Earnings Volatility | Target, Palo Alto Networks See Muted Options Activity as Earnings Approach

Implied volatility often spikes before a company releases its earnings, as market uncertainty drives up demand for options from speculators and hedgers. This heightened demand inflates both the implied volatility and the price of the options. Following the earnings announcement, implied volatility generally returns to normal levels.

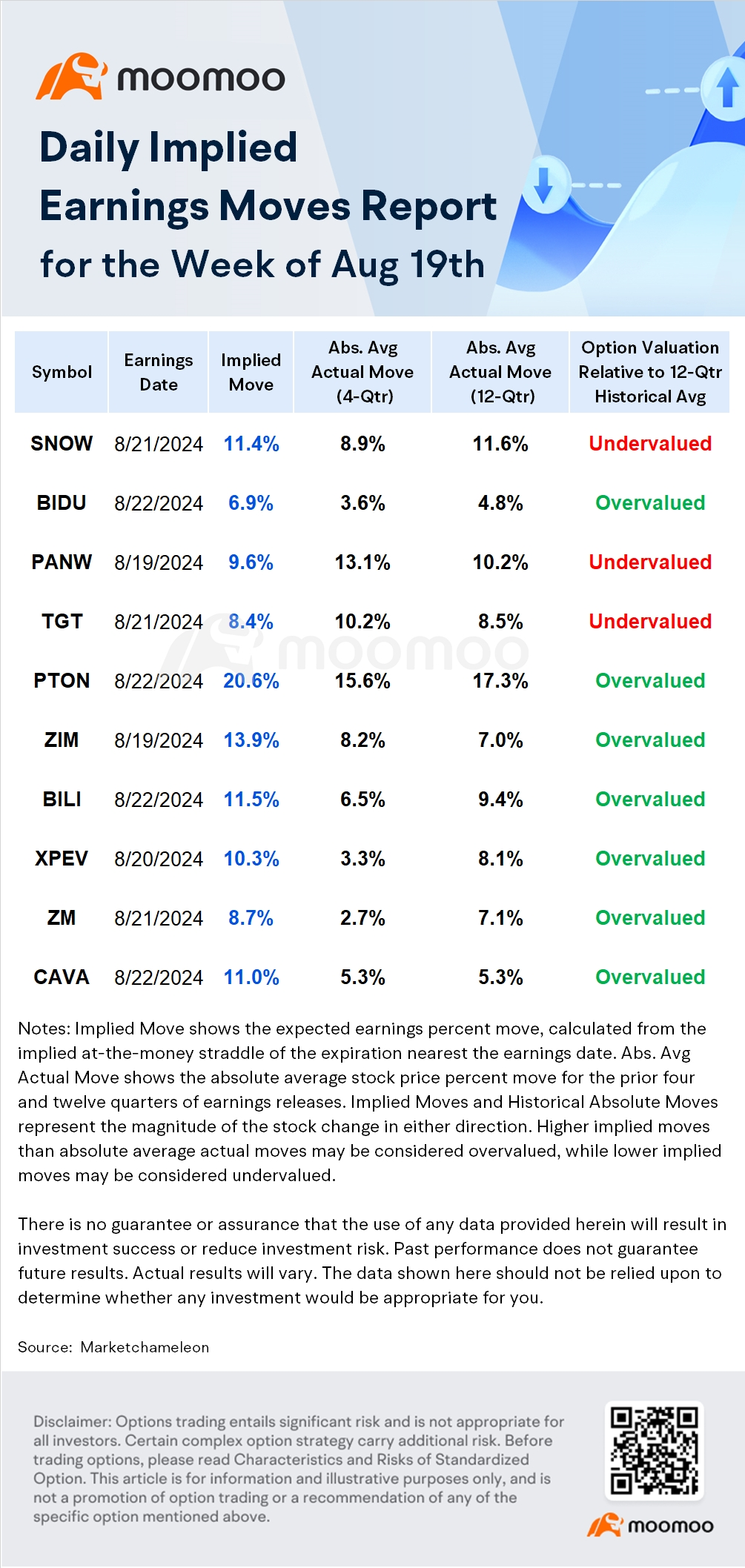

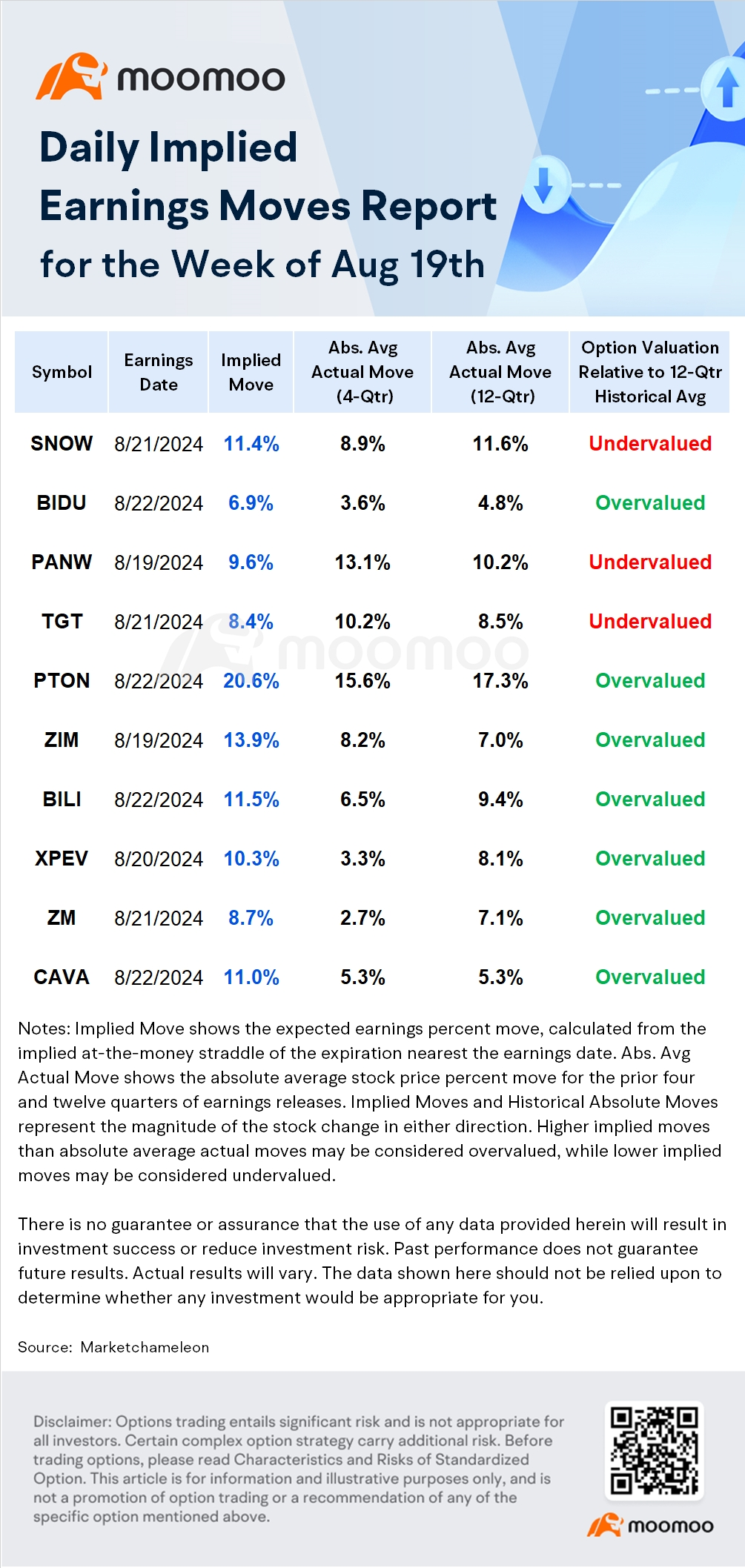

Here are the top earnings and volatility for the week:

