Can Earnings Serve as a Catalyst for Stock Market Momentum?

This week marks the commencement of earnings releases from several tech behemoths, with $Microsoft (MSFT.US)$, $Alphabet-A (GOOGL.US)$ $Alphabet-C (GOOG.US)$, $Meta Platforms (META.US)$, and $Tesla (TSLA.US)$unveiling their earnings results—heralding the onset of the so-called "Magnificent Seven" earnings season, drawing keen investor interest. Nonetheless, analysts are sharply divided over the earnings forecasts for the current quarter.

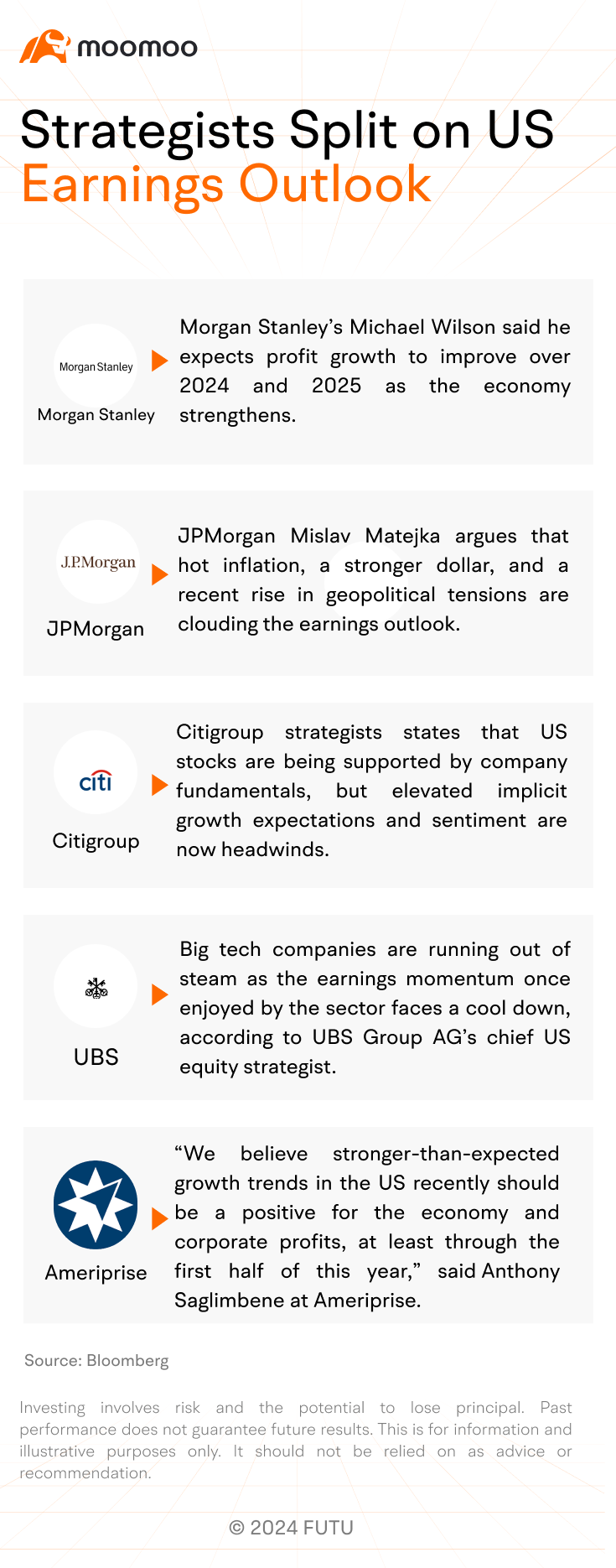

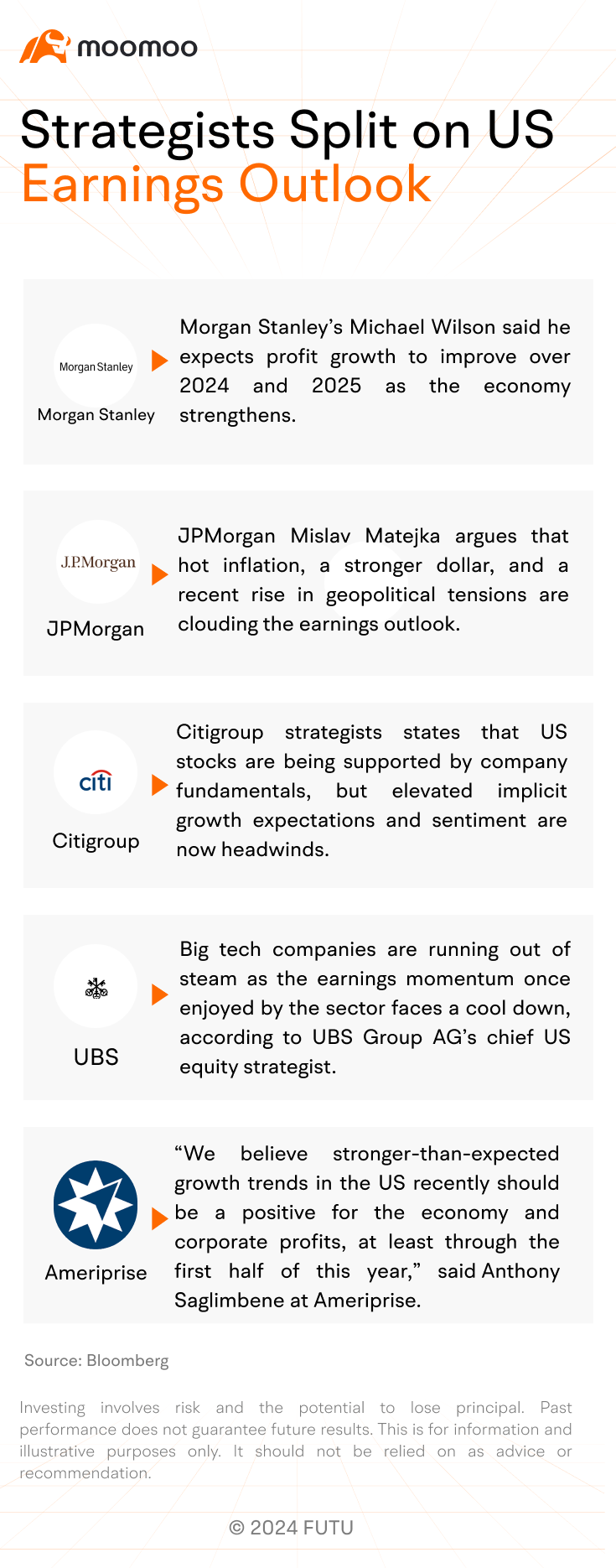

Analysts at UBS are bearish on the profitability prospects for these tech giants. UBS has downgraded its industry rating for the " Big Six" technology equities (Alphabet, Apple, Amazon, Meta, Microsoft, and $NVIDIA (NVDA.US)$) from "Buy" to "Neutral." They indicated,“Earnings momentum is turning decidedly negative following a surge in profit growth.”

JPMorgan strategist Mislav Matejka also posits that earnings estimates might be excessively elevated.“Investors are expecting S&P 500 earnings-per-share to accelerate by almost 20% by the fourth quarter compared to the projected first-quarter levels," Matejka wrote in a note. "That hurdle rate is too steep in our opinion.”

Nevertheless, dissenting perspectives exist. Morgan Stanley's Michael Wilson, while being one of the staunchest bears of 2023, retains a cautiously optimistic outlook. He observes that bolstered by new order inflows, there has been an uptick in business activity surveys, which corroborates the expectation of sustained earnings expansion. "In light of this, we contend that a stance of cautious optimism remains warranted," Wilson asserts. Despite this, he projects that the bulk of earnings growth will materialize in the latter part of the year.

Despite a rally in equity markets on Monday, investor sentiment remains highly attuned to the forthcoming earnings season amidst a backdrop of persistent declines in U.S. equities last week and prevailing uncertainty surrounding the U.S. economy.

In a Bloomberg Markets Live Pulse survey involving 409 participants, approximately two-thirds voiced their expectation that earnings performance will bolster the U.S. stock market benchmarks. This sentiment reflects the highest confidence level in corporate profitability since the question was introduced in the survey in October 2022. Investors are anticipating that robust earnings will act as a catalyst for an uptick in equity markets.

The weakening of rate cut anticipations by the Federal Reserve has contributed to recent volatility in U.S. equity markets. The CPI for March came in higher than anticipated, following the previously announced unemployment rate for March, which held steady at 3.8%. A series of signals suggest that inflation remains persistently high, subsequently causing the market's expectations for a rate cut to be swiftly pushed back.

Jeremy Straub of Coastal Wealth stated that this week is of great significance for the markets, as earnings reports from major tech companies and key inflation data on Friday could redefine the market's near-term trajectory.

"If the earnings from the big tech firms and the inflation data on Friday disappoint, this could extend the duration and depth of the current market adjustment," he pointed out. "While there may still be room for further declines in the stock market, we maintain a constructive outlook on equities for 2024."

Source: Reuters, Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

TechTrek Invest : There is alot of fear, not to mention war in the middle east and ongoing conflict with Ukraine. Then there is the Fed flip flopping with interest rates. When the market gets clear signals it will either improve or decline. We are only one good news story away from the next Bull Run.