Global Equity Fell Sharply as Investors Piled into Safe-Haven Assets. Will the Volatile Market Persist?

The market continued to be affected by geopolitical conflicts and weakness in technology stocks heading into the weekend.

All three major U.S. stock indexes wavered throughout the session, with weakness in the chip sector weighing the Nasdaq down the most. The Nasdaq fell 0.52% on Thursday. 10-year US Treasury yields fell, with the yield rising from a low of 4.52% on April 18th to a peak of 4.60%. The dollar index rose 0.19%, appreciating against a basket of world currencies. Major Asian stock indexes tumble on Friday. At the close in Tokyo, the Nikkei 225 declined 2.53% to hit a new 1-month low.

Meanwhile, gold climbed past $2,400 per ounce on Friday, back to record highs, and on track for its fifth weekly gain. As for Bitcoin, after the price fell below $60,000 earlier, the price returned to $64,000 on April 19th. WTI crude futures jumped to a peak of $86 per barrel on Friday, recovering most of the losses from earlier in the week, although the prices have fallen back to around 83 dollars later. Large explosions in Iran, the reimposition of US sanctions on Venezuelan oil, and potential new EU curbs on Iran buoyed oil markets.

The geopolitical conflict in the Middle East continues to escalate

Two US officials confirmed to the CBS News that an Israeli missile has struck Iran today. Early Friday morning, explosions were heard around the central city of Isfahan, Iranian media reported, saying three drones were destroyed after the country's air defense systems were activated.

It comes after Iran launched more than 300 missiles and drones towards Israel on 13 April in an unprecedented attack. Tehran has maintained this attack was in response to a suspected Israeli strike on its Syria consulate, which killed 13 people.

Meanwhile, Israel's commitments to improve aid access in the Gaza Strip have had limited and sometimes no impact, United Nations Secretary-General Antonio Guterres said on Thursday as he pushed for urgent, meaningful and measurable progress to avert famine.

Nevertheless, there has been no damage to Iran's nuclear sites, the International Atomic Energy Agency has confirmed. The UN agency's Director General Rafael Mariano Grossi stressed that nuclear facilities should not be a target in military conflicts, and urged "extreme restraint from everybody."

Hopes for interest rate cuts became even slimmer

Fed policymakers are leaning towards maintaining current borrowing costs well into the year, citing sluggish progress in inflation.

New York Fed President John Williams, citing economic strength, said on Thursday he does not see a convincing case for cutting the central bank's policy rate now.

On Tuesday, Fed Chair Jerome Powell declined to provide guidance on when rates might be lowered.

"Markets are still recalibrating what 'higher for longer' means and whether or not there will be any interest rate cut at all this year from the Fed," said Oliver Pursche, senior vice president at Wealthspire Advisors in New York.

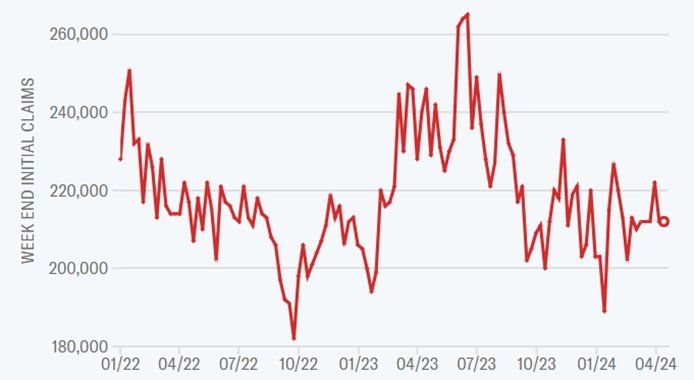

Economic data released on Thursday showed low jobless claims and solid factory data. Unadjusted claims declined 6,756 to 208,509 last week. Economists polled by Reuters had forecast 215,000 claims in the latest week. Claims have been bouncing around in a 194,000-225,000 range this year.