-Earnings Release Date: Post-market on Aug 19

-Earnings Forecast: Q4 FY2024 revenue of $21.6 billion, up 5.68% year-over-year; EPS of $0.67, up 4.00% year-over-year

Before PANW's earnings announcements, the market typically anticipated a move of about ±7.8% in the stock's price. Interestingly, the actual average movement was slightly higher at ±8.2%, exceeding expectations by 0.4%. On the opening, the stock often gapped an average of ±7.6%, followed by a post-open drift averaging ±2.9%.

Analyzing the stock's performance during regular trading hours post-earnings, PANW's highest surge reached +20.0%, while its steepest drop was -29.0%. For those trading options, the average one-day return on a straddle position was +8.2%. Over the past 12 quarters, the options market has tended to overestimate PANW's earnings move half the time, predicting an average move of ±8.6% versus the actual average move of 10.2%. This indicates that PANW's post-earnings volatility was often underpredicted. Furthermore, PANW's stock has historically risen after earnings reports, climbing on average 3.9% in the first day of trading in 9 out of the last 12 instances.

The recent software update issue with $CrowdStrike (CRWD.US)$ may have consequences across the cybersecurity industry, with potential insights to be gleaned from the upcoming earnings report of rival Palo Alto Networks. As CrowdStrike's incident led to a global tech outage, there is speculation whether this could lead to customer caution or opportunities for Palo Alto Networks to capture more market share.

Guggenheim's John DiFucci anticipates a "modest upside" to Palo Alto Networks' revenue and billings, despite "soft sales at the end of the quarter following the CrowdStrike incident." Meanwhile, Piper Sandler's Rob Owens mentioned that the incident may have caused widespread IT/security team mobilization, which "likely resulted in some deals getting pushed out of the quarter for everyone."

Analysts are also keen to observe the progress of Palo Alto Networks' strategy of offering a broader platform of services, which has been met with some skepticism from investors. This "platformization" involves giving away certain products for free temporarily to encourage long-term adoption. Citi's Fatima Boolani expressed concerns that this approach "will likely continue pressuring billings," and is unsure if future guidance will meet the expected 12% growth.

Another point of interest for investors is whether customers might prefer a diversified approach to cybersecurity spending rather than relying on a single vendor, a consideration highlighted by the CrowdStrike incident.

Here are the options for the company that saw the largest increase in open interest last Friday.

-Earnings Release Date: Pre-market on Aug 15

-Earnings Forecast: Q1FY2025 revenue of¥247.45 Billion CNY, up 5.68% year-over-year; EPS of¥12.19 CNY, down -8.34% year-over-year

Before Target Corporation's (TGT) earnings reports, the options market expected an average price movement of ±5.7%. However, the actual average movement turned out to be ±6.7%, exceeding the expected move by 1.0%. The stock typically experienced opening gaps of about ±6.0%, with subsequent drifts averaging around ±2.6% after the market opened.

In regular trading hours following the earnings release, the maximum spike TGT shares saw was +20.9%, while the sharpest decline recorded was -27.9%. For options traders utilizing straddle strategies, the average one-day return was an impressive +22.6%. Over the last 12 quarters, the options market has correctly estimated the magnitude of TGT's earnings moves only half the time, with a forecasted average move of ±7.2% versus an actual average move of 8.5%. This suggests that TGT exhibited greater volatility in response to earnings than was anticipated by the options market.

Morgan Stanley anticipates that Target may report earnings closer to the lower end of its projected range for the year or may even revise it downwards, citing a slow economy and weak Q3 trends.

"Slowing consumer discretionary spending, particularly in June and July, is weighing on retailer Q2 results and H2 outlooks. We think Target is in the crosshairs of this dynamic," the analysts commented.

