Countdown to Bitcoin Halving: Is a New Era on the Horizon?

Since mid-March, Bitcoin has experienced a significant rebound, currently maintaining itself above the psychological barrier of $70,000. Bitcoin halving marks the second major trend after the launch of Bitcoin spot price ETF in 2024. With only nine days left until the highly anticipated halving event on April 20th, investors and traders are closely monitoring any potential price movements and trading activities.

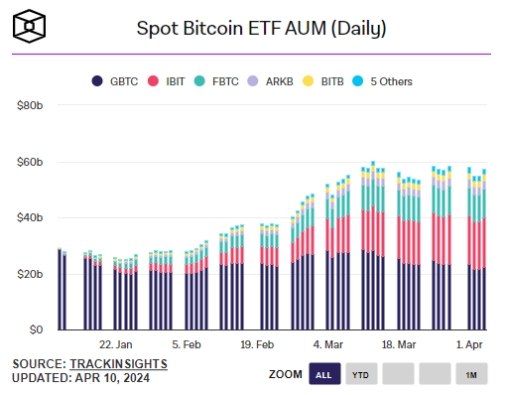

ETFs Experience Slower Inflows in Recent Weeks

The spot Bitcoin ETFs have experienced an extraordinarily successful debut by virtually all significant indicators. Spotlighting spot-crypto ETFs, the introduction of Bitcoin funds to the U.S. market in January has drawn considerable attention. Accumulating approximately $58 billion in assets, these funds represent one of the most triumphant initial performances in the history of new investment fund categories.

According to a recent report on Monday by James Butterfill, Head of Research at CoinShares, year-to-date capital inflows into digital asset investment products soared to $13.8 billion last week, primarily propelled by the advent of spot Bitcoin ETFs. Remarkably, this figure has already surpassed the $10.6 billion total for the entirety of 2021 by a significant margin.

Nonetheless, Butterfill highlighted a noticeable cooling in the enthusiasm among ETF investors, as recent inflows have not maintained the robust weekly levels recorded in early March. Notably, last week's trading volumes dipped to $17.4 billion, a substantial decrease from the $43 billion peak observed in the initial week of March.

Observers within the industry have identified the distressed lender Genesis's divestment of its GBTC shares as a potential contributing factor. Valued at an estimated $1.6 billion in mid-February, while recent court filings on Friday revealed that Genesis and its associated entities had entirely liquidated their holdings of nearly 36 million GBTC shares by April 2.

Hong Kong to Inject New Momentum into Bitcoin

Hong Kong is in competition with Singapore and Dubai to establish itself as a hub for digital assets, aiming to rejuvenate its image as a leading financial center. In a move signaling this ambition, the Securities & Futures Commission (SFC) granted Harvest Global Investments authorization to manage funds related to virtual assets on Tuesday. The SFC's official records also indicate that the Hong Kong branch of China Asset Management received similar consent that day. According to Reuters, the regulators will likely approve spot bitcoin ETFs as early as next week.

According to Rebecca Sin, an ETF analyst at Bloomberg Intelligence, the introduction of spot-Bitcoin funds in Hong Kong could be on the horizon. She observes that Bitcoin's substantial uptrend, with the cryptocurrency quadrupling in value since the dawn of 2023, is fostering positive net inflows. Sin predicts that the total value of global Bitcoin ETF assets is poised to reach the $100 billion mark soon.

Analysts' Opinion

Benchmark's Palmer has suggested that the anticipated bitcoin halving set for later this month could precipitate "a supply shock," mirroring effects observed in past halving events. He speculates that the impact of this supply constriction might be amplified by a "demand shock" due to the advent of spot Bitcoin ETFs.

Bernstein has revised its year-end forecast for Bitcoin, elevating the target from $80K to $90K, and has adjusted its projections for mining stocks within its analytical purview.Thebroker raised its $CleanSpark (CLSK.US)$ target to $30 from $14.20, trimmed $Riot Platforms (RIOT.US)$ to $22 from $22.50, and boosted $MARA Holdings (MARA.US)$ to $23 from $14.30. Analysts Gautam Chhugani and Mahika Sapra elaborated on these insights in a recent research report,

With a new bitcoin bull cycle, strong ETF inflows, aggressive miner capacity expansion, and all-time high miner dollar revenues, we continue to find bitcoin miners compelling buys for equity investors seeking exposure to the crypto cycle.

However, as the halving directly cuts the block reward in half, which means that miners will see their block reward income decrease, assuming mining power remains constant. Peter Eberle, president and chief investment officer at crypto investment firm Castle Funds, said in a call,

Halving is a challenge to inefficient miners, such as those who have older, slower machines, or machines that are [exceptionally] electricity consuming, or those who are in places where the electricity costs are high.

J.P. Morgan cautions that the anticipated block reward halving could potentially limit growth within the industry. The bank has downgraded CleanSpark to neutral from overweight due to its high power costs and limited growth potential.

Which Bitcoin investment option are you bullish on?

Source: The Block, Blockworks, Yahoo Finance, Bloomberg, Market Watch

By Moomoo News Marina

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

KL6808 : There are plenty of hypes and euphoria about the forthcoming halving of BTC.

While I do not deny I also wish this event will propel the crypto asset to its ATH, I would prefer to be less optimistic in terms of the magnitude of the rise.

For those who have zero exposure to this asset class, do not simply adopt the FOMO mentality and go all in.

71635570 KL6808 : Howdy KL6808

I’m fairly new to crypto but hearing bits the opposite as with the 1/2’ing trend says they jump back up so why would this be any diff?

My Q is, when do you buy in?

I’m not sure if going in before is better as that’s when I guess your investment would be cut in 1/2 but then will go higher?

OR

Do you go in right aft and catch the waive with your full investment?

If opt#1 then should we be pulling what we have now and reinvest right aft?

Thots?

KL6808 71635570 : While I started investing in BTC and ETH earlier, if I remember correctly, back in 2016, I only have very limited knowledge about them.

Perhaps you can start reading up what typically happened after halving.

Whether history will repeat itself, time will tell.