Earnings Volatility | Options Market Sees Big Move in MARA, RIVN and AMC Shares After Earnings

Stock prices may see larger-than-normal moves during earnings season, making it a potentially attractive time for options traders. For investors looking to trade against these moves, you should always keep track of how the options might shift after their earnings.

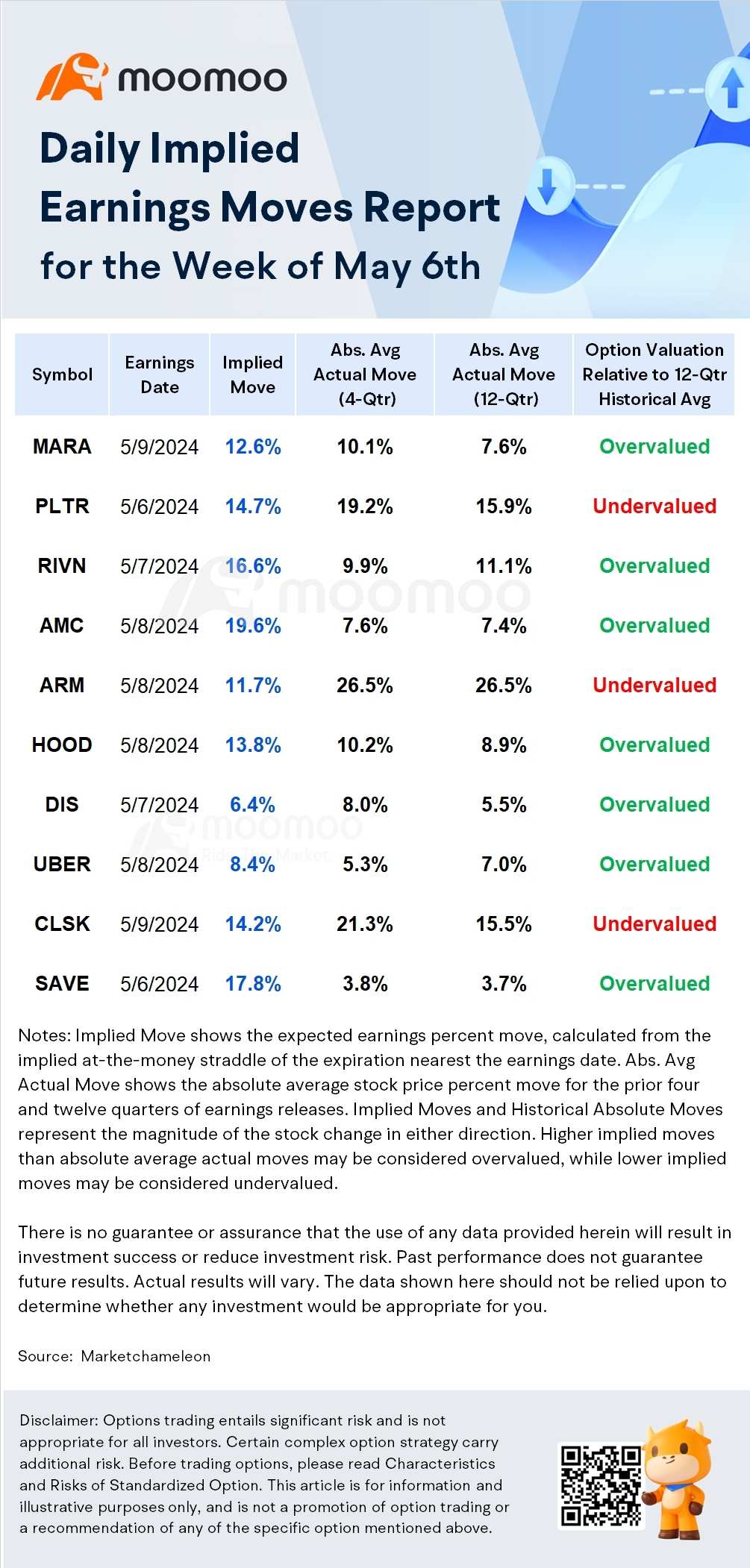

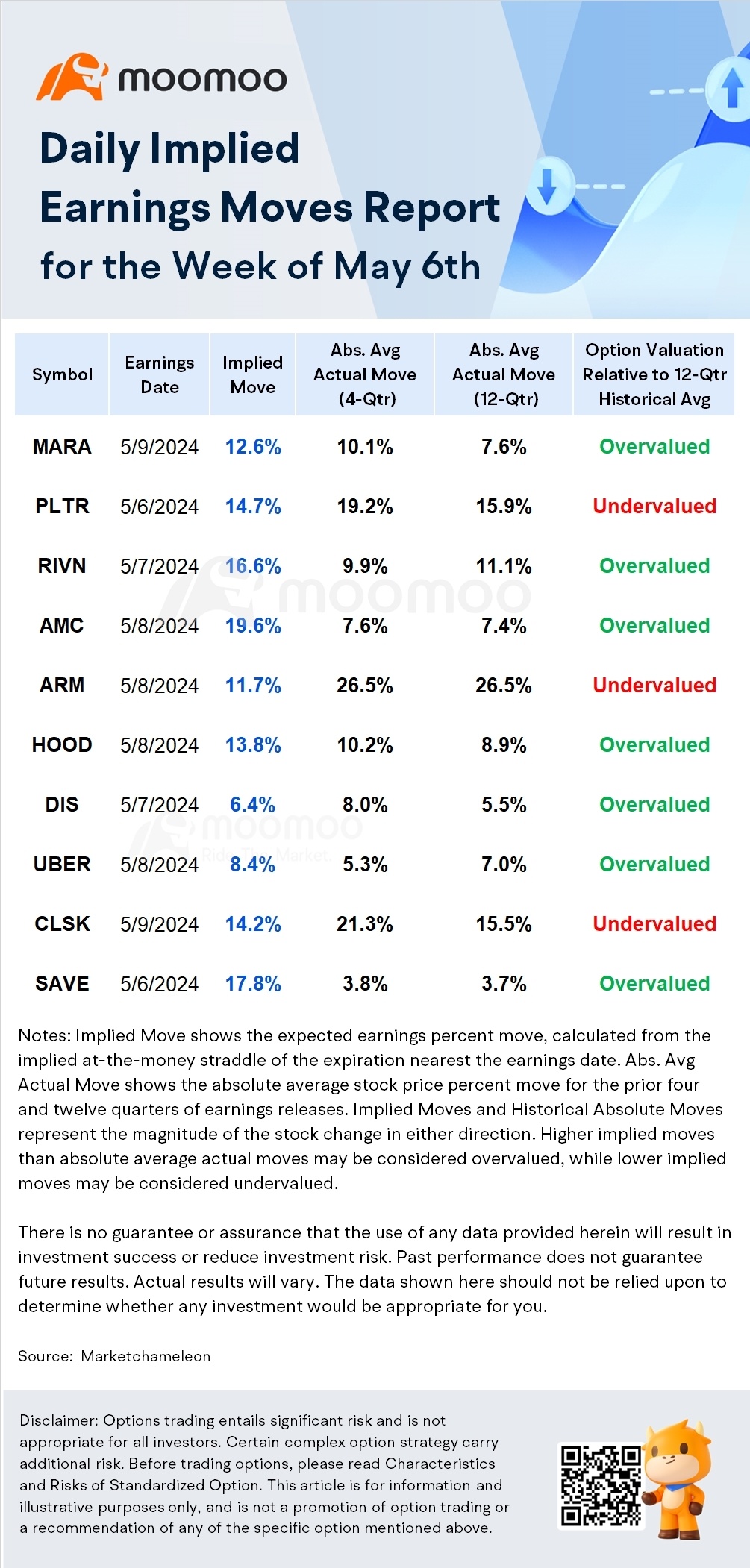

Here are the top earnings and volatility for the week:

- Earnings Date: 5/9 Post-market

- Earnings Consensus: 2024 Q1 revenue of $190.2 million; EPS of $0.208

Earnings Catalyst

MARA's implied move is ±12.6%, indicating a higher degree of expected volatility compared to the historical average of ±7.6% for the past 12 quarters.

MARA shares have moved lower in the immediate aftermath of earnings 9 out of 12 previous reports. On average the stock moved down -4.6% in the first day of trading after the company reported earnings.

The options market overestimated MARA stocks earnings move 75% of the time in the last 12 quarters. The predicted move after earnings announcement was ±11.1% on average vs an average of the actual earnings moves of 7.6% (in absolute terms).

Marathon, a cryptocurrency mining company, is experiencing a high level of short interest, with nearly 20% of its stock being held short, and more than half of that off of listed exchanges. Despite this skepticism, Bitcoin prices have remained relatively stable over the past three months, fluctuating between $60,000 and $65,000, with a brief dip to $59,000 that was quickly recovered. The Bitcoin blockchain has achieved a milestone with its 1 billionth transaction, maintaining an average of over 178,000 transactions per day.

Marathon has had a successful month, mining 850 Bitcoin in April, which could be valued at around $52.7 million at the current price range. The company also anticipates a 25% increase in its mining capabilities in 2024. Additionally, transaction fees for Bitcoin have peaked due to the "halvening" event, which reduces the reward for mining Bitcoin by half.

In a positive development, Marathon has signed a consulting contract with the Kenyan government to discuss regulatory issues and Bitcoin's energy consumption.

- Earnings Date: 5/6 Post-market

- Earnings Consensus: 2024 Q1 revenue of $617.61 million; EPS of $0.033

Earnings Catalyst

PLTR's implied move is ±14.7%, indicating a slight lower degree of expected volatility compared to the historical average of ±15.9% for the past 12 quarters.

PLTR shares have moved higher in the immediate aftermath of earnings 6 out of 12 previous reports. On average the stock moved up 3.0% in the first day of trading after the company reported earnings.

Historical performance on the last 12 earnings days shows a 58% probability of post-earnings price declines, the largest gain being +12.6%, and the largest drop at -13.9%. The options market overestimated PLTR stocks earnings move 33% of the time in the last 12 quarters. The predicted move after earnings announcement was ±13.4% on average vs an average of the actual earnings moves of 15.9% (in absolute terms). This shows you that PLTR tended to be more volatile than the options market predicted for the earnings stock price reaction.

Shares of Palantir Technologies Inc. have surged by 36% this year, riding on the back of a strong performance in the data analytics company's artificial intelligence applications. The company has seen a 200% increase over the last 12 months, particularly propelled by growth in its U.S. commercial sector.

Investors are keenly awaiting Palantir's first-quarter financial results, which will be released after the market closes on Monday. The report is expected to shed light on the company's AI initiatives and whether the momentum seen in the fourth quarter—when commercial revenue jumped 32% to $284 million—has continued.

Palantir has forecasted first-quarter revenue to be between $612 million and $616 million. Wall Street expects numbers in line with this guidance, with a 17% year-over-year increase in revenue to $615 million and operating income at $198 million.

Looking ahead to 2024, Palantir anticipates revenue growth and adjusted free cash flow that signals confidence in the ongoing demand for its AI products. Citi analyst Tyler Radke recently upgraded his target price on Palantir to $23, reflecting a cautiously optimistic outlook ahead of the earnings report.

The market response to Monday's earnings release could be a significant indicator of investor confidence in Palantir's trajectory for the rest of the year.

Don't Get Crushed by Earnings. Here are things you should know before considering a trade.

Knowing the IV Crush

Before significant corporate events such as earnings announcements, product launches, or clinical trial results, implied volatility tends to increase. However, after the news has been released, the implied volatility can drop significantly due to the sudden clarity in the market and the stock price reaction to the news. This phenomenon is referred to as IV crush.

IV Crush And Option Prices

IV crush can lead to a decrease in option prices because the Implied volatility is lowered dramatically. This decrease in option prices due to IV crush can be a risk for options traders who have purchased options at a higher price with the expectation of making a profit from a significant move in the underlying stock price. Conversely, IV crush may not be as prevalent if the option is undervalued and the stock price moves drastically, which can pose a risk for option sellers. It's important for traders to be aware of IV crush and factor it into their trading strategy when considering options trades around significant corporate events.

Not all options are affected equally by an IV crush. IV crush affects short-term option prices more than long-term option prices.

Nonetheless, it's important to note that trading options always involve risks, and investors should consult with a financial advisor before making any trades.

Source: Dow Jones, Market Chameleon, Bloomberg

Disclaimer:

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

The data and information provided has been obtained from sources considered to be reliable, but Moomoo Financial and its affiliates do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment