Berkshire Hathaway's Conviction on Apple Tested as Investors Look to Earnings

$Berkshire Hathaway-A (BRK.A.US)$ is due to report first quarter results Saturday, opening a window into the financial performance of the conglomerate led by billionaire Warren Buffett -- and potentially an update on its investment portfolio that's closely watched by investors seeking to replicate its success.

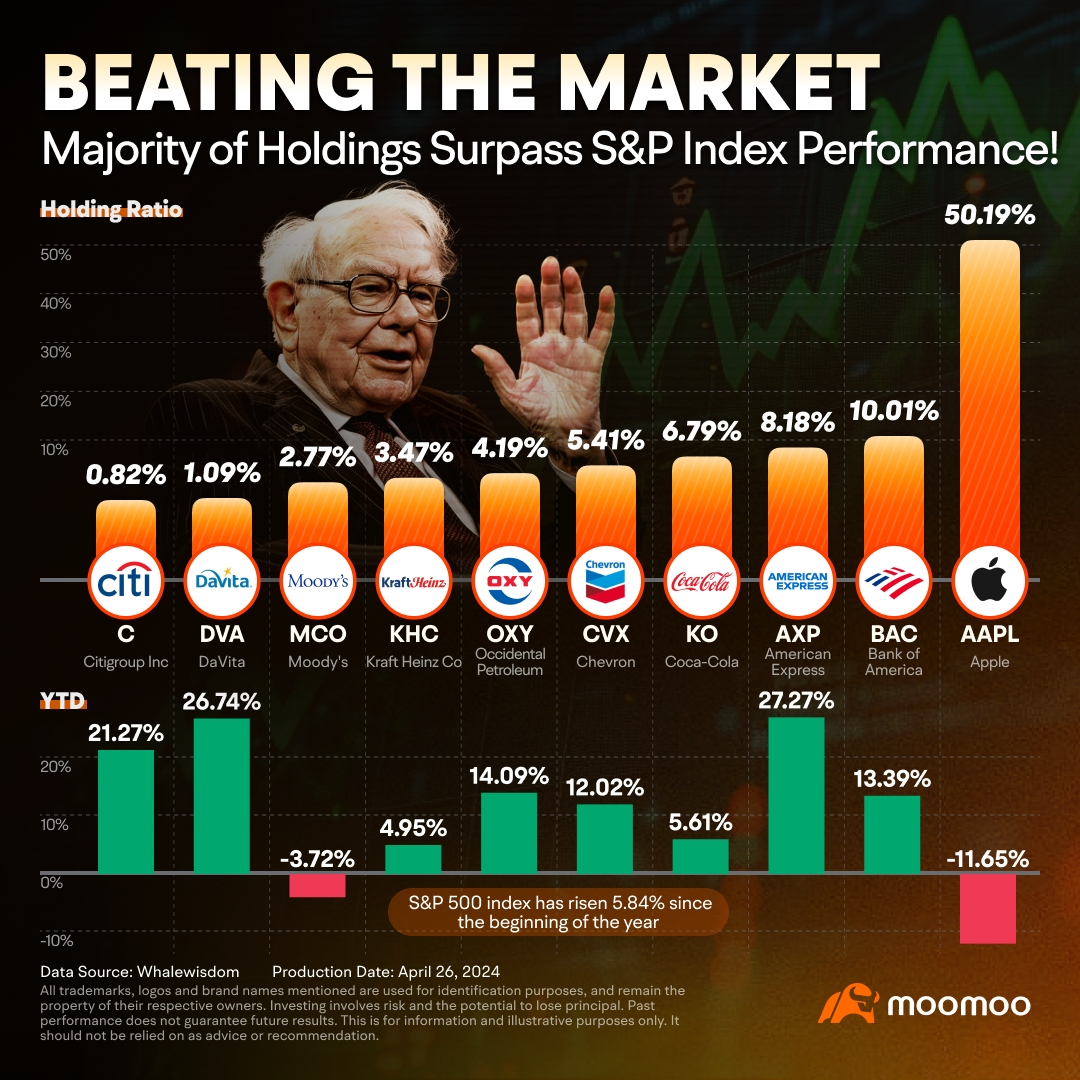

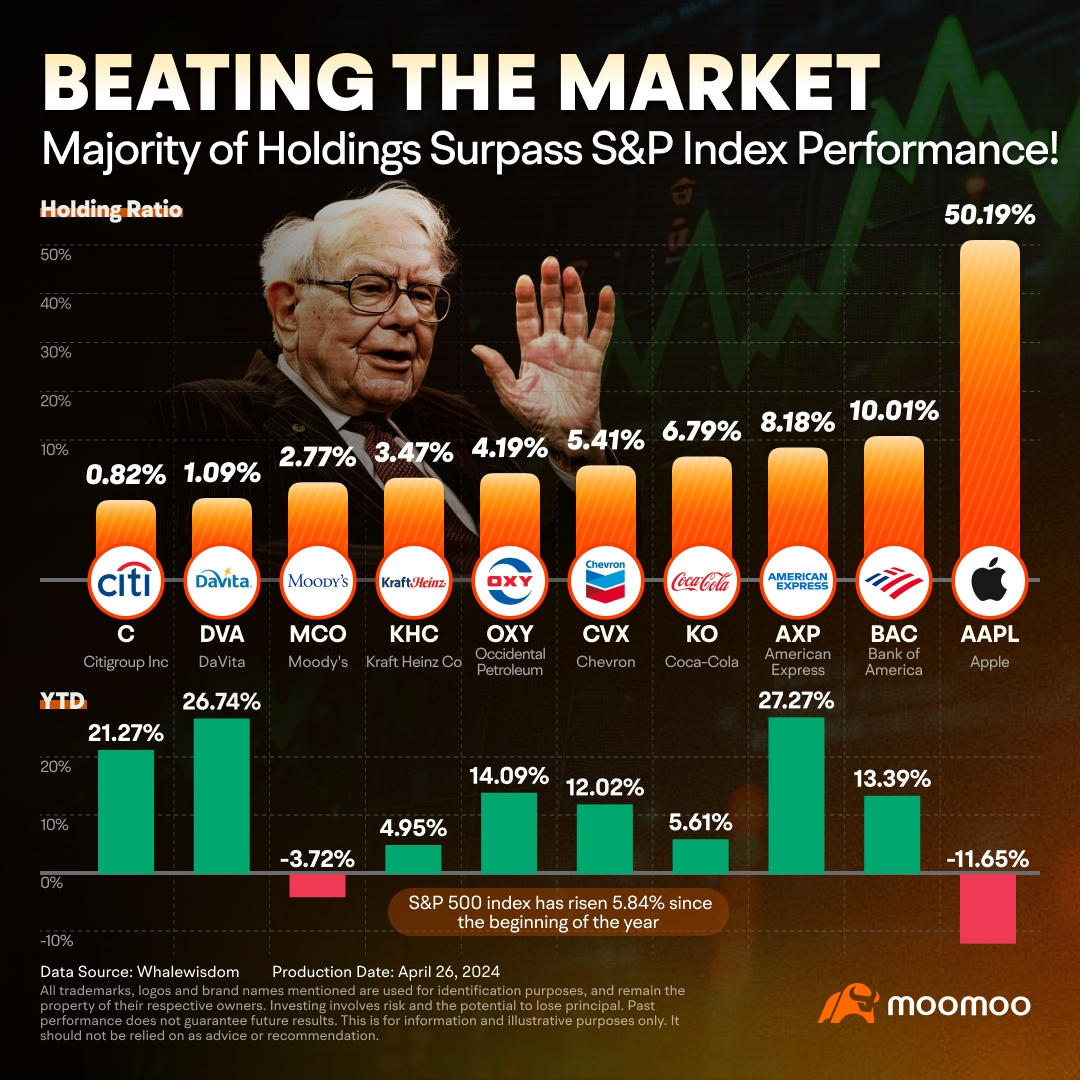

Investors could also be looking for clues whether $Apple (AAPL.US)$'s recent share slump has shaken the confidence of the iPhone maker's third-largest shareholder. Berkshire owned more than 905 million Apple shares as of Dec. 31, according to its 13F filing with the Securities and Exchange Commission. Only Vanguard Group and BlackRock hold bigger stakes in Apple than the Buffett-led conglomerate, according to 13F filings compiled by moomoo.

Apple shares tumbled on April 19 to as low as $164.07, the lowest level April 2023 before rebounding. After the market closed on Thursday, the iPhone maker reported better-than-expected earnings and revenue, announced a record stock buyback and boosted dividend, sending shares climbing 6.6%.

On average, the company is expected to post a 24% jump in adjusted earnings to $6,871.85 per class A shares in the quarter ended March 31, according to estimates compiled by Bloomberg as of April 22. Revenue is seen rising 0.6% to $85.9 billion, the estimates show.

Geico is expected by Bloomberg Intelligence analysts to remain a key capital engine for $Berkshire Hathaway-B (BRK.B.US)$. The insurance subsidiary's premiums earned are forecast to rise 6.35% to $10.2 billion in the first quarter, estimates compiled by Bloomberg showed.

As of Dec. 31, Berkshire had a record cash pile of about $167 billion, according to its filing with the SEC. Buffett's shareholder letter expected to be released along with its earnings results could signal if the conglomerate has deployed its cash to add to its investment portfolio.

Disclaimer: This article is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See this link for more information.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

FIRE Keith : In fact, Berkshire has been reducing its Apple position since the last quarter.