They suggest a revised EPS range of $8.30 to $9.10, about 4.5% below the original midpoint. Despite this, they forecast that if EPS grows by 10% annually in 2025 and 2026, the stock could potentially offer a 10% upside by 2026.

Oppenheimer analysts, Rupesh Parikh and Erica Eiler, also see a challenging environment for discretionary spending, which might lead to a longer timeframe for Target to return to strong sales growth. They note that consumer trends are shifting towards essentials, with discretionary categories weakening. Consequently, they have trimmed their estimates and believe that management might revise guidance accordingly.

Analyst Joseph Feldman expects a modest improvement in Target's second-quarter revenue to $25.3 billion, slightly above the FactSet consensus of $25.2 billion. He remains optimistic about consumer resilience, noting that shoppers continue to look for value and focus on essentials, while also spending selectively on discretionary items that offer innovation. Feldman's commentary on the general shopper behavior suggests a mixed spending pattern.

Here are the options for the company that saw the largest increase in open interest last Friday.

-Earnings Release Date: Pre-market on Aug 22

-Earnings Forecast: Q2 FY2024 revenue of¥34.04 billion CNY, down -0.04% year-over-year; EPS of¥14.75 CNY, up 4.12% year-over-year

In the case of BIDU, the options market had forecasted a post-earnings price fluctuation of ±5.4%, whereas the reality was a more modest actual move of +1.7%. Historically, the options market has overestimated the earnings-related price movements of BIDU stock 85% of the time over the past 13 quarters. On average, the market anticipated a post-earnings movement of ±6.6%, but the actual moves averaged out to be significantly lower at 4.5% in absolute terms.

Ahead of BIDU's earnings announcements, expectations were set for an average earnings move of ±6.6%. However, the actual average movement recorded was ±5.7%, falling short of the predicted move by 0.9%. The stock typically opened with gaps averaging ±4.5%, followed by an average drift of ±3.1% once regular trading commenced.

Post-earnings, during regular trading hours, BIDU's stock experienced its highest surge to a +14.7% increase and its largest dip to a -18.0% decrease.

-Earnings Release Date: Post-Mkt Aug 21

-Earnings Forecast: Q2 FY2025 revenue of $850 million, up 26.11% year-over-year; EPS of $-0.89, down -28.60% year-over-year

In the last 12 quarters, the options market underestimated the movement of Snowflake Inc. (SNOW) stock following earnings announcements 42% of the time. The market predicted an average move of ±10.8%, yet the actual moves were more pronounced, averaging 11.6% in absolute terms. This suggests that SNOW stock exhibited slightly higher volatility post-earnings than what traders had anticipated.

Before SNOW's earnings reports, the consensus was an expected earnings move of ±10.6%. The actual price moves closely matched these expectations, averaging ±10.7%, indicating a high degree of accuracy in the market's predictions. The stock typically saw opening price gaps of around ±9.0%, followed by an average stock drift of ±5.1% once regular trading began.

In terms of trading activity during regular hours after the earnings release, SNOW's stock experienced a significant rally to a high of +23.5%, and on the downside, the largest drop recorded was -21.4%.

Last Week, Warren Buffett's Berkshire Hathaway disclosed that it eliminated its holding of 6.1 million shares of the software company, which it bought at the time of the company's initial public offering in 2020. That holding was worth about $1.2 billion at the end of March.

Source: Bloomberg, Market Chameleon, FactSet, Dow Jones

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

101550592 :

Banana Milk :

Queen Peace : No comment

山芭佬 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Poolshark311 : very good, I like information presented this way, you showed a chart but then went in depth explaining the meaning behind the numbers and I feel like this makes it so much easier to grasp a new concept. options are still new to me and I'm afraid to take the plunge with real money. I've paper traded them but with more detailed info like this I feel like eventually I'll be confident enough in my understanding to try them for real.