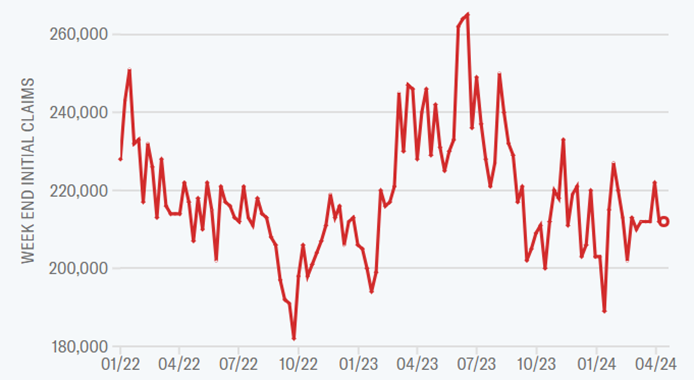

The Philadelphia Fed Manufacturing Index in the US rose 12 points to 15.5 in April 2024, well above market expectations of 1.5. It was the third consecutive positive reading and the highest since April 2022, with the indicators for new orders (12.2 vs 5.4 in March), and shipments (19.1 vs 11.4) rising.

Share prices of several sectors fell after announcing results

Since April, with the advent of the new financial reporting season, the earnings of several companies fell short of expectations, including in the technology and financial industries.

In the banking sector, interest income from JPM and BOA fell short of expectations, showing continued interest payment pressure and weak credit activity in the banking sector.

In tech sector, ASML's earnings have been worse than expected, dragging down the entire sector. Its net income in the first quarter was 1.22 billion euros, down from 2.05 billion euros in the fourth quarter of 2023. New bookings were 3.6 billion euros, well below the 5.4 billion euros foreseen by analysts.

This sparked questions over just how much demand the AI industry was actually providing for chipmakers, and whether it would be sufficient in offsetting weak demand from other sectors, specifically consumer electronics.

Taiwan Semiconductor Manufacturing shares also fell despite the strong earnings results. The reason is that the company made a slight change to its 2024 semiconductor outlook. Specifically, TSM now expects total growth of "approximately 10% year-over-year," excluding memory chips, Wei said in the conference call, vs previous expectations for growth of "more than 10%."

Meanwhile, Netflix shares also fell in late trading following quarterly forecast, although the company delivered sales of $9.33 billion, rising 15% and beating estimates of $9.26 billion.

The decline in tech sector has also spread to other national markets. Tokyo Electron Ltd. fell 8.74% or 3,210.00 points to trade at 33,550.00 at the close. Lasertec Corp declined 8.42%. Samsung Electronics shares fell by 2.51% on Friday.

What's next for the market?

Overall, weakness in technology stocks and investors' embrace of safe-haven assets means the stock market is likely to experience another bumpy road in the short term. However, this does not mean that geopolitics will continue to dominate the market throughout the year.

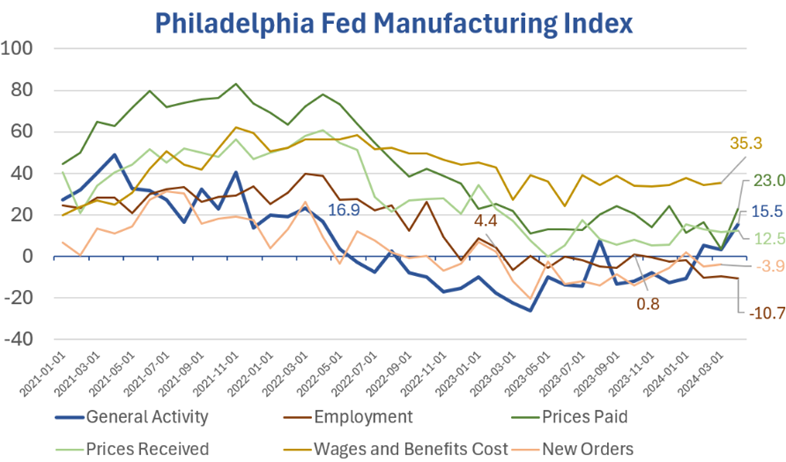

Kim Fustier, who leads the European oil and gas research at HSBC, suggests that even a significant intensification of the current conflict might not disrupt supply chains. HSBC has kept its prediction for Brent crude at $82.50 per barrel for the year. Fustier expressed skepticism about the situation worsening to the extent that the Strait of Hormuz would impact the worldwide flow of oil and liquefied natural gas (LNG).

OPEC+ represents another dynamic in the oil market. This group has been implementing production reductions since November 2022 to keep oil prices elevated artificially. Industry experts believe that OPEC+ holds around 6 million barrels per day of unused production capacity, which could be deployed to temper global market prices should they surge to very high levels, in an effort to avert a slump in demand.

Source: Financial Times, Reuters

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment