CPI and Fed Rate Decision: Here's What the Experts Predict for Today

Wall Street is set for a volatile session as the Federal Reserve prepares to release interest rate decisions following the latest consumer price index (CPI) reading, a dual occurrence that could recalibrate expectations for interest rate cuts this year. Market participants are closely monitoring the May inflation figures, due Wednesday, understanding that these numbers will likely inform the Fed's so-called "dot plot," a chart depicting individual member's rate expectations.

CPI Day Game Plan

Based on the price of at-the-money straddles that expire that day, the options market is wagering that the $S&P 500 Index (.SPX.US)$ will move 1.3% to 1.4% in either direction by Friday, according to Andrew Tyler, head of US market intelligence on JPMorgan Chase's trading desk.

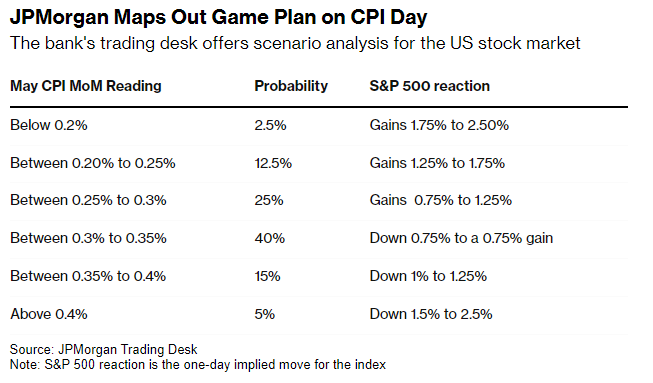

JPMorgan's traders have offered their views on the possible market reactions to different CPI outcomes. With a 40% probability, they see CPI rising between 0.3% and 0.35% as the most likely scenario, which could result in an S&P 500 movement of up to 0.75% in either direction.

JPMorgan has also quantified the odds of the Consumer Price Index (CPI) rising between 0.25% and 0.3% at 25%. This scenario, if it comes to pass, might reignite the 'Goldilocks' narrative of not too hot, not too cold economic conditions which could be ideal for equities.

Other scenarios with different probabilities suggest varying degrees of market response, from a potential rally to a sell-off, depending on whether the CPI data supports a narrative of continuing disinflation or stubbornly high inflation.

Historically, the occurrence of a CPI release and a Fed decision on the same day has been rare, with Dow Jones Market Data showing it has only happened 13 times since 2008. On these occasions, major stock indexes have tended to post gains, with the S&P 500, the $Dow Jones Industrial Average (.DJI.US)$, and the $Nasdaq Composite Index (.IXIC.US)$ typically advancing. Nonetheless, strategists including Dave Sekera of Morningstar Research Services, do not forecast unusual market volatility unless the Fed Chair, Jerome Powell, deviates from his typically measured commentary in the press conference following the Fed's announcement.

"You are going to get inflation data during the meeting, and that is what is going to determine the dots," said Diane Swonk, chief economist at KPMG LLP. "The ultimate determinant is going to be the inflation numbers."

Macro Projection

Economists expect a modest 0.1% rise in the CPI for May, which would be the smallest increase in seven months, potentially signaling a continued slowdown in inflation. Core inflation, which excludes food and energy prices, is anticipated to rise by 0.3%. These projections, if accurate, could provide some relief to investors fearing a resurgence of inflation.

However, the jobs data could be a key factor influencing investor expectations regarding a potential rate cut. The robust employment report for May, which saw nonfarm payroll growth exceeding average rates, suggests a strong labor market that might lead the Fed to focus more on inflation figures before considering rate cuts.

What To Expect

The Federal Open Market Committee (FOMC) is widely expected to maintain its benchmark rate and continue indicating that no reductions will be appropriate until there is more confidence that inflation is sustainably moving towards the 2% target. With policymakers possibly raising their 2024 inflation estimates and unemployment rate projections, the June FOMC meeting is shaping up to be one of the year's most consequential gatherings.

"The June FOMC meeting will be one of the most pivotal this year as Powell may provide the clearest hint yet as to the rate-cut timetable. The new dot plot likely will indicate two 25-basis-point cuts this year, compared with three in the March version," says Anna Wong, chief US economist of Bloomberg Economics.

Investors are now left to weigh the implications of the upcoming CPI report and the Fed's decision. While immediate rate moves are not anticipated, the data will undoubtedly influence market expectations for the timing and trajectory of any future rate adjustments. As the market awaits these critical economic indicators, the balance between cautious optimism and vigilance remains the order of the day on Wall Street.

Source: Bloomberg, Market Watch

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Ivan Teo : Hoping for some rate cut this year.

RDK79 : Economists (at least the ones in this data) were off, again. Got tired of the novel of info in this article so never got to their rate adjustment ‘guess’. My guess, unchanged. Cya next meeting :). Till then let the fun times roll.

72890452 : Just waiting for the CPI data

Donald Perkins : I like how the article said strong labor force. The only thing with the labor numbers is that most are government jobs, which create nothing for the economy and medical jobs, which are supported by tax dollars and part-time and hospitality workers. Real strong jobs. Meanwhile, manufacturers and tech have been laying off workers. This is the strong labor market?