Buy-Rated Stocks to Watch Amid Utilities Selloff and Transition to Renewable Energy

Despite low valuations and solid return prospects, utility stocks have fallen out of favor with risk-seeking investors. This is due to a climb in bond yields and an improving economic outlook, which has made the argument for holding utilities less compelling.

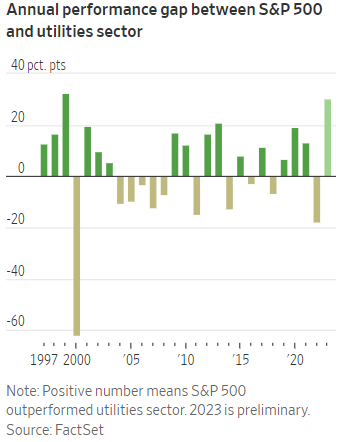

As a result, the sector is down 13% in 2023 compared to the $S&P 500 Index (.SPX.US)$'s gain of 16%, putting utility stocks on track to underperform the market by the most since 1999, when technology stocks were surging.

That dynamic swiftly reversed with the bursting of the tech bubble. The utilities sector soared 52% in 2000, while the S&P 500 fell 10%.

Valuations are currently below their 10-year average, with utility stocks trading at 15.9 times their expected earnings over the next 12 months, according to FactSet. In contrast, the S&P 500 is trading at 19 times its projected earnings, above its 10-year average.

Valuations might be reason enough to wade into the sector, but utilities offer growth. It all starts with the "rate base," a utility provider's value of property used in providing service.

The growth of the rate base is a crucial factor in the utility sector. Regulations limit utilities to a narrow range of returns on assets, but by increasing their asset base, utilities can also increase their earnings. States generally allow utilities to earn up to 10% return on equity, which enables them to raise prices if returns fall below that level. As a result,earnings are expected to grow at a rate close to that of assets, or roughly 8% annually.

If this profit growth materializes, dividend growth should follow suit.

Entergy, for example, could benefit from the earnings and dividend growth to go along with its rate base increases. Analysts expect Entergy's earnings and dividends per share to grow at 7% and 5% annually.

With the rapid adoption of renewables in the past decade, utilities are entering a new phase as decarbonization enablers, and utility stocks are poised to capitalize on a clean energy future, according to Goldman Sachs.

Here are the utility stocks rated a buy by the bank.

Source: WSJ, CNBC, Barron's

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment