Consumer Spending May Continue Growing Until 2024, But Income Disparity Is Alarming

GDP growth has outperformed in 2023 so far on the back of strong real consumer spending. Real spending growth is affected by a number of different factors—real disposable personal income (DPI) growth, changes in financial and housing wealth, credit availability, and consumer sentiment—but is typically most sensitive to real income growth.

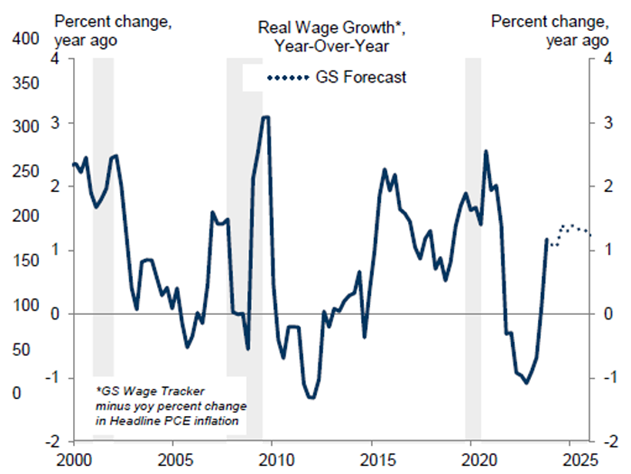

■ Declining inflation leads to a rebound in real wage growth

Benefiting from the phased decline in inflation, according to Goldman Sachs' estimate, residents' real income is expected to increase by 4% in Q4 2023. This growing trend may continue until 2024.

The analyst Jan Hatzius from GS noted that the saving rate will rise from a quite low 3.5% today to over 5% by the end of next year. Nominal wage growth is expected to remain relatively high, with a projected 3.75% increase in wages on a Q4/Q4 basis by 2024. This coupled with decreasing inflation, where GS predicts a 2.4% headline PCE inflation on the same basis, should result in real wage growth of over 1% until the end of next year.The combination of continued job gains and positive real wage growth should therefore provide a healthy boost to real income in 2024.

■ Interest-bearing assets contribute to residents' income

The US household sector holds a substantial amount of interest-bearing assets, meaning that interest income should rise as interest rates increase. While there has been a notable increase since the start of the year, interest income has not yet risen by as much, suggesting the increase in rates on residents’ deposits from the Fed's rate hikes has not yet fully emerged due to the lag effect. Assuming that interest rates remain elevated, household interest income should increase as yields on interest-bearing assets rise to reflect past rate increases.

■ Transfer income from the government faces a headwind

On the negative side, Medicaid's continuous enrollment provision, which guaranteed health insurance coverage for eligible individuals during public health emergencies, ended in April. Medicaid spending should trend downwards over the next year and a half, thereby creating a notable headwind to transfer income. We are likely to see the pullback in transfer income that we expect as states trim enrollment.

■ Real income growth is likely to grow 3% in 2024

After incorporating these drivers, Goldman Sachs expected real income (wage + interest earnings + transfer, etc.) will grow by 3% in 2024 on a Q4/Q4 basis. In terms of components, expected labor income gains (1.8%) account for over half this increase, and interest income increases will raise real income growth by over 1%, and the pullback in Medicaid coverage is set to subtract almost 0.4%. This pace of real income growth is below the 4% pace in 2023, but comfortably above the roughly 2½% real growth pace observed in the 20 years prior to the pandemic.

■ Income gap may limit low-income families' consumption

The latent risk is that the balance sheet of lower-income families is more fragile. That may pose challenges to overall consumption.

Goldman Sachs noted rising interest income will disproportionately benefit higher-income households that have a lower propensity to spend. It forecasted a firm real income growth of almost 4% for households in the top income quintile, and a respectable 1½% real income growth pace for the bottom-income quintile, with the slower growth pace partially reflecting the Medicaid headwind.

The difference in income may mean that U.S. consumption patterns are also changing. Mid-to-high-end consumption will not necessarily significantly reduce consumption when interest rates rise. However, for residents who rely heavily on consumer loans and credit cards, the burden of daily expenses may be increasing, which means they are more inclined to spend money on discount products and low-priced goods.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment