)

Advance to the first target 354.000;

Advance to the second target 367.000;

What are the main tools of the relatively accurate framework for investing and trading weapon libraries, both soft and hard?

1. Baum-Welch algorithm model. Requires improvement and practical application.

2. Hidden Markov model. Requires improvement and practical application.

3. Quantitative calculation of the differential geometric trajectory equation of the profit chip ratio function.

4. Setting of parameters (also called variable parameters), and how to make correct and reasonable choices within a relatively reasonable range when quantification is not possible.

5. Deep understanding of the original weaknesses of human nature as mentioned by God in the Bible – greed and fear, the ability to interpret the human nature and psychology behind key candlestick patterns in key candlestick charts (not quantifiable).

Choose symbols worthy of ownership and investment with long-term upward trends.

Trust stocks for investment, do not invest in doubtful stocks.

In most cases, giving timely help is more important and meaningful than adding beauty to the already beautiful.

Holding stocks for a big rise: Billionaire Ronald Stephen Baron predicts that Tesla's future price will increase sixfold, rising to $1500!

The most important and core thing is to overcome the trials of time and space in major fluctuations, especially in significant downward movements, with unwavering beliefs.

Adding positions: buy on declines, not on rallies; reducing positions: sell on rallies, not on declines.

Buy on dips and declines, systematically and gradually, in stages, with a discrete random variable approach for position building.

Establish a defensive fund and a deep fall repurchase fund;

More than 60% of the positions are used for medium to long-term value investments;

Not more than 30% of the positions are used for short-term trend air combat;

With investment as the main focus, and trading as the secondary, a surgical and relatively accurate framework investment trading approach.

If you study theoretical physics, you will know that the projects under Elon Musk are not only a complete Artificial Intelligence industry chain, but also almost all involve a higher level dominant industry of the next 30-50 years—quantum technology revolution.

If you are studying applied mathematics, you can understand that this listed company has extraordinary actions and lofty goals through function-level quantitative analysis. It is far from what you can see now and imagine. The crux of the problem lies in the fact that the range of variables that can be set is too large. If you cannot coexist with uncertainty, deny, and refuse the emerging things still in a vague stage, you will also lose your future.

Investment trading arbitrage ultimately depends on the results, isn't it? When you look at it from a lifelong perspective, what you see is the era and human nature, and what you see is the law.

When you look at it from a ten-year perspective, what you see is common sense and rule changes.

When you look at it from a three-year or five-year perspective, what you see is courage and foresight.

When you look at it from a one-year perspective, you will believe in talent and ability.

If you look at it from a daily perspective and you don't have a background in theoretical physics and applied mathematics, you are likely to see nothing and only rely on miracles and luck.

When you look at it from a ten-year perspective, what you see is common sense and rule changes.

When you look at it from a three-year or five-year perspective, what you see is courage and foresight.

When you look at it from a one-year perspective, you will believe in talent and ability.

If you look at it from a daily perspective and you don't have a background in theoretical physics and applied mathematics, you are likely to see nothing and only rely on miracles and luck.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment