Go with the trend, against technology, against human nature.

【Core Hint:In the United States, historical big data has proven that speculators can never beat investors. Giving timely help in time of need is much wiser and more meaningful than adding embellishments when everything is going well.

1. In a society with many ignorant people, it is easy to see both ignorant followers and extremist groups.

2. Half of the people lie through repetitive misinformation, while the other half lie through nationalism.

3. The seemingly foolish efforts are actually shortcuts to success.

3. The farthest distance in the world is the distance between "thinking" and "achieving", because it is separated by "doing", which requires overcoming countless obstacles.

People often only focus on the immediate goals and forget about the crisis behind them.

3. The farthest distance in the world is the distance between "thinking" and "achieving", because it is separated by "doing", which requires overcoming countless obstacles.

People often only focus on the immediate goals and forget about the crisis behind them.

Classic candlestick pattern when block orders are absorbing funds - multiple small yang and single mid-yin.

When block orders enter the market and absorb funds, the balance of power between bulls and bears in a particular stock changes. The stock price will gradually rise under the push of the block orders' active bids. However, block orders usually control the accumulation of shares in a planned manner within a specific price range. After the stock price increases for a period of time, the block orders will quickly suppress the stock price with a small amount of chips at the right time (during a market downturn or at the end of the trading session), and this rapid drop is usually referred to as a quick decline. The purpose is to continue accumulating shares at a lower price. This process is repeated, forming a wave or several waves of multiple small yang candles followed by a single mid-yin candle pattern in the candlestick chart.

When block orders enter the market and absorb funds, the balance of power between bulls and bears in a particular stock changes. The stock price will gradually rise under the push of the block orders' active bids. However, block orders usually control the accumulation of shares in a planned manner within a specific price range. After the stock price increases for a period of time, the block orders will quickly suppress the stock price with a small amount of chips at the right time (during a market downturn or at the end of the trading session), and this rapid drop is usually referred to as a quick decline. The purpose is to continue accumulating shares at a lower price. This process is repeated, forming a wave or several waves of multiple small yang candles followed by a single mid-yin candle pattern in the candlestick chart.

Patience is essential, and timing and entry points are crucial, especially timing, which accounts for 70% of success. The outcome of critical moments and critical events determines the success or failure of one's life. The outcome of stock market life depends on the outcome of the big market fluctuations; the outcome of critical moments not only depends on a person's professional experience, but also on their overall quality, as well as a balanced mindset and attention to details and pace. When the stock market index plunges and plummets to its lowest point, using the uglyst graph and indicators, show courage, determination, and decisiveness to gradually establish positions at the LOWER level of BOLL and leave the rest to fate. When you watch television or read news online and hear that the stock market is in chaos and on the verge of collapse, be the rebel and go against the tide - buy! buy! buy!

The masses often become more pessimistic as the stock price falls.

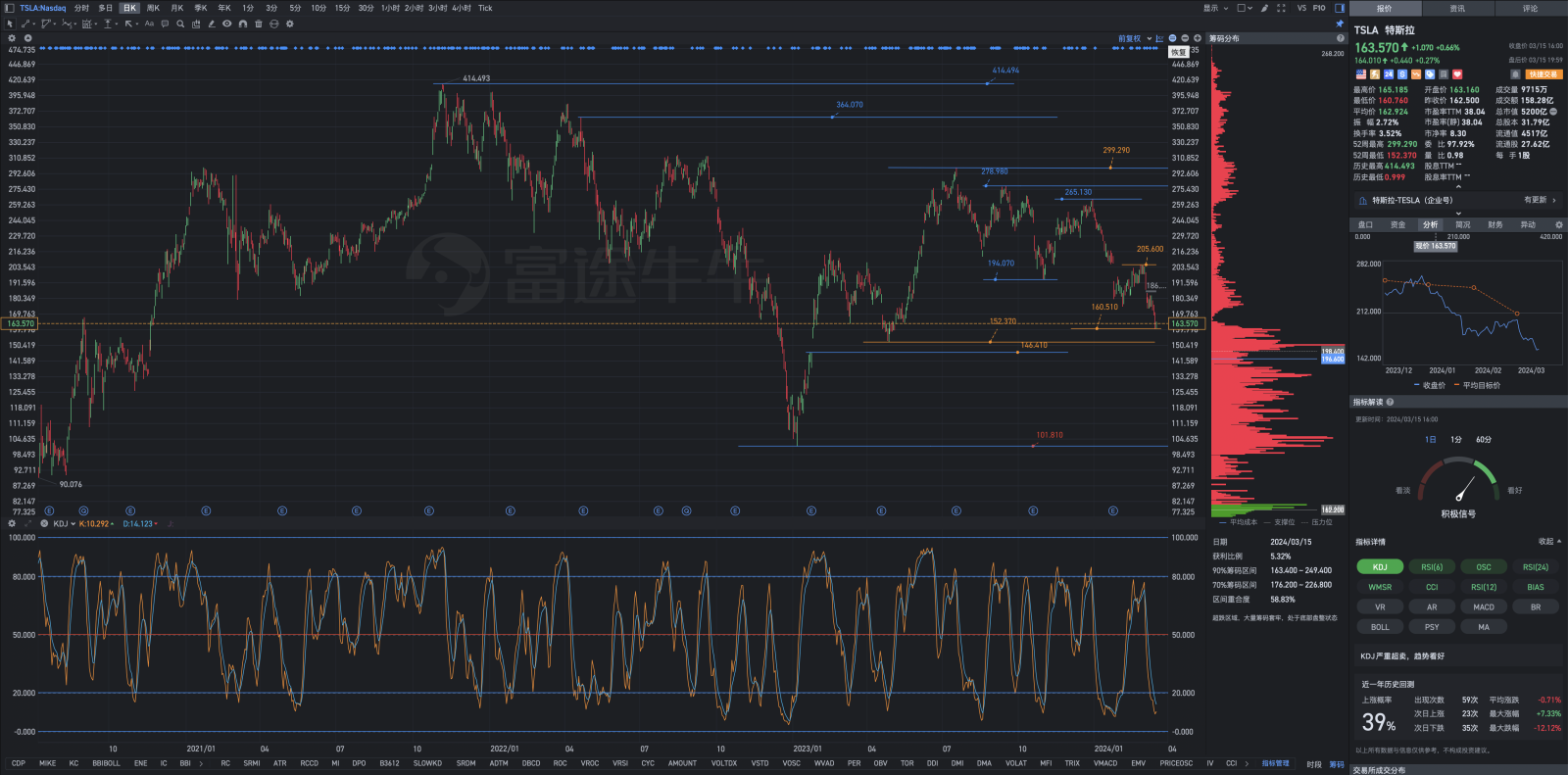

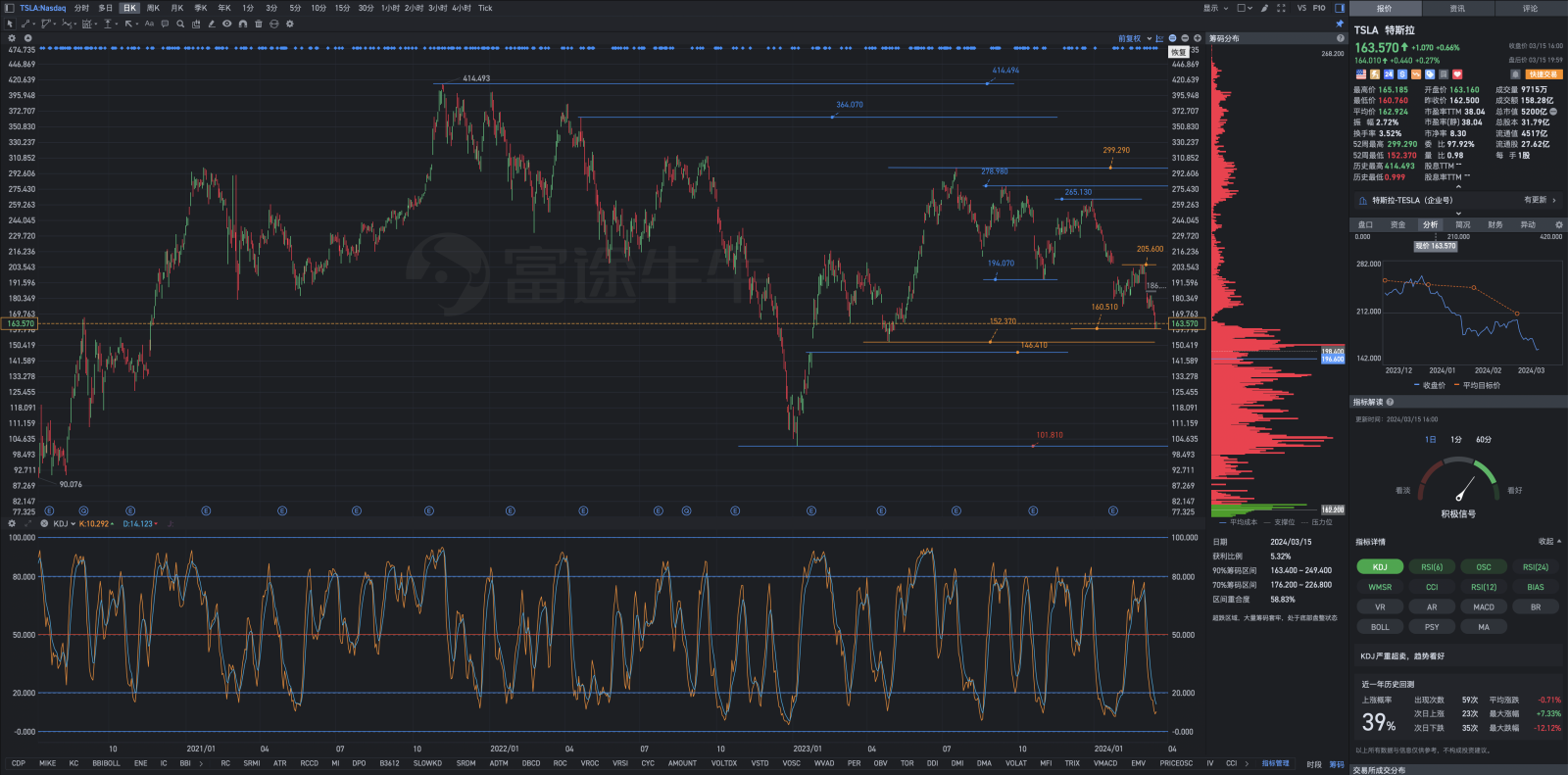

Is it possible to expand the stock price relief zone from 162.900 to 152.370 to 146.410 to 101.810? Some claim that the stock price will go to 23.370 points, without any bubbles, in line with the corresponding PE ratio.

Indeed, Jerome will increase capital and expand shares.

Jerome advises you to be optimistic and cheerful, avoid being sharp and sarcastic, as it is of no benefit to either oneself or others. He carries a personal protective handgun and ample ammunition, so he speaks and acts with discretion. There are so many interesting and meaningful things in this world, far beyond just speculative arbitrage. In the United States, historical big data has proven that speculators can never outperform investors. Offering help in times of need is far more significant and meaningful than simply adding to one's success.

Remember this: In 2010, Tesla was losing money in the long term and not making a profit. The stock price lingered at a low level for a long time, and more than 90% of market participants sold cheap Tesla stocks in a depressed and disappointed mood (no one knows how much stronger Tesla and Elon Musk are now compared to then). At the same time, Stephen A. Schwarzman, one of the Jewish-American super billionaires and philanthropists, and one of the founders of BlackRock with a net worth of over $10.8 billion, told his adult children and young grandchildren to save a little money every day, week, or month from other places, even if they could only buy one share of Tesla stock and keep it there, just like saving it in a bank. On August 26, 2018, about 8 years later, Tesla's stock price finally climbed from $1.13 to $371, an increase of nearly 33,000%.

Just do what you originally wanted to do. For those without trading skills, it is encouraged to hold for the long term. There are dividends and profits. Once you sell and make a profit, don't forget to pay taxes. Paying taxes is a good thing and beneficial to oneself. It's a good thing, honorable!

Reiterate:In the United States, historical big data has proven that speculators can never beat investors. Extending a helping hand in times of need is much wiser and meaningful than adding to the success.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

WilliamZheng : It is better to listen to your voice than to read ten years of books

Elias Chen OP WilliamZheng : Thank you for your generosity,my pleasure,my pleasure.(感谢你的慷慨,我的荣幸。)